UK Chancellor Hunt: Inflation predicted to fall because of 'tough decisions' taken at autumn budget

Reuters reported that British finance minister Jeremy Hunt said it will be necessary to maintain the disciplined approach of his November budget to help reduce inflation, Prime Minister Rishi Sunak's office said following a Cabinet meeting on Thursday.

The article states that Hunt announced a string of tax increases and tighter public spending in a budget plan in November. He is due to present a budget on March 15.

"The Prime Minister and (Hunt) emphasised that the rate of inflation is only predicted to fall because of the tough decisions the Government had taken at the autumn statement to stabilise the economy," Sunak's office said.

GBP/USD update

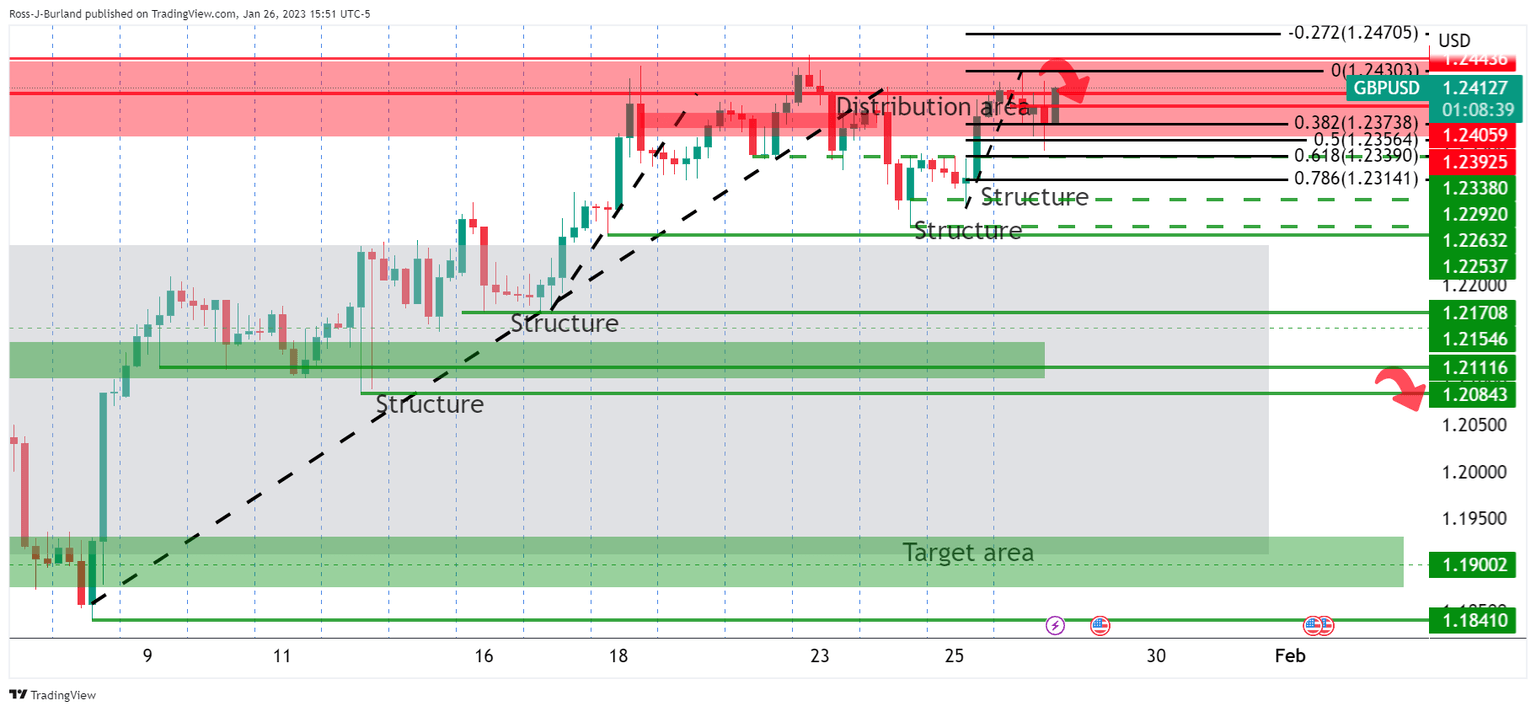

It has been a volatile day on Wall Street and offered two-way business:

The day started out with the London session breaking structure to the downside while the price went on to rally into the locked-in highs in the New York session in and around the red news on the calendar before the inevitable blow-off into in-the-money longs from earlier in the week.

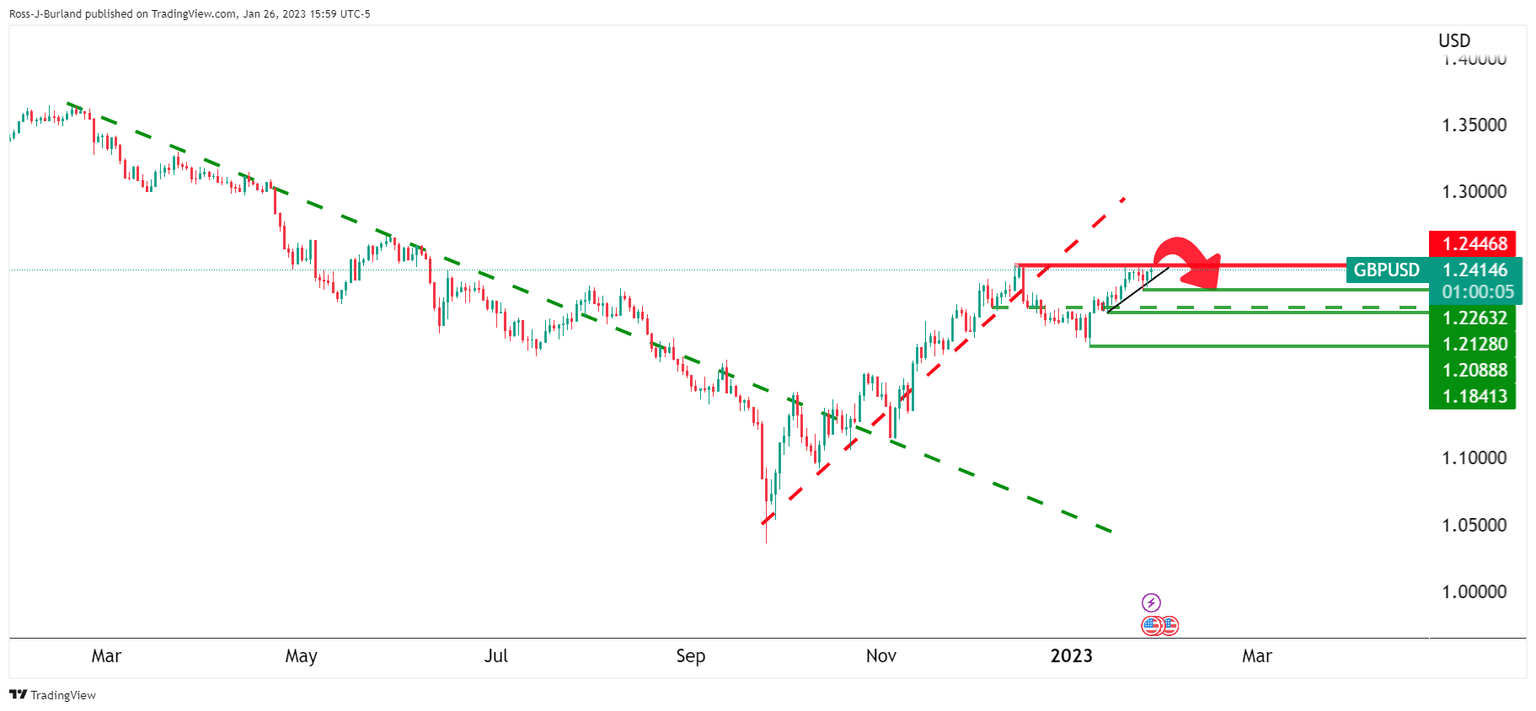

The price has now completed the move into the 4-hour W-formation's neckline and is moving higher towards a bullish extension, potentially on the hunt for more liquidity before another attempt at the downside as per the daily chart:

1.2450 is eyed as equal highs that could be swept before bears engage again.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.