- Tesla (TSLA) stock collapses premarket as Elon Musk tweets about selling 10% of his holding.

- TSLA shares have been surging, breaking records.

- Just as everyone is long, are they are about to be wrong?

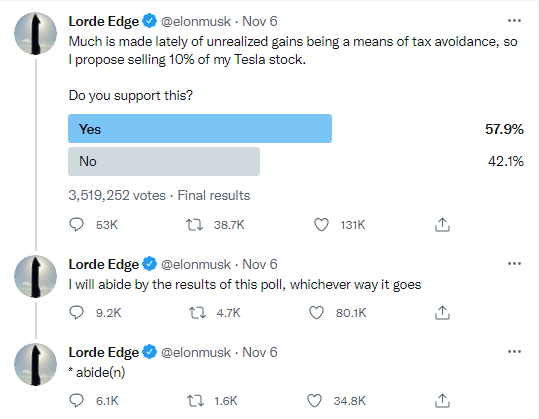

Elon Musk is a copywriter's dream CEO – always controversial, always interesting and always going off-script. He has had a few run-ins with regulators for his commentary over the years and this latest one is not exactly going to endear him to those conservative regulators, or those long his stock for that matter. He is the ultimate long! Tesla shares had been charging along nicely last week, setting record after record, as options volume surged and retail loaded up on calls. The stock broke $1,000 and surged onwards and upwards, soon putting $1,200 in its rearview mirror as the frenzy continued.

Tesla graph, 15-minute

Tesla (TSLA) stock news

Just in case you missed it, we present this tweet from Elon Musk on Friday night. And, yes, it is apparently from his own verified account.

Of course, there is no in-depth detail on how and why Elon Musk might sell the shares. Will it be this week, next week, next year, etc.? Either way, Daniel Ives of Wedbush Securities was not too worried, telling Bloomberg, “Selling 10% is probably going to add 1.5% to 2% to the float, so it doesn’t really significantly move the needle.”

After such a surge in the share price, it would make sense to take something off the table. Face it, if it was you or me, we would certainly be cashing something in to buy a few jets, a house in the Caribbean, a tungsten cube or whatever. But in all seriousness, this has affected the share price and in the wrong way too. TSLA shares are down a pretty hefty 6% in Monday's premarket.

Tesla (TSLA) stock forecast

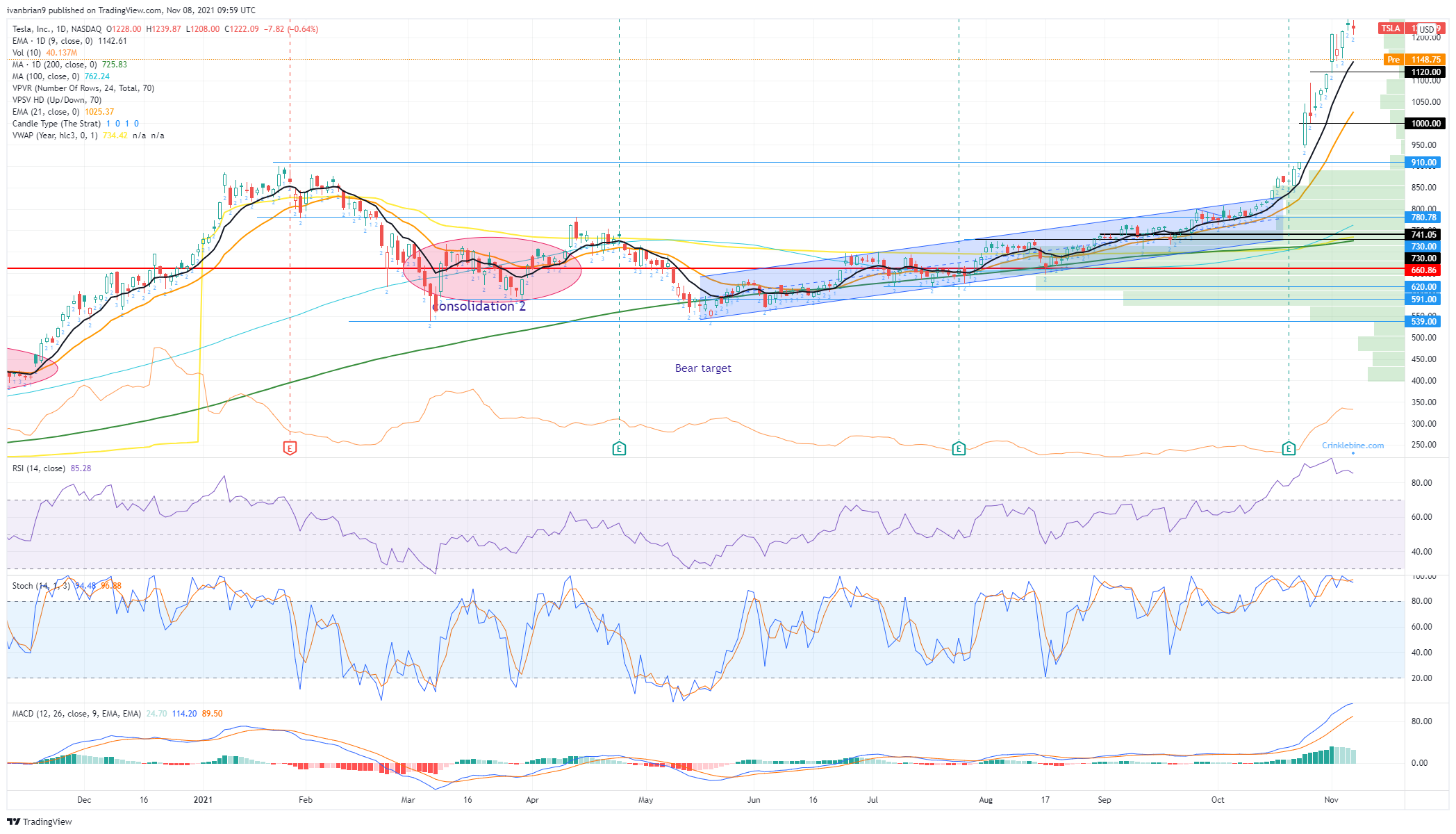

Tesla stock was probably gearing up for a retracement after such a strong move anyway, and now Elon has set that in place. TSLA is trading at $1,154 in the premakret at the time of writing, a loss of 5.5%. Key short-term support is at $1,120 as we have highlighted on the Tesla chart below. This is where the second stage of the surge took off from. Breaking here puts the next breakout level at $1,000 as the target and support.

After that there is a gap to fill down to $910, and we all know by now how the market loves to fill gaps. Options buying will also be significantly reduced as most calls that were purchased were from last Friday's expiry. Market makers who have been caught long the gamma hedge will be unloading, so this could get ugly pretty quickly. Expect a move to test $1,000 this week in our opinion. The RSI remains massively overbought, the stochastics have just crossed over (giving a sell signal), but for now the MACD remains in long territory. It is very stretched though as we can see from the histogram bars.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD tumbles to a five-year low below 0.6000 amid US-China tariffs war

The AUD/USD pair tumbles to near 0.5985 for the first time since the COVID-19 pandemic during the early Asian session on Monday. The Australian Dollar weakens as China slapped a 34% tax on all US imports in retaliation for US President Donald Trump’s tariffs, raising fear of a trade war between the United States and China.

EUR/USD: Markets on edge after US “Liberation Day,” turmoil just began

Financial markets navigated tumultuous waters in the first week of April. US President Donald Trump finally unveiled his reciprocal tariffs plan and spurred panic among worldwide investors. EUR/USD peaked at 1.1146 mid-week, its highest since September 2024, to finally settle at around 1.1000.

Gold correction deepens after new record-high is set on Trump’s tariff announcement

Gold pushed higher with the initial reaction to tariff announcements from the United States on Wednesday and touched a record peak of $3,167 before staging a deep correction heading into the weekend. Investors will stay focused on tariff-related headlines and pay close attention to inflation data from the US.

Week ahead: US CPI and RBNZ decision on tap amidst tariff mayhem

US Dollar traders await US CPI data amid global trade turbulence. RBNZ to cut by 25bps, could maintain dovish stance. China’s CPI and PPI to reveal tariff impact on inflation. Strong UK GDP data could help the pound climb higher.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637719616698586210.png)