TJX Elliott Wave technical analysis [Video]

![TJX Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/financial-planning-with-stock-chart-and-pen-17530871_XtraLarge.jpg)

TJX Elliott Wave Analysis Trading Lounge.

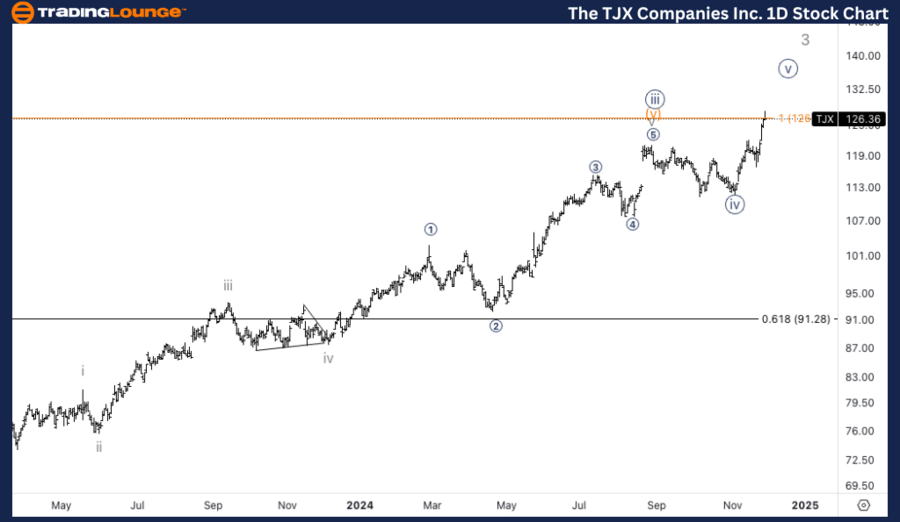

The TJX Companies Inc., (TJX) Daily Chart.

TJX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {v} of 3 of (5).

Direction: Upside into wave 3.

Details: Looking for upside into wave {v}, equality of 3 vs. 1 stands at 126$ therefore near the end of MinorGroup1. Next upside target would be 1.618 3 vs. 1 at 213$.

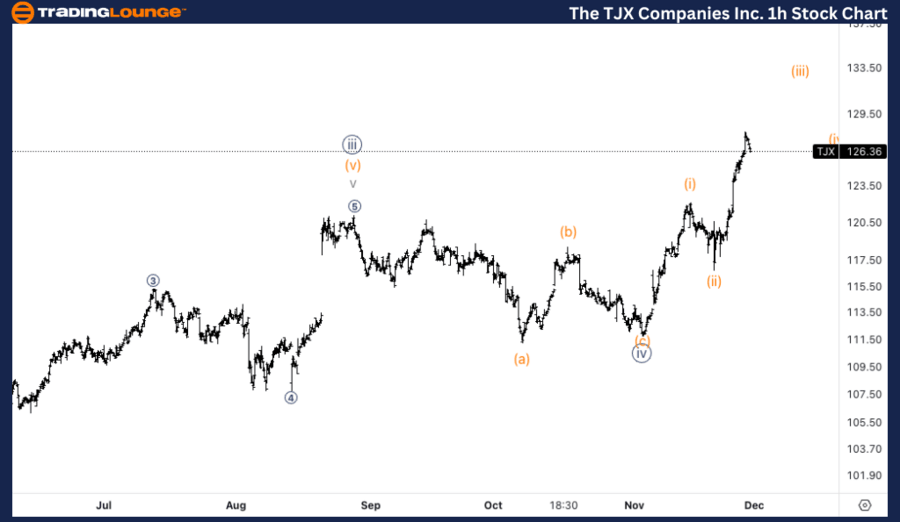

The TJX Companies Inc., (TJX) 1H Chart.

TJX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (iii) of {v}.

Direction: Upside in wave (iii).

Details: Looking for upside into wave (iii) as we seem yet to have completed five waves within wave (iii). Looking for continuation above the end of MG1 at 130$.

This Elliott Wave analysis of The TJX Companies Inc., (TJX) outlines both the daily and 1-hour chart structures, highlighting the current trends and possible future price movements.

TJX Elliott Wave technical analysis – Daily chart

TJX is advancing within wave {v} of wave 3 of the larger (5) wave structure. The price is pushing toward the completion of wave 3, with equality of wave 3 vs. wave 1 projected at $126, near the end of MinorGroup1. If the momentum continues, the next target would be 1.618 times wave 1, which would place the upside potential at $213.

TJX Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, TJX is within wave (iii) of {v}, with upside still unfolding. We have not yet completed the five waves within wave (iii), so further continuation above $130 (the end of MinorGroup1) is expected as the stock completes its impulsive advance.

Technical analyst: Alessio Barretta.

TJX Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.