Watch the video above from the WLGC session before the market opens on 19 Nov 2024 to find out the following:

-

Is the market losing momentum, or is this just a healthy pullback in an ongoing uptrend?

-

Could the recent spike in supply and localized volatility signal a deeper correction ahead?

-

How to use the smaller timeframe to identify the key resistance level and anticipate the market movement.

-

And a lot more...

Market environment

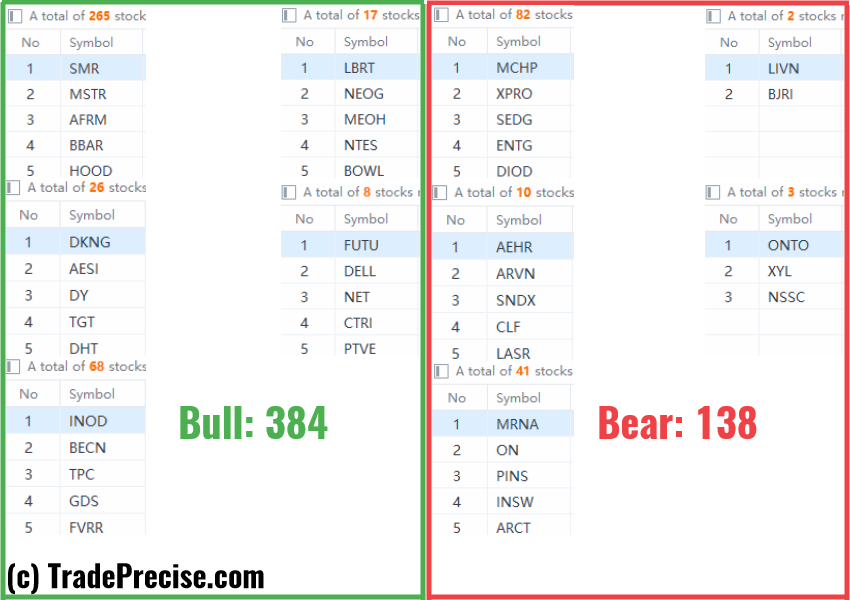

The bullish vs. bearish setup is 384 to 138 from the screenshot of my stock screener below.

Three stocks ready to soar

28 actionable setups including 8 growth stocks (check out 3 of the charts LMND, UPST, SE below) completed 2+ years of accumulation structure and are in the “sweet spot” to transit into uptrend (phase E) were discussed during the live session before the market open (BMO)..

The pullback in the market since last Tuesday provided great reversal entries for many of those over-extended strong momentum stocks.

The plan mentioned in the market update on Monday to look for reversal entries to participate the continuation of the uptrend is still relevant.

Lemonade (LMND)

Upstart Holdings (UPST)

Sea Limited (SE)

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0400 amid a souring mood

EUR/USD loses its early traction but holds within familiar levels around the 1.0400 area on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD stabilizes around 1.2550 in dull trading

GBP/USD turned south and dropped toward 1.2500 after reaching a 10-day-high above 1.2600 earlier in the day. The pair recovered as fears eased and stabilized around 1.2550 in holiday-thinned trading. Demand for safety skews the risk to the downside.

Gold struggles around $2,600 as USD demand recedes

Gold briefly traded below the $2,600 level in the American session on Monday, with US Dollar demand backed by the poor performance of global equities and exacerbated by thin trading conditions ahead of New Year's Eve.

These three narratives could fuel crypto in 2025, experts say

Crypto market experienced higher adoption and inflow of institutional capital in 2024. Experts predict the trends to look forward to in 2025, as the market matures and the Bitcoin bull run continues.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.