These quality dividend kings grow their dividends the fastest

Key points

-

Lowe’s grows its dividend the fastest and can sustain double-digit increases for the next few years.

-

Nordson ramped the pace of its distribution increases to a double-digit figure.

-

Target is emerging as a deep-value opportunity for Dividend King investors looking for aggressive distribution growth.

-

5 stocks we like better than Lowe’s Companies

Dividend growth is critical for high-quality buy-and-hold stocks. Dividends attract buy-and-hold investors, but the distribution growth keeps them there. That’s important because it can help lower volatility and beta. Dividend Kings are among the highest-quality dividend-growth stocks with 50 or more years of consecutive increases, but the growth isn’t always robust. Many Dividend Kings, most for that matter, tend to grow their payments at low-single-digit paces because they are already paying out most of their earnings as distributions.

The good news is that not all Dividend Kings fall into the same category. Some are growing their payments at a double-digit pace, and that’s what we’re focusing on now—Dividend Kings with the fastest pace of distribution growth and the ability to maintain high distribution CAGRs. That’s an important metric because it means above-average returns for investors and a catalyst for higher share prices.

Lowe’s is growing its dividend faster than any other king

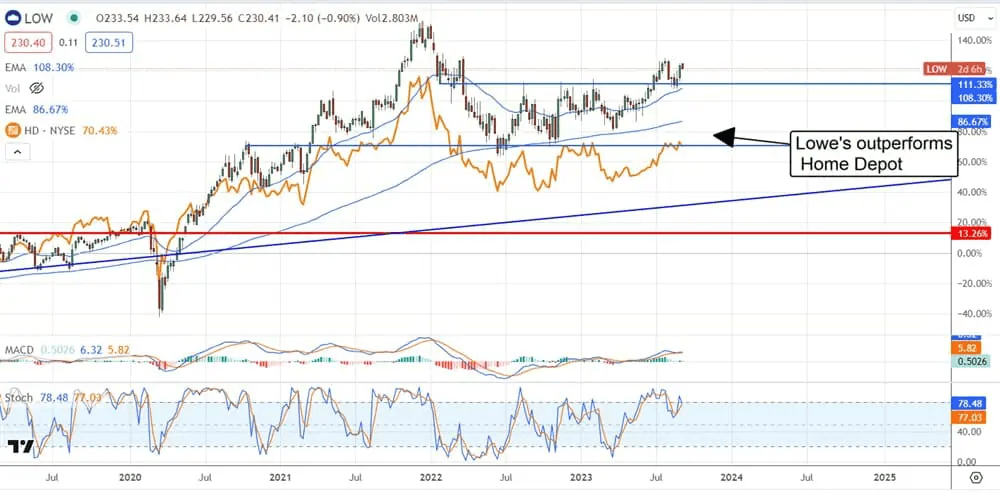

Lowe’s (NYSE:LOW) could now be the most attractive Dividend King. The company is paying 1.90% in yield while trading at a value compared to peers, and it comes with a robust outlook for distribution growth. The company has been increasing the payment for more than 50 years and is paying out less than 40% of its earnings. That low payout ratio is surprising for a stock with such a long history of sustained increases and has allowed the company to increase the pace of increases in recent years.

Lowe’s is running a 20%+ CAGR over the past 5 and 3-year periods. Investors should expect this pace to slow over the next few years, but double-digit increases are still expected. Regarding competitor Home Depot (NYSE:HD), it pays a slightly higher yield but trades at a higher valuation and comes with a less robust history and outlook for distribution increases. Home Depot’s business is also underperforming Lowe’s in 2023. Analysis rate Lowe’s a Hold, but there have been recent upgrades, and the price target is trending higher.

Nordson ups the pace of increases

Nordson (NASDAQ:NDSN) is another Dividend King that can ramp the pace of its distribution increases. The company manufactures technology for dispensing and applying fluids in 3 segments. Those include industrial, medical, and advanced technology solutions, which gives the company ample diversification. Revenue and earnings growth have stalled in 2023 but remain solid and are stabilized above 2019 levels.

The only downside is that the 16% dividend CAGR is pricey at 27X earnings, and the dividend yield is below the S&P 500 average. The upshot is the low 30% payout ratio and low leverage ratio, suggesting another 60 years of sustained increases are possible. Analysts rate NDSN stock a Moderate Buy with a firm price target about 8% above the recent action.

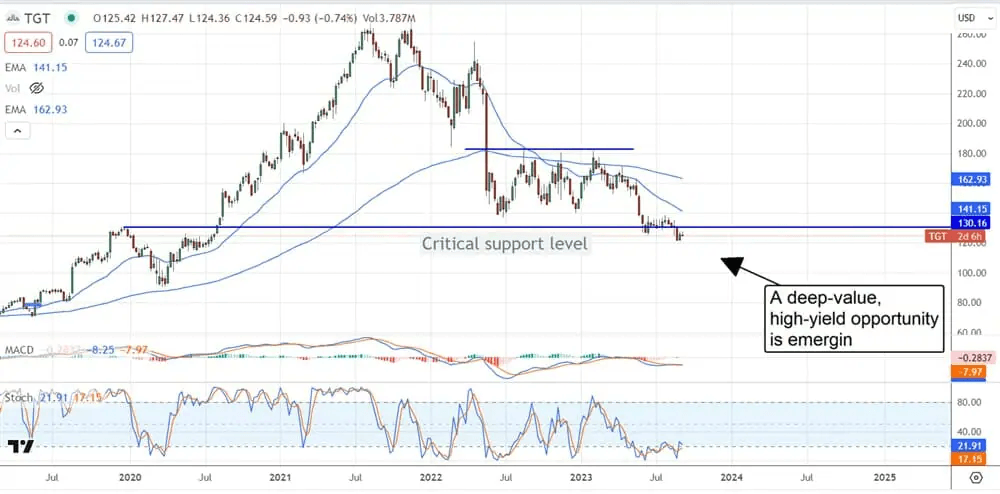

Target becomes a deep value play

Target (NYSE:TGT) shares moved to a new long-term low following the Q2 results, opening a value play in the stock. The company’s P/E fell to only 16X, and the yield is increasing. The stock yields about 3.5%, trading at the new lows, and the payout is still reliably safe. The new guidance has the payout ratio in the range of 60%, which is on the high side but still manageable.

The payout ratio will fall substantially if the company can effect its turnaround and meet next year’s consensus figure. Until then, the company has been increasing its payout at an 11.6% CAGR over the last 5 years. That pace may slow, but annual increases are still expected. Share prices may trend lower soon, but the analysts have been lowering their targets for Q3 results. This has set the bar low and may provide a catalyst in mid-November.

The analysts’ activity is weighing on Target share prices now but may also provide a catalyst in November or early next year. The group is lowering price target estimates, and there have been a few downgrades, but the rating is still a firm Hold with a consensus of 25% above recent action.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.