The Procter & Gamble Company (PG) Elliott Wave technical analysis [Video]

![The Procter & Gamble Company (PG) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/hand-pointing-graph-elements-of-this-image-furnished-by-nasa-76654497_XtraLarge.jpg)

PG Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (3).

Direction: Upside in wave 1 of (3).

Details: We are still trading below ATH, as we are approaching the bottom of MG2 at 165$ where we are expecting resistance.

PG Elliott Wave technical analysis – Daily chart

In our analysis, we identify a trending function characterized by impulsive mode and motive structure. Positioned in Wave (3), our focus is on the upside movement in wave 1 of (3). While we're still trading below the all-time high (ATH), we anticipate encountering resistance as we approach the bottom of MG2 at $165.

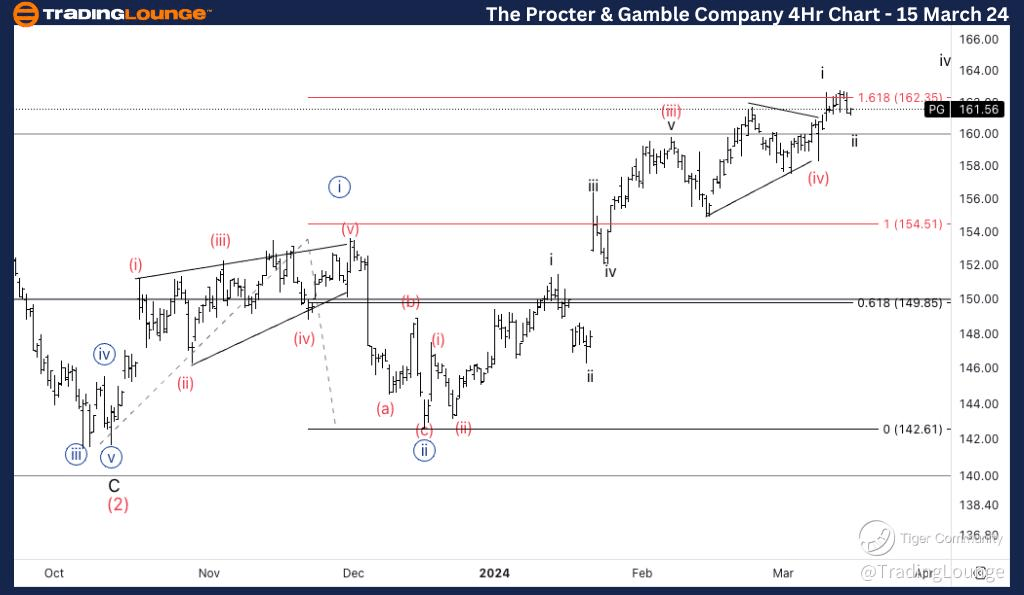

PG Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (v) of {iii}.

Direction: Upside into wave (v).

Details: Looking for further upside into wave (v) as we could have completed wave i of (v). As mentioned, I’d expect 165$ to act as resistance, even if we have touched 1618 {iii} vs. {i} at 162$.

PG Elliott Wave technical analysis – Four-hour chart

Here, we also observe a trending function marked by impulsive mode and motive structure. Positioned in Wave (v) of {iii}, our attention is on the upside movement into wave (v). We anticipate further upward momentum, considering the possibility of completing wave i of (v). Despite touching $162, we expect $165 to serve as resistance, especially given its significance in the Elliott Wave framework.

The Procter & Gamble Company (PG) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.