The Home Depot (HD) Elliott Wave technical analysis [Video]

![The Home Depot (HD) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/stock-market-performance-9668321_XtraLarge.jpg)

HD Elliott Wave Analysis Trading Lounge.

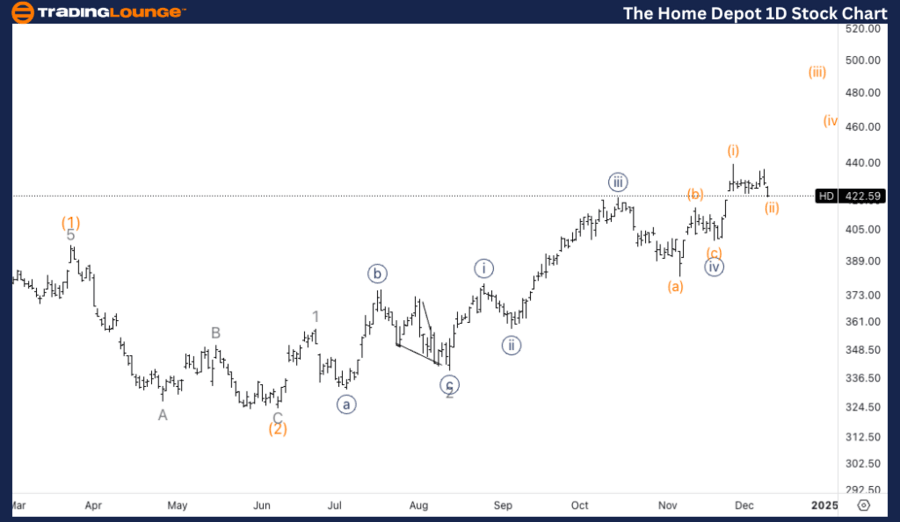

The Home Depot, (HD) Daily Chart.

HD Elliott Wave technical aAnalysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {v}.

Direction: Upside in wave (iii) of {v} of 3.

Details: Looking for upside into what could be an extended wave {v} towards the next Trading Level at 500$.

HD Elliott Wave technical analysis – Daily chart

The daily chart suggests that HD is advancing in an extended wave {v}. This wave is expected to push higher towards the next key resistance area at TradingLevel 500$. The current structure indicates strength in the trend, and the upside potential continues as wave (iii) within wave {v} unfolds.

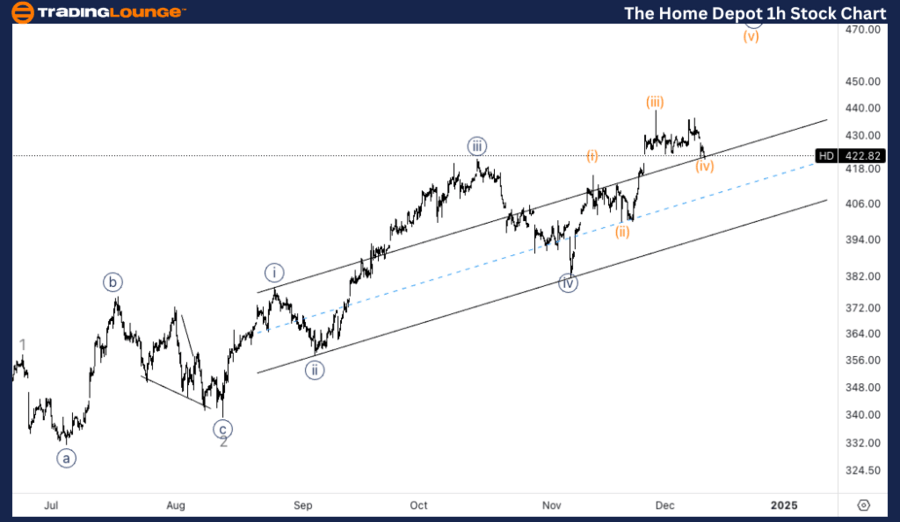

The Home Depot, (HD) one-hour chart.

HD Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (iv) of {v}.

Direction: Upside in wave {v}.

Details: Here’s an alternate highlighting the possibility of a bottom in wave {iv} in place at 380$ and a five wave move into wave {v} unfolding to the upside.

HD Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, there is an alternate scenario suggesting that wave {iv} has already found a bottom at $380. A new five-wave move is expected to unfold as wave {v} pushes higher. This supports the bullish view that HD is on track to continue its upward trend.

This analysis focuses on the current trend structure of The Home Depot, (HD) utilizing the Elliott Wave Theory on both the daily and 1-hour charts. Below is a breakdown of the stock's position and potential future movements.

The Home Depot (HD) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.