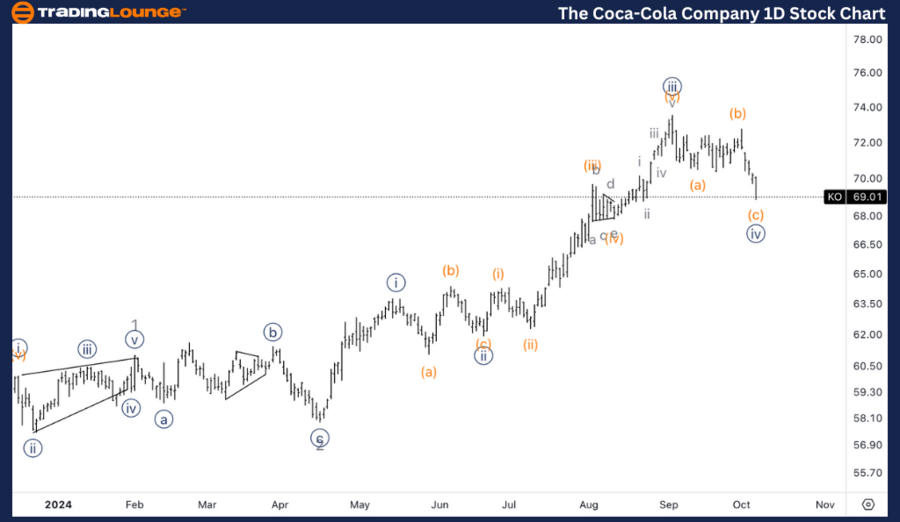

KO Elliott Wave Analysis Trading Lounge Daily Chart,

The Coca-Cola Company, (KO) Daily Chart.

KO Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 3.

Direction: Upside in wave 3.

Details: Looking for a correction in wave {iv} to be near completion to the resume higher and complete higher degree wave 3, ideally at 80$.

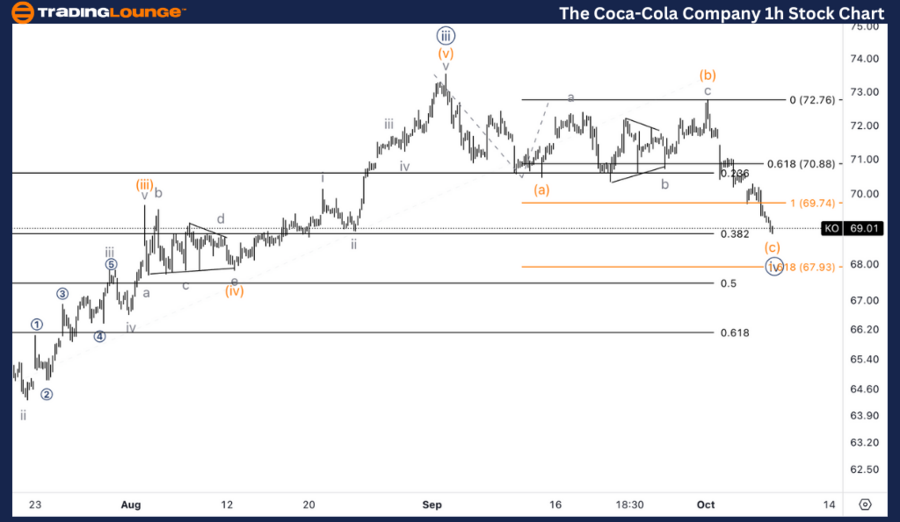

The Coca-Cola Company, (KO) 1H Chart.

KO Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Flat.

Position: Wave (c) of {iv}.

Direction: Bottom in wave (c).

Details: Looking for a bottom in wave (c), as we have reached equality of (c) vs (a) as well as we have reached 38.2% retracement of the advance in wave {iii}.

In this Elliott Wave analysis, we will review the trend structure of The Coca-Cola Company (KO) using both the daily and 1-hour charts to assess the current wave position and potential price movements.

KO Elliott Wave technical analysis – Daily chart

On the daily chart, Coca-Cola (KO) is in wave 3 of a larger impulsive structure, and a correction in wave {iv} is expected to be near completion. Once this corrective phase ends, the stock should resume its upward trajectory, aiming for a target around 80 USD, which would likely complete the larger-degree wave 3.

KO Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, the structure is currently undergoing a flat correction within wave (c) of {iv}. The wave (c) is nearing a potential bottom, as it has reached equality of wave (c) vs (a) and retraced to 38.2% of the previous advance in wave {iii}.

Technical analyst: Alessio Barretta.

KO Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD recovers toward 1.0600 as US Dollar retreats ahead of data

EUR/USD extends the rebound toward 1.0600 in the European session on Friday. The renewed upside is mainly linked to a broad US Dollar pullback as traders look to the topt-tier US Retail Sales data for a fresh impetus. ECB- and Fedspeak also eyed.

GBP/USD holds above 1.2650 after UK data

GBP/USD holds its recovery momentum above 1.2650 in European trading on Friday. The mixed UK GDP and industrial data fail to deter Pound Sterling buyers as the US Dollar rally takes a breather ahead of Retail Sales and Fedspeak.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.