The analysts see a bright future for Sunrun

Key points

-

Solar companies like Sunrun are getting attention from analysts that see a double-digit upside.

-

Rule changes in California may affect near-term demand but long-term fundamentals are sound.

-

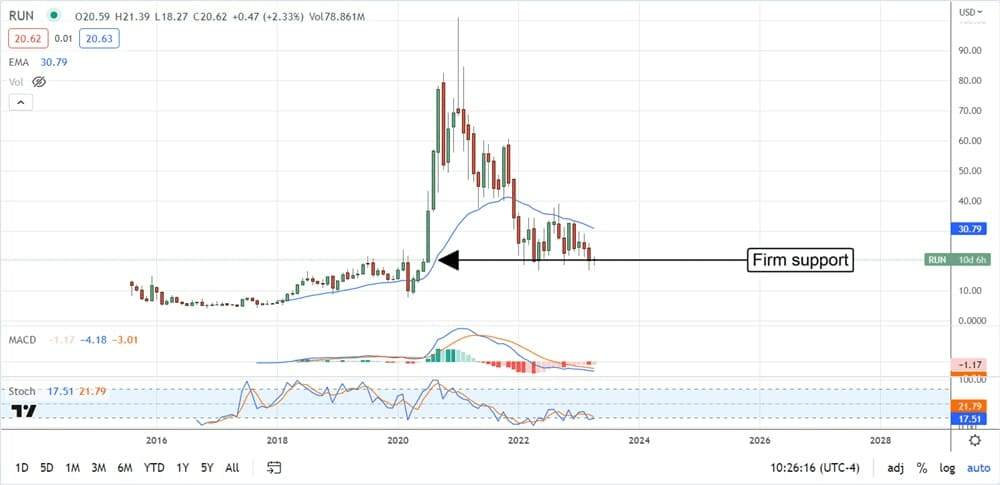

The stock shows clear support at critical levels and may rebound when earnings are released.

-

5 stocks we like better than Sunrun.

Proposed changes to California’s net-metering rules have cut the share prices for companies like Sunrun (NASDAQ:SUN) and Enphase (NASDAQ:ENPH), but analysts still see a bright future. Net-metering, the ability to sell unused power back to the grid, is critical in selling solar to the masses. The new rules cut the proceeds from net metering by 75% and are expected to impact demand.

Ultimately, the cut will make it take longer for residents to recoup the cost of their solar systems but is intended to spur the use of batteries.

The idea is that instead of selling the power to the grid, homeowners can save it for themselves, help support grid integrity, and keep operating costs lower over the long run. That means higher costs for consumers in the near-term but not everyone agrees this is bad news for solar companies.

Raymond James renewable energy analysts Pavel Molchanov thinks the changes will work fine. In his view, the change may cut into near-term demand, but California’s high energy costs and the declining cost of solar installations will support the market.

Sunrun launched a new subscription service in response to California’s change. The service includes equipment that helps maximize use during peak times to optimize customer costs. It’s not the same as batteries or a backup system, but it can store energy for short periods to provide better cost advantages to consumers.

Sentiment shifts for Sunrun and solar companies

The sentiment for Sunrun has slipped over the last year, and its price target has fallen along with it but take that with a grain of salt. The Marketbeat.com consensus sentiment slipped to Moderate Buy, and the price target is down more than 50%, but those trends are ending.

The latest activity includes several reiterated Buy/Strong Buy ratings and 1 upgrade to Overweight from Keybanc. Keybanc analysts think the stock could rise at least 30%, below the consensus and many recent targets. The consensus is about 75% above the current action, but the more recent targets are closer to 50% which is still a robust gain for investors.

Institutional activity may also help this market to reverse. The institutional activity has been roughly balanced for the last 12 months, with sellers outpacing buyers by a small margin, but the trend is changing.

The institutions became buyers on balance in Q1 with a ratio of more than 3:1. They own more than 86% of the stock and may continue to buy with the price action bumping along at the prepandemic highs. Recent buyers include Raymond James and Voya Investment Management.

Short interest has Sunrun set up to run

The negative sentiment in Sunrun has short interest up to over 15%, which is enough to weigh on price action without a catalyst. The next catalyst is Q1 earnings, due at the end of April. The analysts expect a sharp sequential revenue downturn that puts YOY growth at only 4.6%.

This is a low bar for a company growing at a 40% CAGR even with the expected slowdown caused by California. A solid report will get the market’s attention and may even spur the shorts to begin covering positions.

The stock shows a firm bottom at the $20-$21 level, aided by firming sentiment among analysts and institutional buying. It may sustain a rally if the market can hold this level and produce solid results. If not, this stock may fall below support and move to lower levels, including the $10 region.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.