Tesla’s time to take off? [Video]

![Tesla’s time to take off? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Bovespa/bm-amp-f-75135517_XtraLarge.jpg)

Elon Musk has a reputation of a man who gets things done. It is a deserved reputation as his achievements have been quite astounding. Whether it is in space with Starling or SpaceX, on the roads with Tesla, or digitally with AI, Musk consistently takes new ground. Perhaps then it should not be a surprise to see the latest announcements from Tesla. Does it demonstrate that Tesla is going to dominate the EV market?

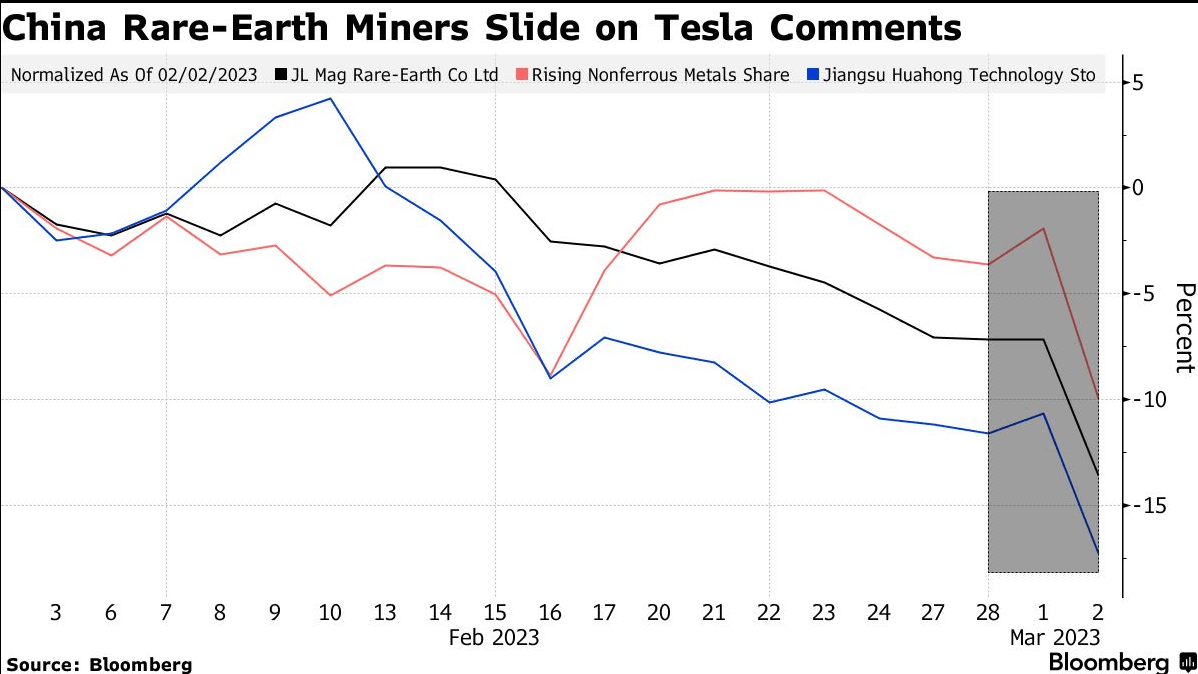

Firstly, Elon Musk has announced that the new Tesla drive train will leave 50% less of a factory footprint, cost $1000 less, and then it will not use rare earth materials. Tesla’s Colin Campbell stated that due to health and environmental concerns mining rare earths, the next drive unit would use a permanent magnet that does not use rare earths at all. This announcement sent the shares of China’s JL Mag Rare-Earth Co and Jiangsu Huahong Technology Stock Co tumbling as reported by Bloomberg.

Bloomberg also reported that Campbell stated that Tesla had designed its own transistor package that uses 75% less Silicon Carbide which is a big win as it is expensive. Tesla also sees the chip shortage is behind them, aims to make a new car every 45 seconds, wants to spend $175 billion to hit 20-man vehicle production and could launch two new models to help achieve that aim.

Tesla’s share price

The current share price of Tesla is around 50% down from the 2021 peak of over $400. It is contained underneath the 100 and 200 EMA. However, do any further dips lower simply offer good value buying opportunities for the long term? Is Tesla, with all the drive of Elon Musk behind it, going to innovate, add efficiency, and expand its models to a new EV-hungry world? Or will mainstream car manufacturers snap up more of the EV market share? Tesla is one share to watch, particularly, on any drops lower into the $125 region.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.

-638134314212093875.png&w=1536&q=95)