Tesla vs. Meta: Who will reign supreme?

Battle of the titans

Last week a very bizarre headline broke that Elon Musk and Mark Zuckerberg were preparing to fight each other in a cage fighting match. Elon Musk is never one to break away from a challenge and he does hold the weight advantage, but Mark Zuckerberg is said to be quite handy in the ring with some experience under his belt. Whether this fight actually goes ahead or whether it is just a bit of fun between the two men remains to be seen. However, according to CNBC, the match could bring in over $1 billion in revenue. Although market sentiment can be impacted by magazine covers, the impact of a cage-fighting match on Twitter’s, Tesla’s, or Meta’s share prices is far less obvious.

Would Meta win if it fought Tesla?

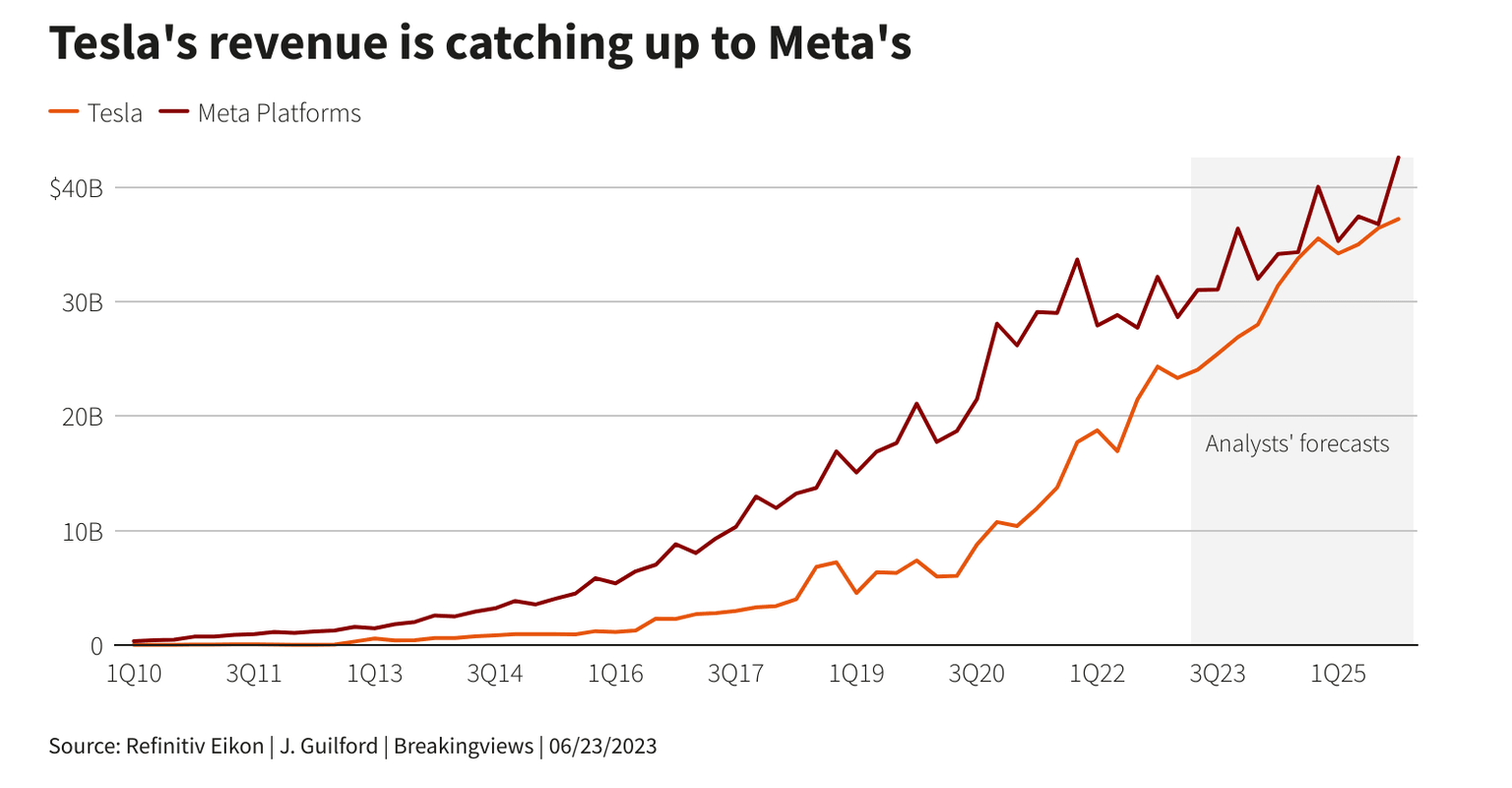

An interesting piece by Reuters theoretically pitched the two companies that Musk and Zuckerberg lead against each other. The view from this Reuters piece is that Tesla would win in a fight against Meta. The piece noted that Tesla’s revenue is fast catching up with Meta’s.

Tesla has also performed significantly better, with a dollar invested in Tesla’s stock-market debut in 2012 now worth $144, compared to $7.45 for Meta. Tesla has a market capitalisation of around $800 billion which is around $100 billion more than Meta’s.

While Meta has a stronger financial position with a larger cash reserve ($37 billion), Zuckerberg has also generated more cumulative free cash flow ($116 billion) and returned a significant amount ($96 billion) to shareholders through buybacks. Tesla’s future, however, is presented as more promising with plans for charging networks and battery production set to capitalise on a green world. These plans have already received US Government support too. So, is Tesla really going to be the winner between the two companies, or can Meta find a way to fight back?

In conclusion, the cage fight between Elon Musk and Mark Zuckerberg is unlikely to impact the share prices of Tesla, Twitter, or Meta. However, if the fight goes ahead we could see volatility in those share prices if there is a risk of any serious injury. Aside from that risk, the main battle between the two companies is likely to take place in the financial arena rather than the MMA ring.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.