Tesla (TSLA Stock) – Q2 earnings preview

The electric vehicle bellwether Tesla (#Tesla) will be announcing its earnings for the second quarter on 26th July, after market close.

Despite facing a number of headwinds such as supply chain instability and seasonality, Tesla topped analysts’ estimates and managed to deliver the highest ever vehicle deliveries in the previous quarter, total 184,800 vehicles. In regard to the chip shortage that hit automakers globally, Tesla has taken a precautionary step ahead by pivoting to new microcontrollers, at the same time developing firmware for new chips made by new suppliers. The company has even considered buying a chip plant in the future, to further withstand any unwanted shortcomings raised from the chip shortage issue and maintain its competitiveness.

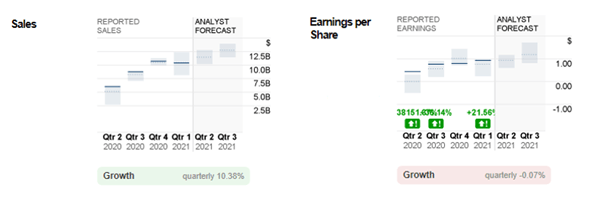

In general, reported sales of Tesla in Q1 2021 were $10.4B, slightly below consensus estimates and the previous quarter by $0.1B and $0.3B, respectively. Nevertheless, earnings per share (EPS) was positive and last stood at $0.93, exceeding consensus estimates by more than 20%.

Reported EPS and Sales versus Analyst Forecast for Tesla, by quarterly and annually:

Source: https://money.cnn.com/quote/forecast/forecast.html?symb=TSLA.

For the upcoming announcement, market participants remain optimistic over the future growth of Tesla after the company recently reported vehicle deliveries of more than 200,000 (or up 120% y/y) for the first time in a three-month period, reflecting solid market demand despite the restrictions and lockdowns imposed. Consensus estimates is that the company shall achieve $11.5B in sales, up 91.67% y/y from Q2 last year; EPS is expected to achieve $0.93, up more than 110% from the same period last year. The positive estimation was on the basis that strong sales of mass-market vehicles, better fixed cost absorption, and potentially higher software upgrade sales shall offset the negative growth impact caused by limited deliveries of the more expensive Model S and Model X vehicles. In addition, a decision to take a step forward in developing AI as an effort to upgrade the current vision-based, full-self driving (FSD) software is another bold move, yet exciting enough for a better prospect.

However, it is still worthy to note that considering recent tumbling in the cryptocurrency market, according to Barron’s, Tesla, a holder of the asset, may record losses of almost $90 million by the time it wraps up its second quarter. There is also another report that mentioned the losses endured by the automaker giant may be large enough to erase profits earned over past few quarters, if Bitcoin falls below $30,000. In addition, recent complaints regarding its product quality in China and the growing local competition may serve as a headwind for Tesla to further secure its market share in the country.

According to Barron’s, Tesla vehicles that are sold in China have accounted for about 30% of its overall sales in the three months ended in June this year.

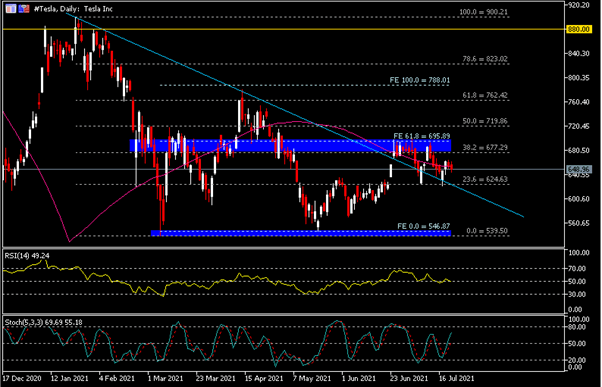

#Tesla is seen pressured below the critical resistance zone $677.30 – $695.90, leaving behind a double top price pattern. As of its close on 19th July, the company’s share price remains supported above $624.60 (or FR 23.6% which extends from the highest point of the year (25th January) to lowest point seen in 5th March), currently testing the 100-SMA – the immediate resistance. Considering the current share price, it is about 8.2% below the median target as offered by 33 analysts, which is $703.00.

On the downside, a breakout below $624.60 will indicate the share price to be back in a descending triangle structure. The zone between $539.50 to $546.90 (the lows seen on 19th and 15th March, respectively) serves as an important support level to watch. In terms of indicators, RSI hovers around 50.0 (neutral) while Stochastics rebounds above 50.0, with %K and %D stood at 69.69 and 55.18, respectively.

All in all, #Tesla has been ranked as 3 (Hold) by Zacks, considering the company’s share price has been consolidating in the range $620 – $700 for the past month.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.