- TSLA stock drops sharply on Friday as growth stocks hit hard once more.

- Tesla releases earnings on Wednesday after the close.

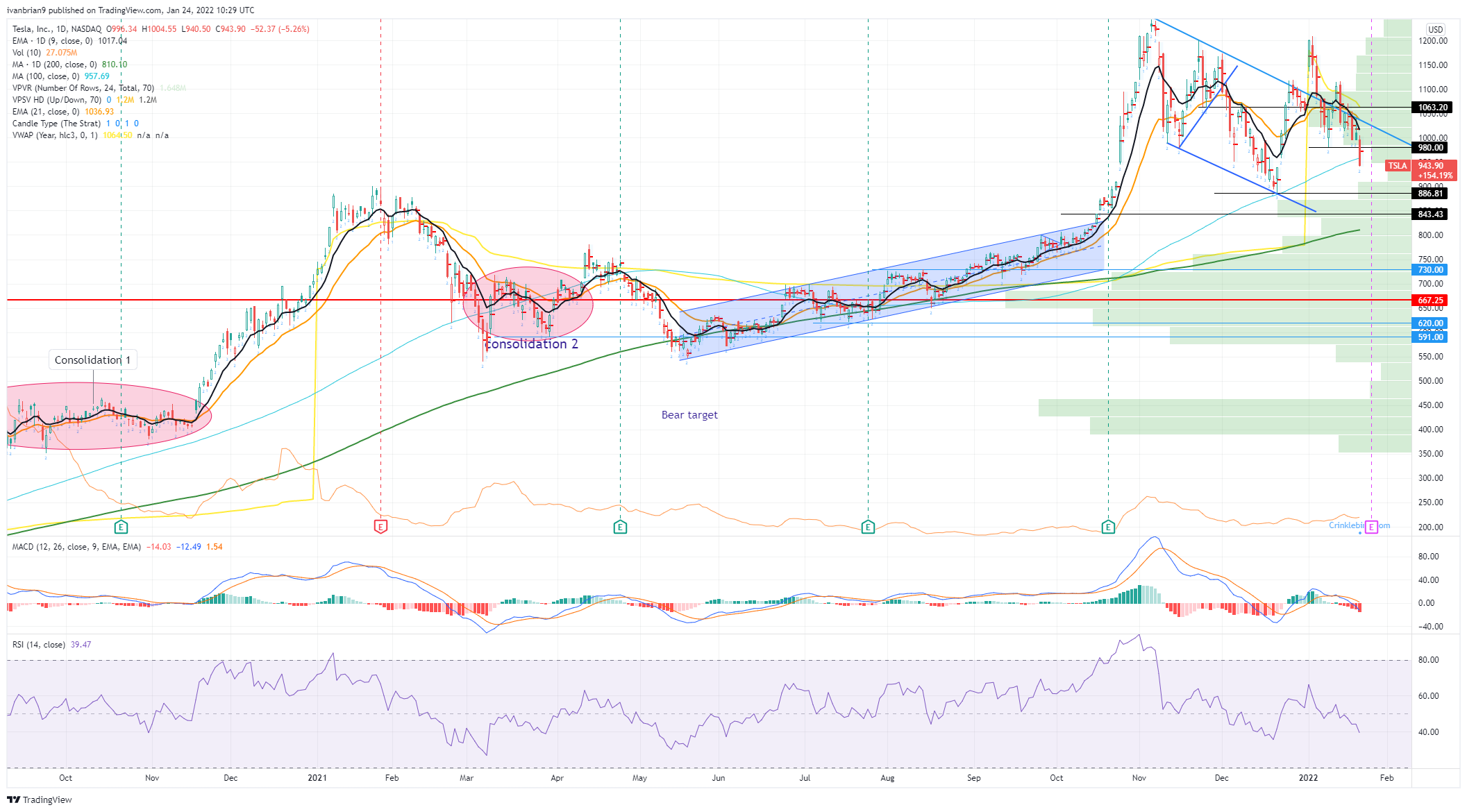

- TSLA shares have broken the key support at $980.

Tesla (TSLA) finally broke below $980 on Friday in a day of heavy losses for the electric vehicle leader. Growth stocks continue to suffer, and Friday saw perhaps an acceleration of that trend. Risk aversion is growing ahead of the first rate hike, while geopolitical tensions are also not helping risk appetites as the Russia-Ukraine situation continues.

Tesla had attempted to hold things together on Thursday when it put in a surprising up day despite the main indices falling. However, from Friday's price action it now appears that Thursday's gain was a mere aberration and normal service is now resumed. Tesla reports earnings on Wednesday, so there may be some hope of stopping the losses. It will take a strong set of earnings to do that however.

Tesla Stock News

There has been quite a bit of news over the weekend for Tesla but nothing that looks too positive. For starters, the stock remains one of the stop stocks trending on social media with WallStreetBets mentions high. Usually, that would be taken as a positive sign, but the power of the retail crowd has faded and many of their favorite meme names are significantly underwater this year.

Elon Musk was busy sharing pictures of the graffiti on the walls of the new Berlin factory over the weekend, which generated some talk that production may be imminent. Another new plant, Texas is due to come on stream shortly, and reports over the weekend indicate that Tesla is looking to begin Model Y deliveries from the Texas plant before this quarter is up. However, the negative momentum generated by Netflix (NFLX) earnings last week has spread across the growth sector with TSLA shares suffering as a result.

Ahead of Wednesday's earnings release, average forecasts are for earnings per share (EPS) of $2.35 on revenues of $16.65 billion. The average analyst price target for Tesla currently sits at $1,057. Tesla has already released its delivery data with a total of 305,840 vehicles produced in Q4 2021 and 308,600 vehicles delivered in the fourth quarter.

Tesla Stock Forecast

For now Tesla stock enters a confirmed bearish phase. Breaking $980 has created a new low and also confirmed the higher high from January 4. This spike is when Tesla released its delivery data, so this has already been baked into the price. This means an outperformance is even harder now on the earnings number. $886 is the next significant low, and if this bearish trend is to continue, then that low needs to be broken. Small resistance at $1,115 and then the January 4 high of $1,208.

Tesla chart, daily

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.1100 on modest USD recovery

EUR/USD struggles to hold its ground and retreats toward 1.1100 in the second half of the day on Tuesday. Upbeat Retail Sales data and the uncertainty surrounding the Fed's upcoming interest rate decision helps the US Dollar recovery and weighs on the pair.

GBP/USD pulls away from multi-day highs, trades below 1.3200

GBP/USD stays on the back foot and trades below 1.3200 in the second half of the day on Tuesday. The cautious market stance ahead of the Federal Reserve's policy meeting supports the USD and limits the pair's upside.

Gold under mild pressure near $2,560

Gold stays under modest bearish pressure on Tuesday and trades below $2,580. The benchmark 10-year US Treasury bond yield holds steady above 3.6% ahead of the Fed's policy announcements on Wednesday, making it difficult for XAU/USD to gather bullish momentum.

Why the Fed is set to cut interest rates and what does that mean Premium

The Fed is expected to cut interest rates on Wednesday. This is a crucial event as it directly affects families and businesses in the United States (US) – but also abroad given the importance of the US as the world’s largest economy.

Bitcoin approaches its $56,000 support level

Bitcoin is approaching a crucial daily support level of $56,000, hinting at a possible recovery. Ethereum faced rejection from the resistance level, suggesting a downward trend with weak momentum. In contrast, Ripple has bounced above the 100-day EMA, indicating a continued upward trend.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.