- Tesla corrects over 4% as Wall Street tumbles on hawkish Powell.

- Volkswagen Group to become the EV market leader in Europe.

- Tesla CEO Elon Musk takes a bite out of Apple.

Update, November 2: TSLA shares clinched five-day highs at $1,172.84 on Wednesday and then corrected sharply amid a broader market sell-off. Fed Chair Jerome Powell’s calls for a hastened taper and Omicron covid variant woes sapped investors’ confidence, weighing heavily on the Wall Street indices. The re-emergence of Germany-based Volkswagen Group to become the electric vehicle (EV) market leader in Europe threatened the prospects for Tesla, causing the stock price to fall 4.35% to $1,095.

Tesla (TSLA) stock can do no wrong in 2021, and it avoided another market meltdown on Tuesday. While panic ensued following Powell's remarks about the taper and inflation, TSLA held firmly in the green. Equity indices finished nearly 2% lower on Tuesday, but Tesla shares closed at $1,144.76 for a gain of 0.7%. This was another strong outperformance for a stock that is up 62% year to date.

Contrast that with the Nasdaq, up 25 % for 2021, and the S&P 500, up a similar amount. 2021 has been the year of the electric vehicle, and Tesla paved the way for others to follow, notably Rivian (RIVN) and Lucid (LCID).

Our chart above shows the strong correlation between Tesla and Lucid with both stocks putting in a stellar second half for 2021.

Tesla (TSLA) stock news

Elon Musk is nothing if not entertaining, and on a slow news day for Tesla he livened things up by taking a pop on Twitter toward Apple.

Don’t waste your money on that silly Apple Cloth, buy our whistle instead!

— Elon Musk (@elonmusk) December 1, 2021

The Apple cloth he is referring to is a polishing cloth available from Apple for $19. Tesla recently launched a Cyberwhistle for what reason? Who knows, but it is currently sold out. At $50 for a whistle, it is not exactly cheap. It seems people just love a Tesla product. Apple was no slouch either on Tuesday as the stock set all-time highs.

Tesla (TSLA) stock forecast

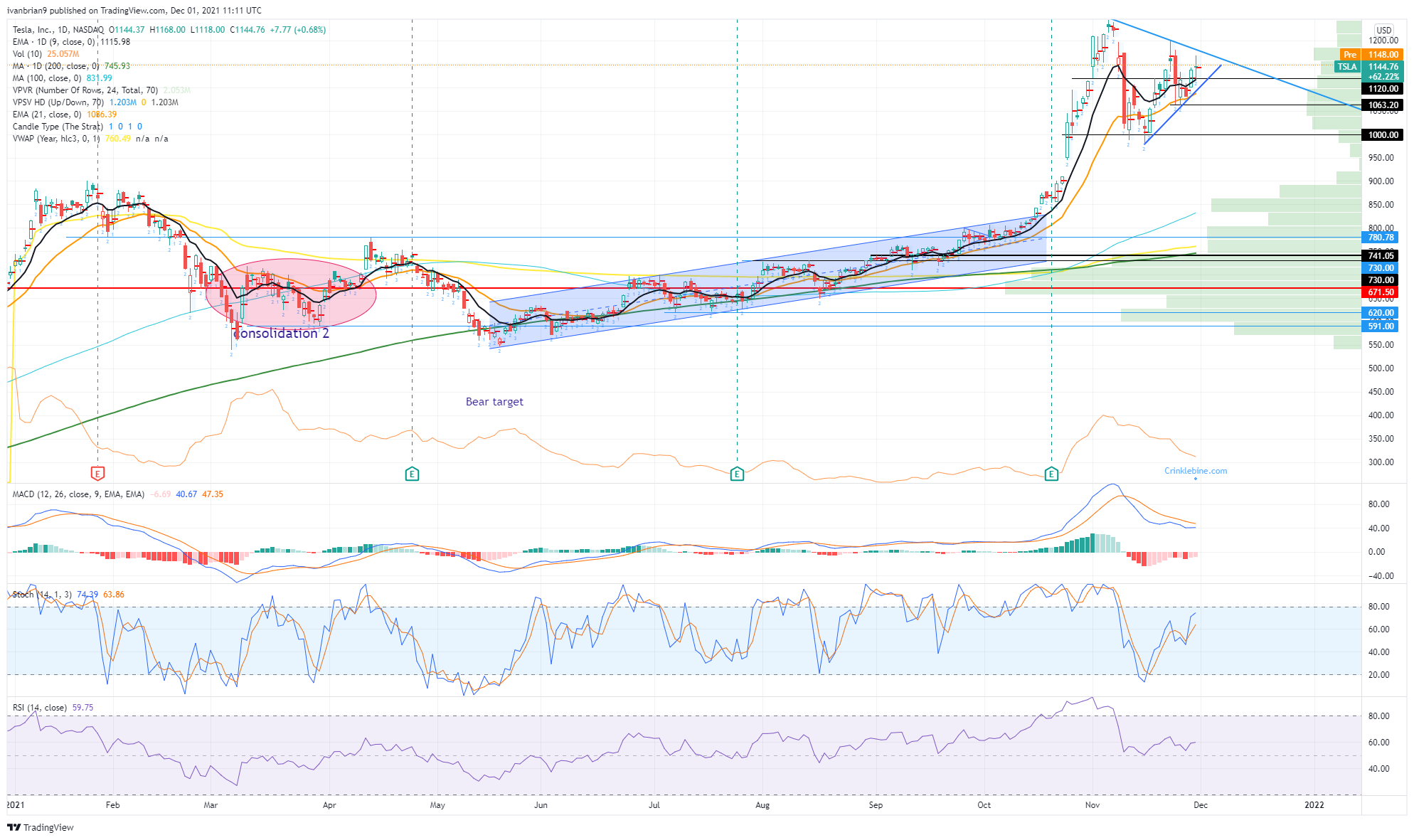

The triangle formation still holds and a breakout is awaited. A triangle pattern is usually a continuation pattern, and Wednesday could provide the catalyst to break higher. The stock has consolidated well despite some strong headwinds: notably, Elon Musk selling a Cybertruck load of stock, and Tesla not performing well in a recent reliability test. It did however score highly on customer satisfaction, and investor satisfaction is also high given the strong performance. We expect more all-time highs this week even with the surrounding Omicron volatility. Our view will change if Tesla cracked below key support at $1,063.

TSLA 1-day chart

Previous updates

Update: TSLA shares are down 3.47% heading into the close, trading at $1,105 per share. US indexes changed course ahead of the close, trimming intraday gains and turning red after a solid start to the day. There was no particular catalyst behind the late decline, although investors remain cautious as they finish digesting the latest pandemic develops and comments from US Federal Reserve chief Powell, who called for speeding up tapering as soon as this month. At the time being, the Nasdaq Composite is down 198 points or 1.28%.

Update: TSLA shares are looking less likely to break $1,200 on Wednesday though the stock traded up to $1,172 on the open. Mid-session TSLA was up 1% at $1,156, while the S&P 500 rose 1.6%.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stays firm near 0.6300 after strong Chinese exports data

AUD/USD is trading well bid near 0.6300 in Asian trades on Monday, opening the week on the front foot. Risk sentiment remains in a sweeter spot following the weekend's news of lower US tariffs on Chinese electronic supply chain and strong Chinese exports data for March. Tariffs talks will remain on the radar.

USD/JPY recovers to 143.00 amid volatile trading

USD/JPY is trimming losses to retake 143.00 in Monday's Asian trading. The US Dollar pauses its latest leg down, with traders digesting Trump's tariff news from the weekend. However, the Fed-BoJ policy divergence expectations underpin the Japanese Yen, keeping the weight intact on the pair.

Gold record rally pauses on Trump’s tariff concession

Gold price builds on Friday’s pullback from record highs of $3,245 early Monday. Trump’s lower tariffs on Chinese electronics and chips offer relief to markets. Technically, Gold could see a brief correction before the next leg up.

Bitcoin is on the verge of a breakout while Ethereum and Ripple stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637739533256339534.png)