- Tesla goes parabolic yet again on Monday, breaking above $1,200.

- TSLA stock rises over 8% on a slow news day.

- Tesla helped to drive the S&P 500 Index higher nearly singlehandedly.

Update: Tesla is finally beginning its landing descent but whether it comes smoothly back to earth or crash lands is anyone's guess. This one is beyond analysis now and is pure momentum. The played-out will they won't they news with Hertz has helped fuel a remarkable surge that GameStop would be proud of. Recent SEC filings show selling by some Tesla directors, not suprising given the share price rise.

Tesla (TSLA) stock price, what can you say? It defies all logic – well, my logic anyway. This one is pure momentum or as the kids would say, "FOMO". Fear Of Missing Out for us older readers. Nothing wrong with pure momentum plays and following the trend. That is what behavioral economics is about after all. The weight of money behind this one is staggering though and has seen Tesla go into space without having to launch! To the moon as our AMC friends would say.

Tesla price is now over $1,200, after having only breached $1,000 last week. That is 20% in a few sessions. Elon Musk has even expressed surprise at the move, which had its genesis in Hertz (bankrupt only last year) hitching itself to the bandwagon that is Tesla, saying it was placing a huge 100,000-unit order for Teslas.

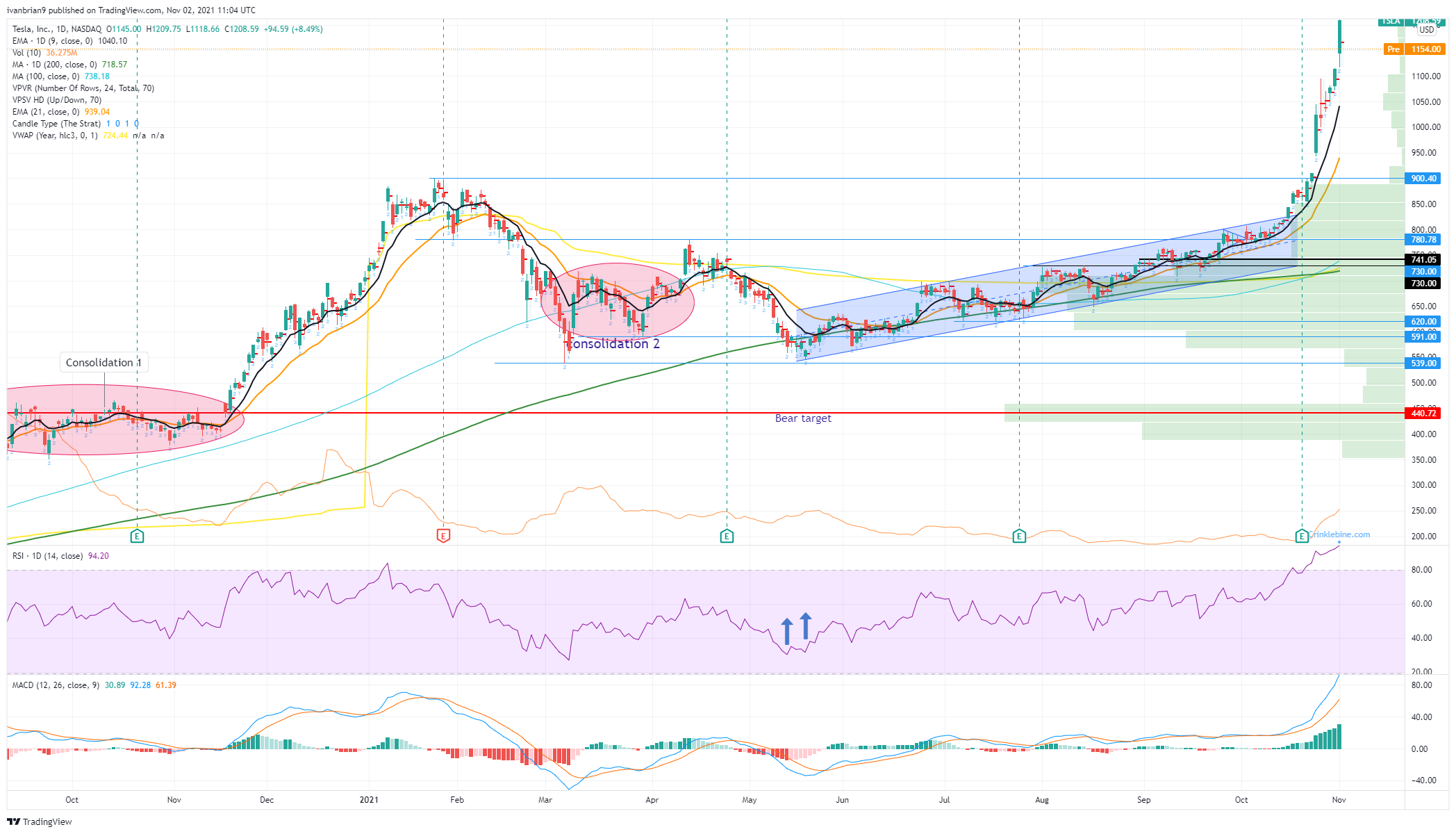

The Tesla chart below shows the acceleration of the move, which has now extended well into overbought territory on most metrics with a super high reading on the RSI. Over 40% in 11 days for a mega tech name? Beat that FAANG!

Tesla 1-hour chart

Tesla stock news

Tesla shares immediately have been the top trenders across social media and mainstream news outlets. This came after a strong set of results and deliveries. Last week the electric vehicle (EV) sector leader delivered a strong beat on EPS, coming in at $1.86 versus the $1.57 estimate. Revenue was also ahead of forecasts, coming in at $13.76 billion versus the consensus estimate of $13.63 billion.

Elon Musk appears determined to dampen down some of the recent froth in the stock price. Earlier he had said Tesla was not a demand problem and that he was surprised the Hertz news had such an impact. He has then followed this up today by saying no contract has been signed with Hertz (HTZZ) and that deal has zero effect on Tesla's economics.

Tesla stock forecast

Tesla shares' 1-year performance is now up over 200%. Hard to argue with that type of return as Tesla motors on. We cautioned yesterday against chasing the stock higher (that worked out well!), and if we were cautious yesterday we should be downright running for the hills today. Indeed Tesla is down 5% in the premarket. No one can be too surprised about that really.

$1,000 is obviously strong support and where the movement really took off from. There was huge buying last week of $1,000 calls, which expired on Friday. The RSI remains massively overbought and the MACD similarly stretched. A pullback is inevitable. Those who are long – congratulations! Use a trailing stop to book some profits. Support exists at $1,000, but breaking $950 will turn Tesla neutral in the short term in our view.

TSLA 1-day chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays defensive near 1.1350 as US Dollar looks to stabilize

EUR/USD remains on the back foot for the second consecutive session, trading near 1.1350 in the European trading hours on Tuesday. The pair weakens as the US Dollar attempts to regain stability amid the US-China trade war and growing concerns over US recession. German/ EU data are awaited.

GBP/USD battles 1.3200 after UK jobs data

GBP/USD is defending minor bids near the 1.3200 mark in the early European session on Tuesday. The latest data from the UK showed that Unemployment Rate steadied at 4% in the quarter to February while Average Earnings disappointed, weighing negatively on the Pound Sterling.

Gold price holds above $3,200; bullish bias remains amid trade uncertainty

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair. Trump's temporary tariff reprieve improves global risk sentiment and might cap the commodity.

XRP resilient amid looming ETF deadlines

Ripple (XRP) flaunted a bullish outlook, trading at $2.1505 at the time of writing on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move, eyeing $3.0000 psychological level.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637714472266733023.png)