Tesla Stock Price and Forecast: TSLA extends gains above $600, eyeing $635 as next target

- The Fed steadies the ship with inflation talk, markets take it in stride.

- Tesla stock closes up on the session in a down day.

- TSLA shares attempting to push higher to $635 resistance.

Update June 17: After overcoming the surprisingly hawkish Fed decision, Tesla Inc (NASDAQ: TSLA) has been extending its gains on Thursday, this time rising along with broader stock markets. Shares of Elon Musk's electric vehicle maker are buoyed by the recent presentation of a new model and by growing investment in the sector. Maintaining a safe distance from the round $600 level opens the door to $635, as explained in-depth below.

Tesla closed up on a down day on Wednesday, June 16, always a bullish sign. Markets took the Fed inflation talk in stride with only modest losses. The main indices closed down not much over 0.5%. Tesla closed up nearly 1% at $604.87. The last two weeks of June are historically pretty ugly for US equities, the so-called seasonality effect, so getting through this to the positive month of July is a goal for Tesla shareholders and traders.

TSLA stock forecast

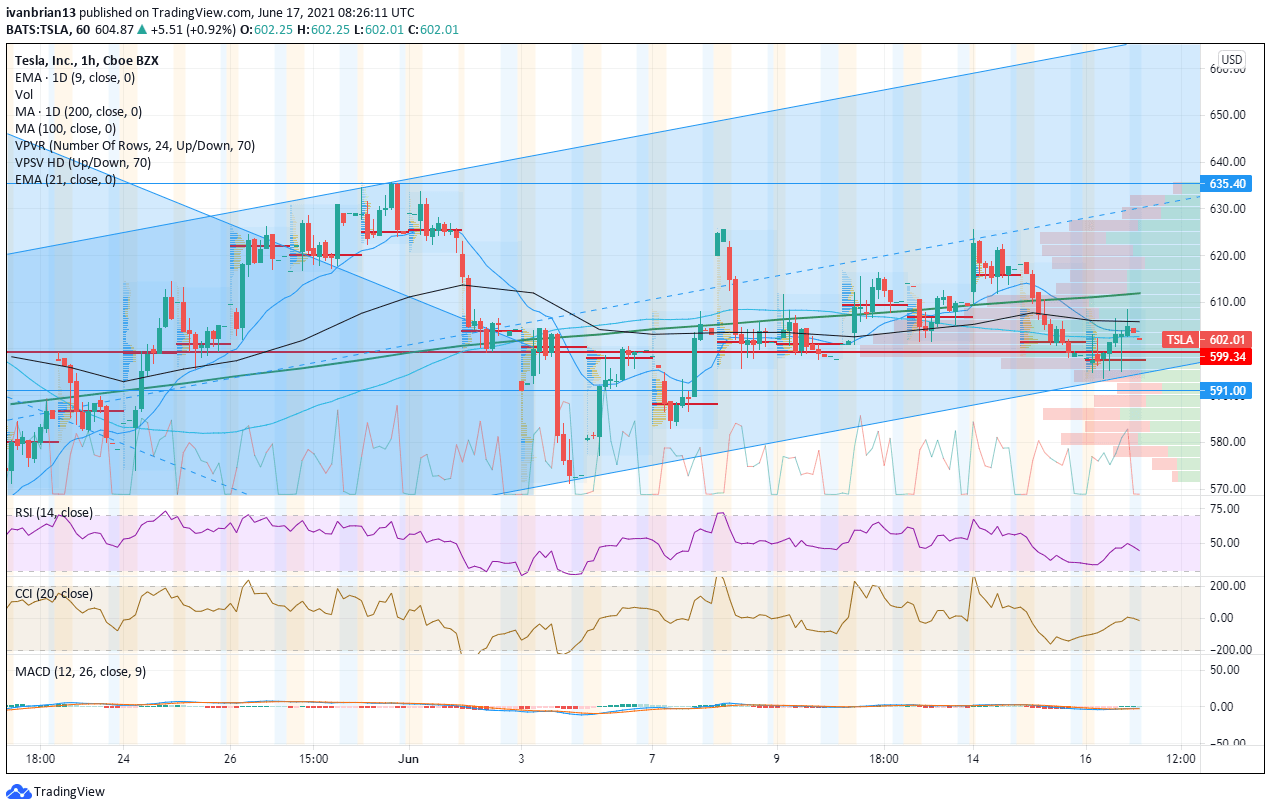

An early bounce from the up-trend channel identified here at FXStreet in early June set the scene for a push higher. Looking at the hourly chart below gives a bit more granularity to the flow data. The bottom support line of the trend channel has worked quite well numerous times. The only negative thing that is possibly concerning is the lack of volume toward the top of the trend channel. The right side of the chart shows the volume profile for each price point. This clearly shows what we have been identifying in the daily chart, namely a break of $635 should accelerate due to a lack of volume-based resistance.

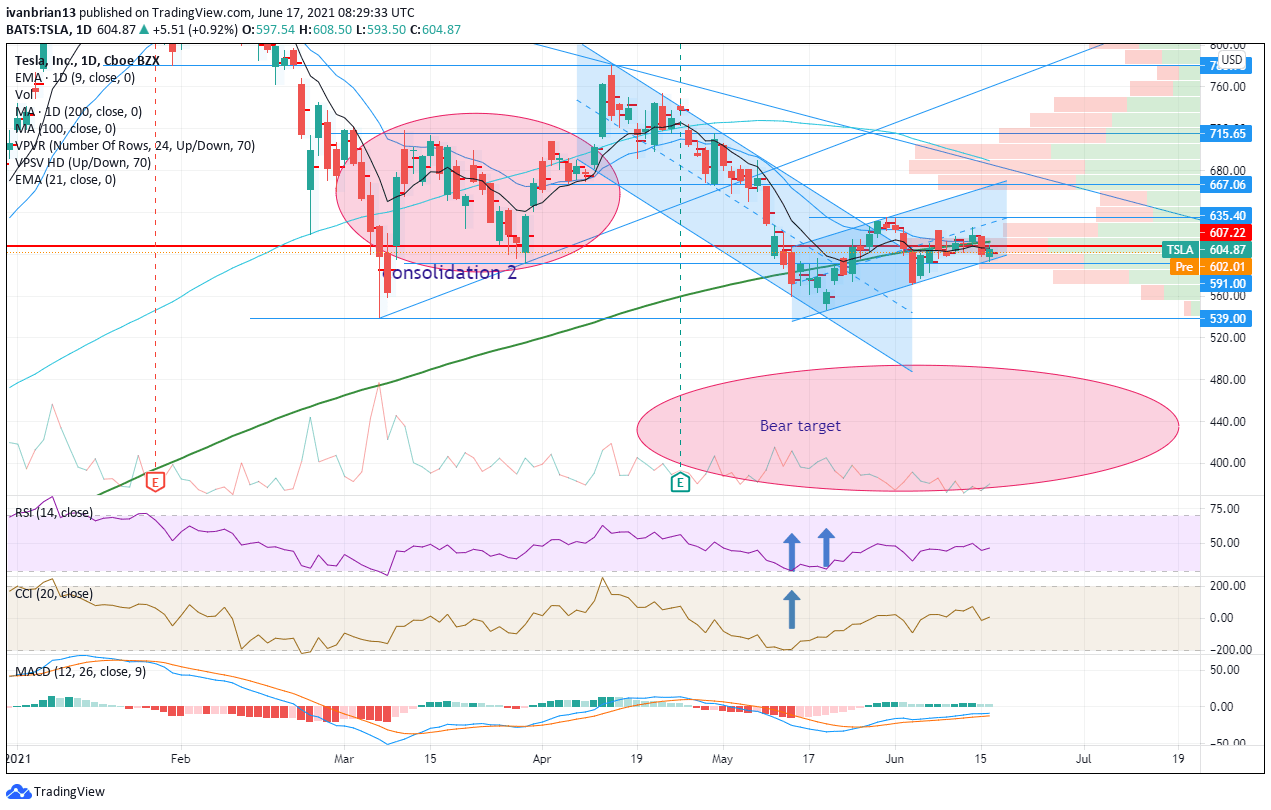

The situation remains relatively stable on the daily chart. $635 is a key level to break and should then see a push to $667. The $539 low is key to hold as below is a lack of volume-based support, meaning a fall may accelerate to the bear target zone. For now though, Tesla stock remains supported by the up trending channel, but the 9-day moving average is above the current share price. Ideally, traders would like to see this change. $539 and $635 remain the pivots.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.