- Tesla stock breaks the big $635 resistance level and the move accelerates.

- TSLA spikes 5% on the move as buyers chase the gap move.

- $667 above is the next level but heavy volume here will make it tough to break.

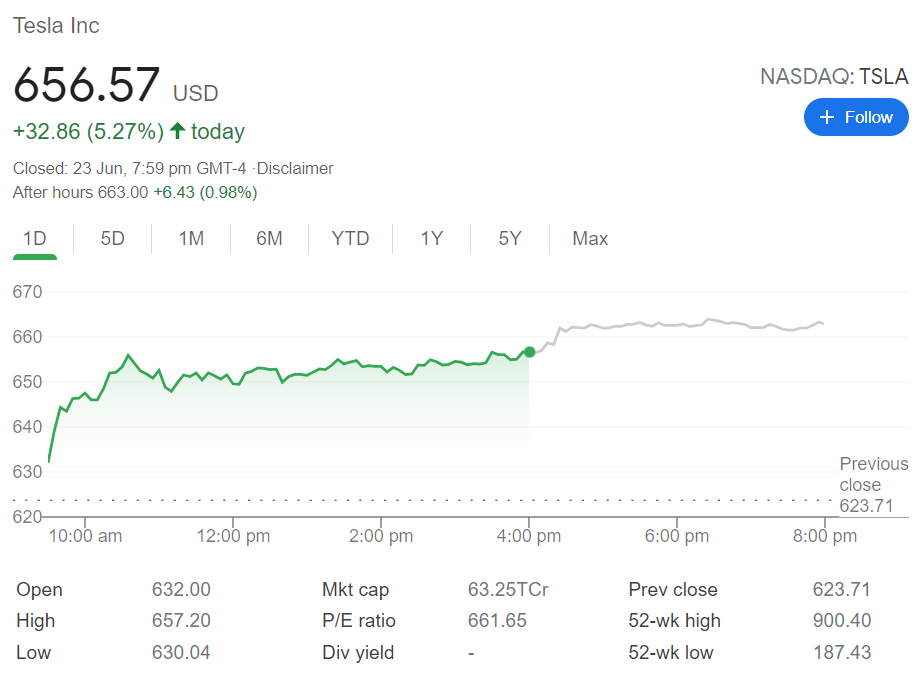

Update June 24: TSLA stock rallied hard on Wednesday after a powerful breach of the $635 critical resistance. Tesla shares jumped over 5% to reach the highest levels in six weeks at $657.12. In post-market trading, the stock added another 1% to finish at $663.30. The technical breakout was one of the key catalysts behind the price surge. The latest news that Tesla launched its first charging station in China with an energy storage function for electric vehicles triggered the blistering rally.

Tesla key statistics

| Market Cap | $601 billion |

| Price/Earnings | 621 |

| Price/Sales | 21 |

| Price/Book | 26 |

| Enterprise Value | $753 billion |

| Gross Margin | 21% |

| Net Margin |

3% |

| Average Wall Street Rating and Price Target | Hold, $652 |

Tesla stock forecast

Tuesday's move continued the recent slow but steady progress Tesla shares have been making. Importantly, the 9-day moving average is now acting as a nice guide for support to higher levels. The 200-day moving average is also finally starting to recede into the distance. Tuesday's candle was a continuation and crucially green and bullish as Monday was a bit indecisive. Monday saw a red engulfing candle as traders struggled for directional bias. Tellingly, the volume profile on both days was skewed toward the high end of the daily range.

For now, the short-term risk-reward remains skewed marginally to the upside. $635 really is a better entry point for fresh longs as a break is bullish and should lead to renewed momentum. The volume profile to the right of the chart shows how volume drops off above $635 and does not kick in until $660, so a break should accelerate. Traders already long should keep an eye on the 9-day moving average, which is currently guiding higher. Because of this it is best to use a trailing stop to try and ride the hopeful trend higher. Momentum indicators are beginning to also tick higher and confirm the price action. Both Relative Strength Index (RSI) and Commodity Channel Index (CCI) remain in neutral territory.

Previous updates

Update: The early powerful break which we called (see below) has been sustained and the stock looks set to register a powerful bullish candle. At the time of writing with just over one hour left in the regular session TSLA stock is trading at $653.85 up nearly 5%. The hourly chart below shows just how thin volume was (red/green bars on the right of the chart) above $635 which was also the May 28 high, so a key level.

Update: It is nice when things work out and some nice calls on Bitcoin and Tesla this morning have helped reaffirm the importance of the technical views in equity markets. Tesla broke the key $635 level we identified and accelerated through it as we also predicted. "The volume profile to the right of the chart shows how volume drops off above $635 and does not kick in until $660, so a break should accelerate," our call from this morning. Tesla's Model was named in number 1 spot by cars.com's American-made index and Bitcoin bouncing has also helped sentiment.

Tesla shares are still struggling for direction but are moving in the right direction, albeit slowly. Tuesday saw further small gains as the stock closed up just 0.4% at $623.71. The electric vehicle sector leader has been making steady progress since bottoming out in early March at $539. Tesla returned to test this support zone in late May and has been trading along with the 200-day moving average ever since.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds steady below 0.6550 after PBOC's status quo

AUD/USD is trading in a tight range below 0.6550 in Asian trading on Wednesday. The pair lacks bullish conviction after the PBOC left the Lona Prime Rates unchanged. Escalating Russia-Ukraine geopolitical tensions keep the Aussie on the edge ahead of Fedspeak.

USD/JPY pares gains below 155.00 amid risk-off mood

USD/JPY is paring back gains below 155.00 in Wednesday's Asian session. A broadly softer US Dollar, a risk-off market mood and looming Japanese intervention risks limit the pair's upside. Mounting Russia-Ukraine tensions weigh on risk appetite, lending support to the safe-haven Japanese Yen.

Gold advances to over one-week high on rising geopolitical risks

Gold price (XAU/USD) attracts some follow-through buying for the third consecutive day on Wednesday and climbs to a one-and-half-week high, around the $2,641-2,642 region during the Asian session.

UK CPI set to rise above BoE target in October, core inflation to remain high

The United Kingdom’s (UK) Consumer Price Index (CPI) data for October will be published by the Office for National Statistics (ONS) on Wednesday at 07:00 GMT.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637600540484705645.png)