- Elon Musk's tweet could check Tesla's record rally.

- Tesla stock does it again and surges over 8% on Monday.

- What goes up, must surely come down, or does it?

Update November 2: Amid a fresh record rally in Wall Street indices, Tesla Inc. gained further momentum and extended the previous week’s upsurge, starting out a new week, as well as, a month with a bang. Speculations surrounding the Hertz purchase of Tesla for its fleet powered the record run in shares of the Electric Vehicle (EV) company.

Looking ahead, it remains to be seen if Tesla stock price continues its bullish momentum, especially after the company’s founder Elon Musk watered down the speculations by tweeting out, “If any of this is based on Hertz, I’d like to emphasize that no contract has been signed yet. Tesla has far more demand than production, therefore we will only sell cars to Hertz for the same margin as to consumers. Hertz deal has zero effect on our economics.”

Tesla (TSLA) is surely the best example we currently have of the saying "The market can stay irrational longer than you can stay solvent." It is truly a classic case of momentum creating momentum, creating more momentum. Or as modern parlance would have it: FOMO (FEAR OF MISSING OUT). This one is not for your valuation models or comparison charts. It is pure momentum. Jump on the momentum train and hold on for as long as you can.

To give an example, the stock has risen in the last week a multiple of the combined market caps of the world's five biggest automakers combined. Tesla sells a fraction of the number of cars these mainline auto manufacturers make. Its margins are good but not that good. Cynics and bulls can argue we have seen this before when a disruptor enters and creates a new marketplace, citing Amazon (AMZN). Amazon also traded on an enormous price /earnings (P/E) multiple for years in its early stages. Just like Tesla, Amazon was compared against mainstream retailers who traded on old school metrics and P/E ratios in the teens, while Amazon had a P/E in the thousands. Lo and behold, Amazon grew into its P/E rating as it created an entirely new marketplace.

Can the same be said of Tesla? For sure, it is a disruptor, an innovator, and its products are revered. It reminds many of Apple when it launched the iPod. Design and sleek looks were at the heart of the success. Customers felt they were getting something beautiful to touch and feel – a special product. Tesla evokes the same loyalty and reactions among its customers. Tesla has almost singlehandedly created the electric vehicle (EV) space. So far, so Amazon.

The area where one struggles to project Tesla's exorbitant earnings going forward is that its competition is not as inflexible or non-existant as Amazon's was. Amazon did not have another rival. Tesla so far has no one, but all those legacy automakers are switching to going fully electric. EVs are the future of automobiles. Tesla has carved out the space and established itself as the benchmark, but it will need to upscale production enourmously in the face of increasing competition over the next five to ten years in order to justify its current valuation. That is the challenge. Maybe it can do it. It certainly has a massive head start.

Tesla (TSLA) stock news

The latest explosion in the price was in large part caused by the news that Hertz is ordering 100,000 Teslas. Then Hertz and Uber combined with Hertz saying it could offer 150,000 Teslas to Uber over the next three years. This news was enough to set Tesla into lift-off, and the price move even surprised Elon Musk, who said he was surprised this news moved the stock as demand is not a problem for Tesla. Rather production is.

Tesla (TSLA) stock forecast

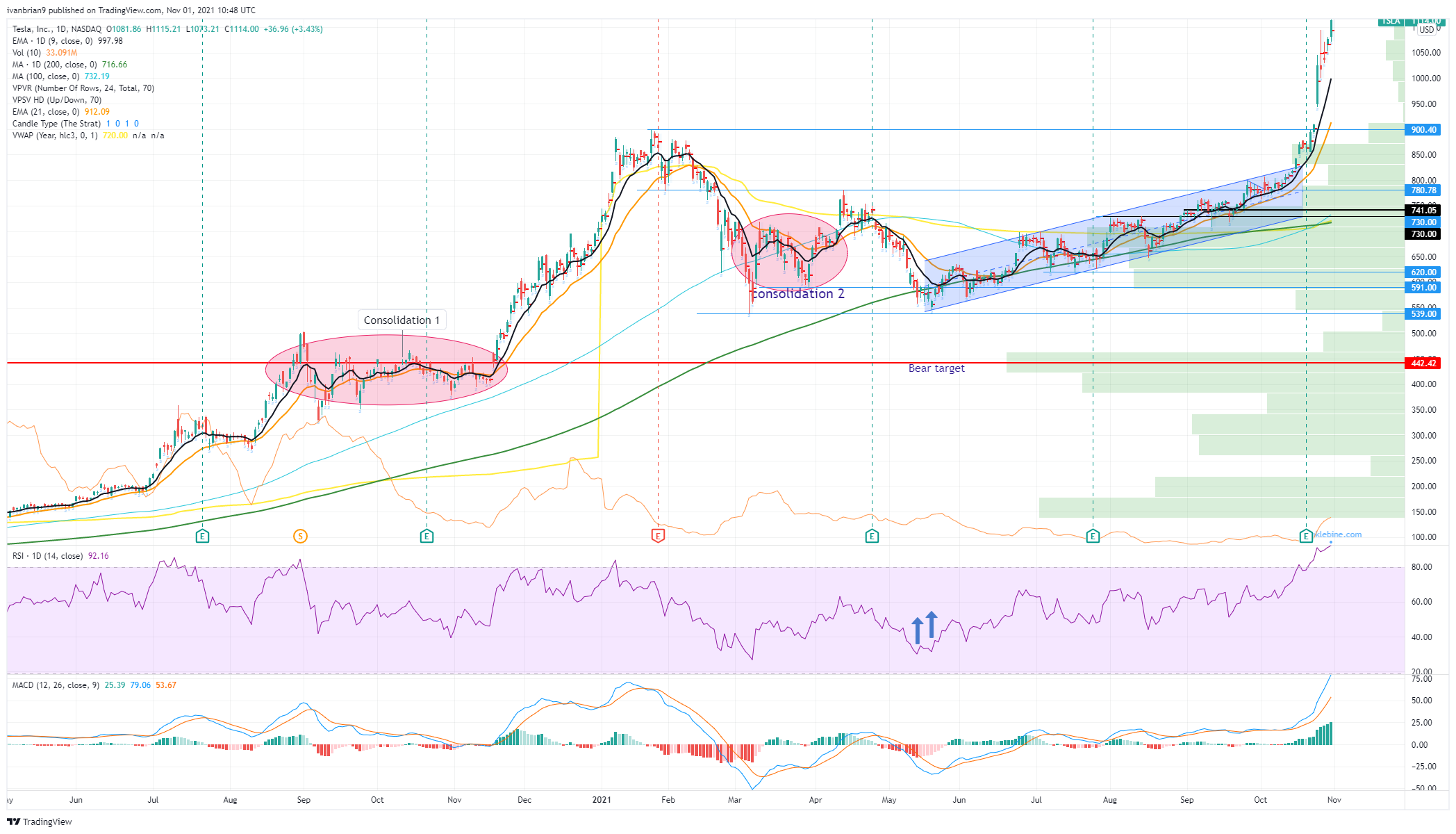

Whatever your valuation view on the stock, the chart does not lie, and we have to urge some caution now after this rally. The Relative Strength Index (RSI) has not been this overbought for some time and is at an extremely high 92. The Moving Average Convergence Divergence (MACD) is also looking extremely stretched. Tesla has stretched massively from the short-term 9-day moving average. While the trend is strong and clearly bullish, we are calling for a correction and a move back to $1,000 in the short term.

Support is at the $1,000 round number and the 9-day moving average. Below that, support at $950 is the breakout. Below $950 Tesla is back in neutral.

Previous updates

Update: Please do not scroll down to see our epic call from this morning! It is better to only talk about the winning trades but here at FXStreet we like to be balanced and fair in our approach and so when we get it wrong we get it properly wrong! In our defense we said we wre urging caution not an outright short. Either way Tesla stock confounded us today and surged over 8% despite looking stretched on many metrics. Not a huge amount of newsflow out there on the stock but the sector took a boost from XPEV deliveries and totally overlooked NIO's poor delivery data. This market just keeps on going and going and going. At some stage the music will stop so please use trailing stops to book profits in the event this one ever had a down day again!

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD clings to recovery gains below 0.6550 on weaker USD, upbeat mood

AUD/USD holds sizeable gains below 0.6550 in the Asian session on Monday. A sharp pullback in the US bond yields prompts some US Dollar profit-taking after US President-elect Trump named Scott Bessent as Treasury Chief. Moreover, the upbeat market mood supports the risk-sensitive Aussie.

USD/JPY remains heavy below 154.00 as USD weakens with Treasury yields

USD/JPY remains under intense selling pressure below 154.00 in the Asian session on Monday. Retreating US Treasury bond yields drags the US Dollar away from a two-year top high and drives flows towards the lower-yielding Japanese Yen, though the BoJ uncertainty could limit losses for the pair.

Gold: Is the tide turning in favor of XAU/USD sellers?

After witnessing intense volatility in Monday's opening hour, Gold's price is licking its wounds near $2,700. The bright metal enjoyed good two-way trades before sellers returned to the game after five straight days.

Elections, inflation, and the bond market

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.