- Tesla stock closes the session on Friday barely changed on the day.

- TSLA stock is still stuck in a consolidation phase.

- Tesla delivery data should be the catalyst for a move higher.

Tesla took life easy on Friday with the stock barely changing on the session at all, eventually closing at $775.22 for a tiny loss of -0.03%. Probably not surprising when all traders were waiting for the Q3 delivery data from Tesla, and these were duly released on Saturday.

Tesla 15 minute

Tesla key statistics

| Market Cap | $767 billion |

| Price/Earnings | 404 |

| Price/Sales | 26 |

| Price/Book | 33 |

| Enterprise Value | $756 billion |

| Gross Margin | 22% |

| Net Margin |

6% |

| 52-week high | $900.40 |

| 52-week low | $379.11 |

| Average Wall Street Rating and Price Target | Hold, $704 |

Tesla (TSLA) stock news

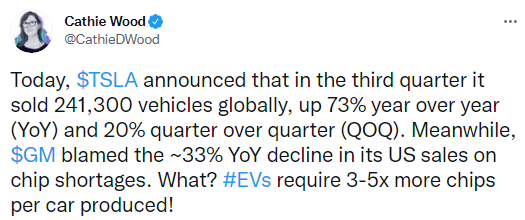

Getting straight into those delivery numbers, the headlines certainly look positive. After asking staff to go "super hardcore" it looks like Elon Musk and his team have delivered with Q3 deliveries hitting a record. Deliveries were up 20% in Q3. Tesla (TSLA) delivered 241,300 vehicles in the quarter, which was an increase of 73% YoY and making it the sixth straight quarter of delivery growth. Wall Street analysts had expected deliveries of 229,242, so this was a comfortable beat. This data is even more impressive when you consider the semiconductor crunch that has affected most car makers globally. RBC was moved to increase its price target slightly from $745 to $755. Legacy car manufacturers have been blaming this chip shortage recently for poor delivery numbers, and noted Tesla bull Cathie Wood of ARK Invest tweeted strong support for Tesla's performance by comparison.

Tesla (TSLA) stock forecast

We have been waiting for this one, and we can see from the triangle pattern formed that Tesla stock has been like a coiled spring waiting to explode. The breakout should finally see Tesla make and break $800 and once through there the next resistance and volume does not kick in until $900! We had been expecting some volatility and mentioned a strangle options play to take advantage of any surge higher or lower. From the previous write-up: "An $830 call for October 8 costs around $4, and a $735 put for the same expiry is around $16.". Notice how the market was skewed with puts being considerably more expensive. Now, this delivery data may cause a sudden flip. We will update this once markets open.

Tesla remains bullish in our view from the chart. The stock is above the 9-day moving average and has consolidated from the spike above $780.

FXStreet View: Bullish above $765.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD struggles to hold above 1.1000 after mixed EU data

EUR/USD is having a difficult time stabilizing above 1.1000 in the European session on Monday. The Eurozone Sentix Investor Confidence slumped to -19.5 in April while the annual February Retail Sales jumped 2.3%, limiting the pair's upside despite the broad US Dollar weakness.

GBP/USD reverses below 1.2900 despite US Dollar weakness

GBP/USD fails to sustain the recovery and reverses below 1.2900 in European trading on Monday. The pair shrugs off broad US Dollar weakness as risk sentiment takes a fresh hit, with European traders hitting their desks, weighing on the risk sensitive Pound Sterling.

Gold price holds above $3,000 amid a global meltdown; bulls seem non-committed

Gold price attracts some sellers near the $3,055 support-turned-resistance and stalls its intraday recovery from the $2,972-2,971 area, or a nearly four-week low touched earlier this Monday. Investors continue to unwind their bullish positions to cover losses from a broader meltdown across the global financial markets

Solana Price Forecast: Bears gain momentum as SOL falls below $100

Solana (SOL) extends its loss by over 7% and falls below the $100 mark at the time of writing on Monday after crashing 15.15% last week. Coinglass data shows that SOL’s leveraged traders wiped out nearly $70 million in liquidations in the last 24 hours.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637689348028321253.png)