Tesla Stock Price and Forecast: Why TSLA stock is likely to break $843

- Tesla stock loses 3% on Thursday after the CPI number.

- High growth is not the sector to be in during this hawkish environment.

- Tesla will struggle with this macro backdrop.

Tesla (TSLA) stock lost 3% on Thursday after the US CPI report. The inflation reading was higher than expected and showed inflation broadening out to all sectors of the economy. Fed futures immediately priced in a near 80% chance of a 50bps rate hike at the next Fed meeting in March. In Friday's premarket, things have steadied somewhat with yields giving up some ground. VIX though has risen as investors grow increasingly nervous about the prospects for equities going forward.

Tesla Stock News

Tesla CEO Elon Musk did not help the macro focus when he reportedly said "something has got to give" on US national debt. We also see some news about Tesla looking to add a new design center in Beijing. Not too significant, per se, but it does underline just how important China is to many big tech firms.

Tesla obviously has its Shanghai gigfactory, and China is the world's largest electric vehicle market. China in 2021 represented over 50% of the world's electric vehicle sales. The macroeconomic backdrop though will be the main driver here. Thursday's CPI report was shocking, but so far yields have remained calm. In fact yields on the US 10-year are down slightly this morning but remain above the significant 2% level. This is the highest since summer 2019. Also of note is the yield curve inversion. The US 10Y - US 2Y yield curve is flattening and is currently at 43bps. The yield curve inversion has a 100% success rate in predicting US recessions going back four decades. Again, this does not bode well for yield-sensitive tech and growth names.

Tesla Stock Forecast

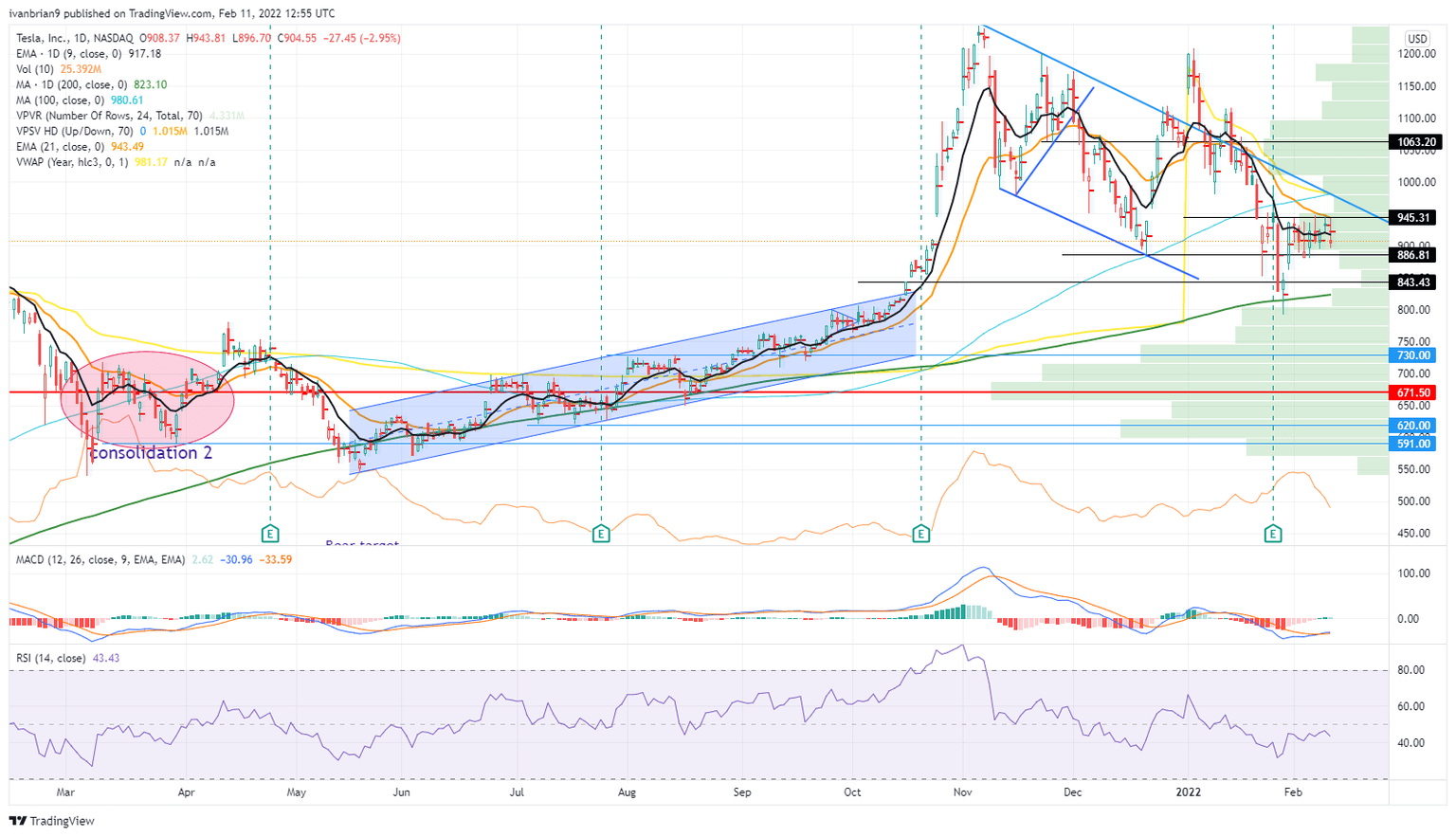

This is a classic macro versus technical divergence. The macro picture looks strained. TSLA stock will find it difficult to make any headway with such a strong macro picture, but technically resistance at $945 looks like it could break. That may be unlikely, but it is worth pointing out just in case.

TSLA shares are stuck in a $945 to $886 range channel and one will break at some point. If it is to be $886, which is FXStreet's guess, then the 200-day moving average is next at $823. The most recent low at $792 is even more significant. If this truly is a continuation of the downtrend started in January, then a lower low should be set. Note how volume has been dropping. This is no surpise as risk was off the table before the CPI yesterday. The Relative Strength Index (RSI) is also weak and below 50, so there is no direction here.

Tesla (TSLA) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.