Tesla Stock Price and Forecast: TSLA rebounds over 4%, focus shifts to Q4 earnings report

- Tesla stock achieved our short-term $910 target on Monday.

- TSLA shares even closed below $900 for the first time since October 21.

- Expect a sharp bounce on Tuesday, but the trend is still lower.

Update, December 22: Tesla (NASDAQ: TSLA) staged an impressive rebound from seven-week lows of $886.12, ending Tuesday higher by 4.29% at $938.53. Worries over the rapid spread of the Omicron covid variant faded, as the risk-on sentiment returned heading into the Christmas break. Expectations of an upbeat Q4 earnings report also aided the upturn in Tesla stock price. Tesla is due to report fourth-quarter deliveries in the first couple of days in January.

Tesla shares reached our short-term target on Monday as the EV leader closed below $900 for the first time since the Hertz-induced power move higher. To recap, back in October Hertz announced it was going to order 100,000 Tesla vehicles. Both stocks surged. There was some confusion with CEO Elon Musk tweeting nothing had been signed, but the stocks soared anyway.

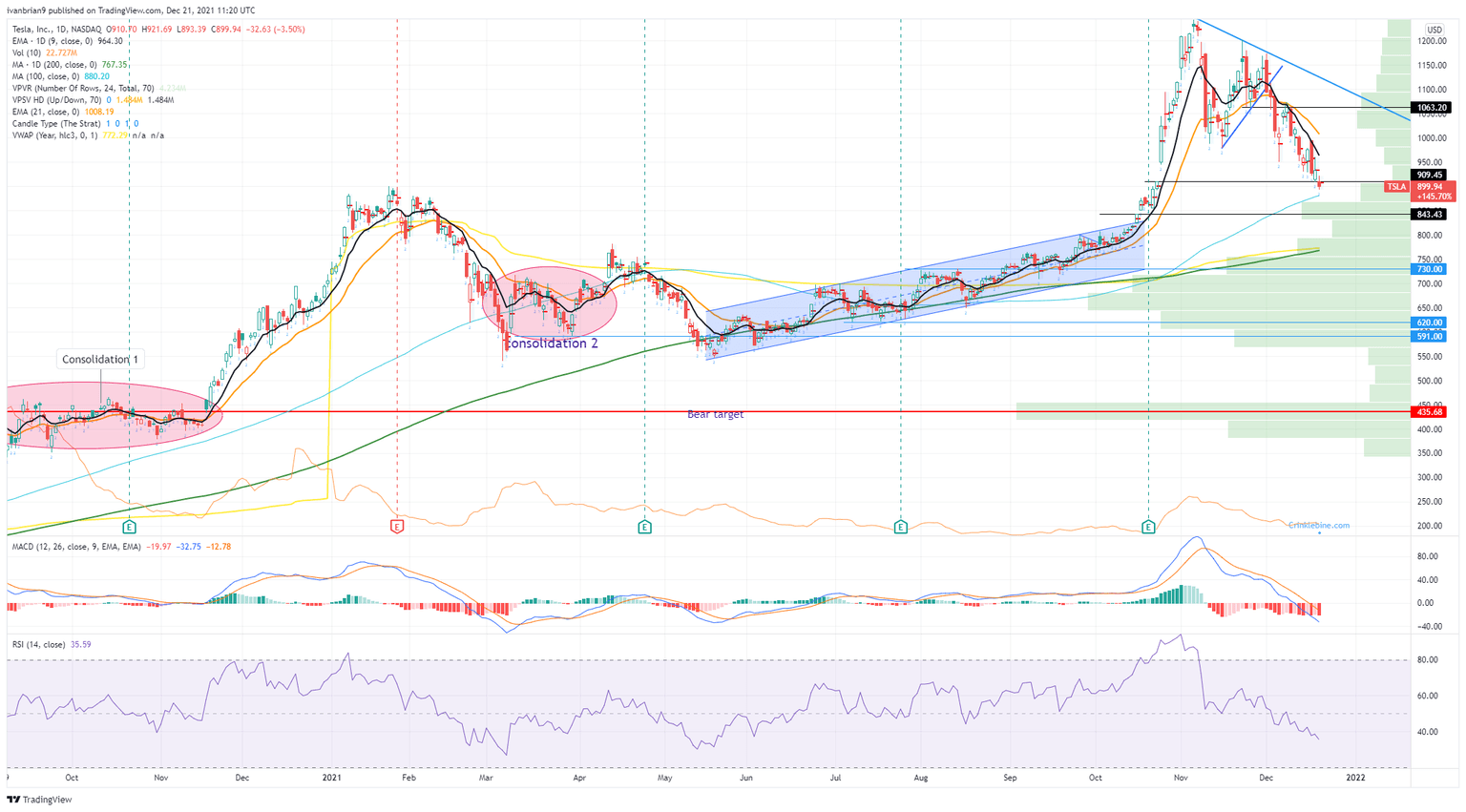

However, since Musk tweeted about selling 10% of his Tesla holdings, it has been one-way traffic for stockholders. Peaking at $1,243 in early November, Tesla shares have given up some 23% since then. We had identified this trend soon after the initial tweet and called for a move to fill the gap at $910. Now that our target is achieved, it is time for a reassessment.

TSLA stock chart, hourly

Tesla stock news

We expect a bounce today for Tesla with global equity markets looking a bit more stable following comments from Moderna (MRNA) about their booster's effectiveness against Omicron. Senator Joe Manchin (D-WV) has also been on the wires with a more conciliatory tone, meaning some form of the Build Back Better plan may make it through Congress early next year.

On Monday we highlighted the fact that Tesla was about to join the ranks of New York's police department, adding to its status as a New York yellow taxi vehicle. Tesla's likely major competitor this year and next, the Ford (F) Mustang Mach-E has also joined the New York taxi rank fleet. EV startup firm Gravity is running the fleet. “Gravity’s first vehicle is a Ford Mustang Mach E — making Gravity’s the first taxi fleet to include the Mach E. Gravity will also deploy a Tesla Model Y once final inspections are complete,” the startup said in a statement.

Tesla stock forecast

Target achieved, so now what? The medium-term indicators are still bearish. A declining Relative Strength Index (RSI) that is not yet oversold mimics a similar move by the Moving Average Convergence Divergence (MACD) indicator. Expect a bounce today, but the 9-day moving average at $964 is likely too far. We would expect this resistance to hold, and indeed the 9-day moving average has been working well, holding the downtrend in place since December 1. There is another gap to fill down to $843, so this is the next target unless the 9-day moving average is broken. The next support of note before the gap at $843 is the 100-day moving average at $880.

TSLA daily chart

Previous updates

Update: Tesla (NASDAQ: TSLA) charged 4.29% higher on the day from a low of $886.12 to a high of $939.50. The day was risk-on as investors brushed aside the covid related risks, relying on governments to encourage strict vaccination protocols and restrictions that essentially forces the working population to get vaccinated. In specific news related to the stock, Tesla Inc still has not submitted documents related to its upcoming gigafactory in Grünheide, Berlin. Nor does it have a final green light from the local authorities for the official start of production at the Giga Berlin.

Looking ahead, Tesla is due to report fourth-quarter deliveries in the first couple of days in January and positive results are expected. A number around 270,000 will give Tesla about 900,000 deliveries for all of 2021 leaving it poised for a strong fourth-quarter earnings report with detail to follow the delivery results. Investors will also be looking for a new product announcement and there are prospects of new Cybertruck or Semi truck delivery dates.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637756810315770198.png&w=1536&q=95)