- Tesla stock is set to open lower on Monday.

- TSLA stock will likely test $800 on more geopolitical tensions.

- Lucid Group reports earnings after the close on Monday.

Tesla (TSLA) shares look set to open lower on Monday as Russia Ukraine headlines continue to set the global financial markets narrative. It is hard to avoid the dominance despite what some might say are mildly positive signs for the electric vehicle leader.

Tesla Stock News

Cathie Wood has begun buying the dip in Tesla and took in another $3 million worth of Tesla stock on Friday. Despite this, Tesla shares are looking like they will open some 1% lower on Monday with Tesla currently at $802.83 in Monday's premarket. This would not be as bad as feared given the significant losses in European markets this morning. The German Dax is down nearly 2.5%, and the Eurostoxx 50 is down over 3%. Forecasting on a micro-level is being overpowered by the Russia-Ukraine conflict, so look for headlines here for future direction. Tesla is high beta and considered one of the riskier assets. Currently, we are in extreme risk-off mode across global financial markets. This has led to a surge in the dollar and gold, traditional safe-havens. Keep an eye on these assets and geopolitical headlines for the more meaningful directional queues.

Tesla Stock Forecast

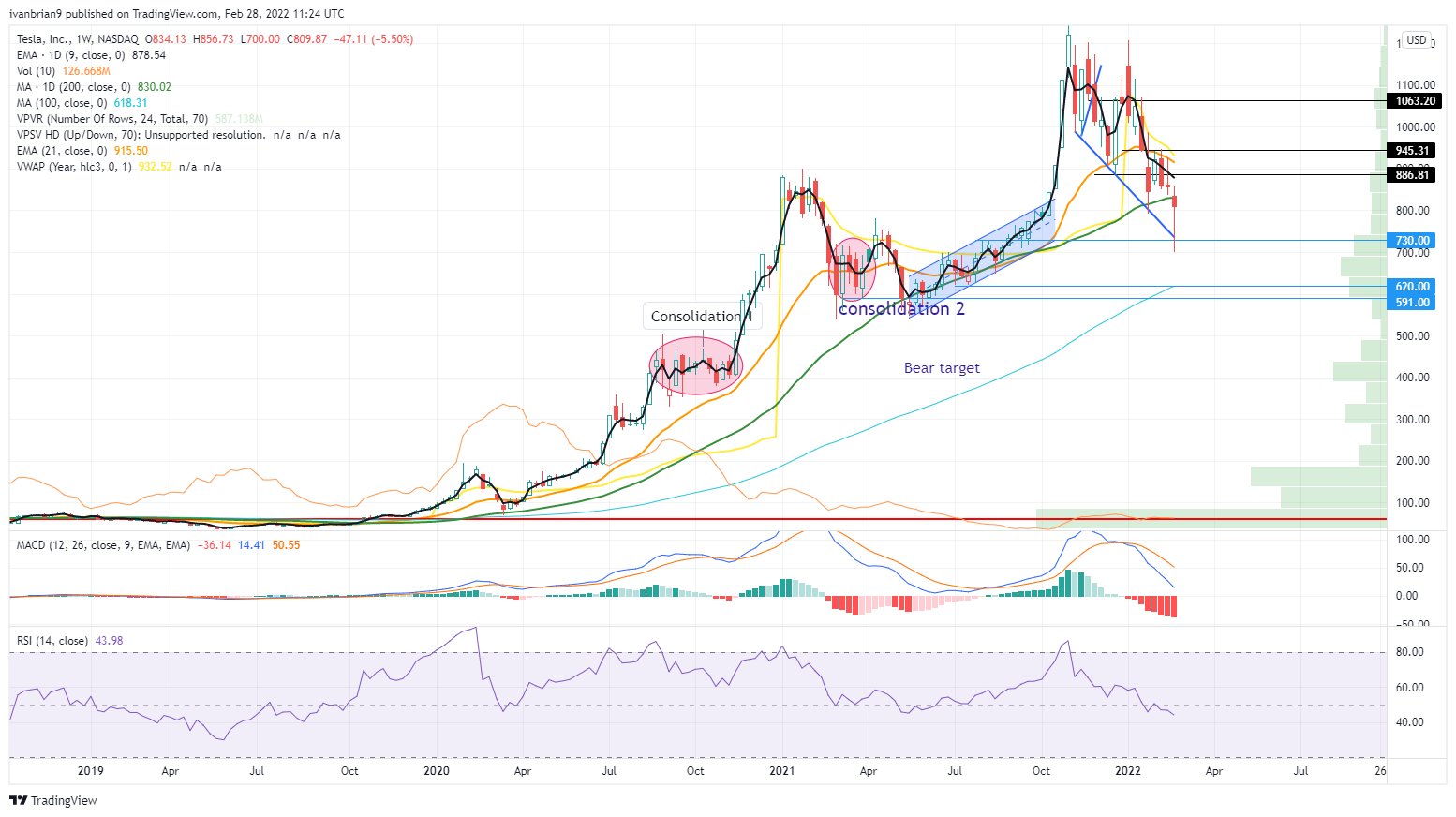

Looking back with the benefit of hindsight, the repeated failure to break above $945 set up the technical picture for the recent falls. Tesla stock has now cleanly broken below the 200-day moving average, a feat it has not managed since June of last year. Back then it was a brief flirtation as it retook the 200-day the very next day. This time the case is different and could lead to long-term pressure on TSLA. $730 was briefly broken on Friday, but this level is significant and a close below will set stop losses in play most likely. The 9-day moving average is about to cross the 200-day, again significant as this has not happened in Tesla since October 2019.

Tesla (TSLA) chart, 1-day chart

From the weekly chart, we can see breaking and holding below $730 takes Tesla back to the consolidation phase from March and April of last year. This is a neat range between $700 and $600. That may hold Tesla stock for a time, but the bears will target $400 if they can push Tesla out of the support at $600. This is the consolidation phase from September and October 2020.

Tesla chart, weekly

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.