- Tesla stock extends gains on Thursday and settles at $714.94.

- TSLA stuck in a wide band of $620 to $760.

- Twitter files suit against Tesla CEO Elon Musk.

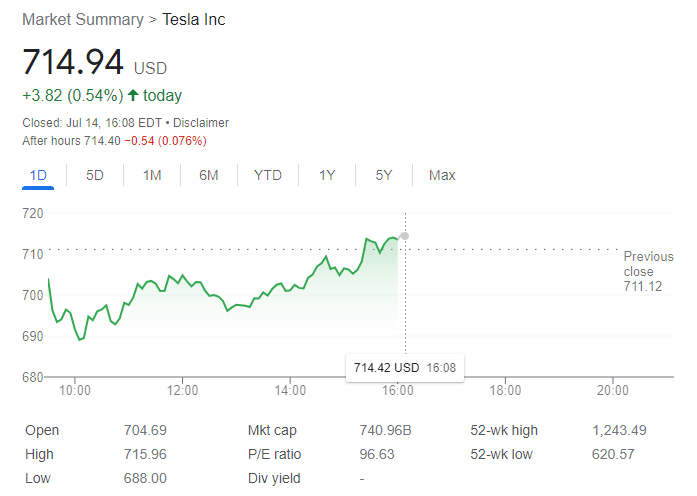

Update: Tesla (TSLA) shares were up 0.54% on Thursday and closed at $714.94. Wall Street started the day dip in the red as fears of a recession undermined demand for high-yielding assets. However, US indexes managed to bounce back after Federal Reserve Governor Christopher Waller noted that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, adding that a 75 bps hike will bring them to neutral. The Dow Jones Industrial Average finished the day down 142 points, while the S&P 500 lost 0.30%. The Nasdaq Composite managed to add 3 points or 0.03%.

Tesla (TSLA) remains volatile and directionless, both in terms of stock performance and its autonomous driving unit. The stock has been under pressure for most of 2022 but so far has held the key $620 support. Tesla has been caught in the downdraft from Elon Musk's attempt to buy Twitter (TWTR). As things turn ugly in that sphere, investors are trying to determine how that impacts Tesla. It could be seen as a positive with Elon Musk now less stretched on the acquisition and free to focus more energy on Tesla. Another positive can be taken from the lack of any need to pledge Tesla stock as collateral for the Twitter deal, but the news on Tuesday that Twitter had filed suit sent Twitter shares higher in hopes of potentially pushing the deal through. This, in our view, is highly unlikely.

Tesla Stock News: Is Tesla now driverless?

As well to the fury surrounding the Twitter lawsuit, it also came to light on Wednesday that Tesla's Head of AI has now formally left the company after a four-month break.

It’s been a great pleasure to help Tesla towards its goals over the last 5 years and a difficult decision to part ways. In that time, Autopilot graduated from lane keeping to city streets and I look forward to seeing the exceptionally strong Autopilot team continue that momentum.

— Andrej Karpathy (@karpathy) July 13, 2022

I have no concrete plans for what’s next but look to spend more time revisiting my long-term passions around technical work in AI, open source and education.

— Andrej Karpathy (@karpathy) July 13, 2022

Thanks for everything you have done for Tesla! It has been an honor working with you.

— Elon Musk (@elonmusk) July 13, 2022

Tesla has recently announced a delay to its AI day until September 30, so perhaps this is to announce some development or replacement? Either way, it creates more uncertainty for the stock.

Tesla Stock Forecast

My short position in Tesla is more of a macro view rather than a negative take on Tesla itself. Tesla is one of the highest stocks out there in terms of P/E and other multiples. In a combined monetary and fiscal tightening scenario, stocks such as this tend to rerate pretty sharply. I do feel Tesla has some challenges ahead, but these are not unique to Tesla. The automaker will probably navigate them better than legacy automakers who are notoriously terrible at navigating recessions.

Tesla has had a free run at the EV sector just as Netflix had a free run at the streaming sector, and look what happened next once the legacy companies entered. Most Wall Street analysts forecast Tesla to have a market share of 15% of the EV or auto market. This is way too high in my opinion. No automaker has ever managed to have such market share to my knowledge. Toyota is currently the world's number 1 with a 10% market share.

Technically, $620 remains the key level. A break there should lead to a move to $540, but there is a volume gap until $430 and things could get really ugly if $620 breaks. This current phase looks like a consolidation phase after the move lower. Consolidation phases usually result in a breakout in the direction of the preceding trend, i.e. bearish. Breaking $760 ends this and likely ends my short!

Tesla chart, weekly

The author is short Tesla and Twitter.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD jumps back above 1.1000 on renewed US Dollar sell-off

EUR/USD is posting sizeable gains above 1.1000 in early Europe on Monday. EU prepares for retaliatory tariffs and rekindles the global trade war and US recession fears, drowning the US Dollar again aross the board. Traders now look to the EU Sentix and Retail Sales data.

GBP/USD holds recovery gains above 1.2900 amid fresh US Dollar weakness

GBP/USD clings to recovery gains above 1.2900 in European trading on Monday. The pair capitalizes on renewed US Dollar weakness as risk sentiment takes a fresh hit, with European traders hitting their desks. Trump's tariffs-led US recession fears and dovish Fed bets keep the USD undermined.

Gold price rebounds swiftly from multi-week low; lacks follow-through

Gold price reverses an Asian session slide to over a three-week low, though it lacks follow-through. Recession fears continue to weigh on investor sentiment and benefit the safe-haven commodity. Bets for more aggressive Fed rate cuts undermine USD and also lend support to the XAU/USD pair.

Crypto market wipes out $1 billion in liquidation as Asian markets bleed red

The crypto markets continue to decline on Monday, with Bitcoin falling below $78,000. The Asian markets also traded in the red, with Japan’s stock market extending losses to 8.5%, its lowest level since October 2023.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.