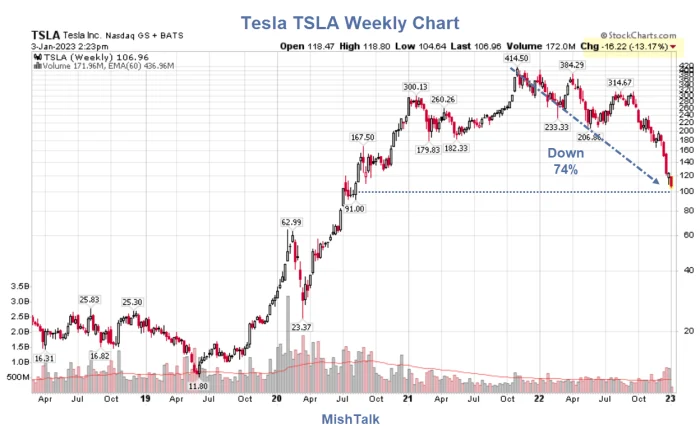

Tesla (TSLA) shares started 2023 where they left off last year. The dive continues.

Tesla chart courtesy of StockCharts.Com annotations by Mish

Tesla delivered 405,278 vehicles in the fourth quarter. That was a new record but it was far short of analysts' estimates of 431,117.

For the year, Tesla deliveries rose by 40%, missing Musk's 50% annual target.

New year, same selloff

Reuters reports Tesla Shares Slump on Demand Worries, Logistical Issues

Tesla Inc shares started 2023 where they left off last year, plunging more than 14% on Tuesday on growing worries about weakening demand and logistical problems that have hampered deliveries for the world's most valuable automaker.

"Demand overall is starting to crack a bit for Tesla and the company will need to adjust and cut prices more especially in China, which remains the key to the growth story," Wedbush Securities analyst Dan Ives said.

Global automakers have in the past few months battled a demand downturn in China, the world's top auto market where the spread of COVID-19 has hit economic growth and consumer spending.

Tesla is offering hefty discounts there as well as a subsidy for insurance costs.

Analysists always react late

At least four brokerages cut their price targets and earnings estimates on Tuesday, pointing to the deliveries miss and Tesla's decision to offer more incentives to boost demand in China and the United States, the two largest global auto markets.

Top automakers

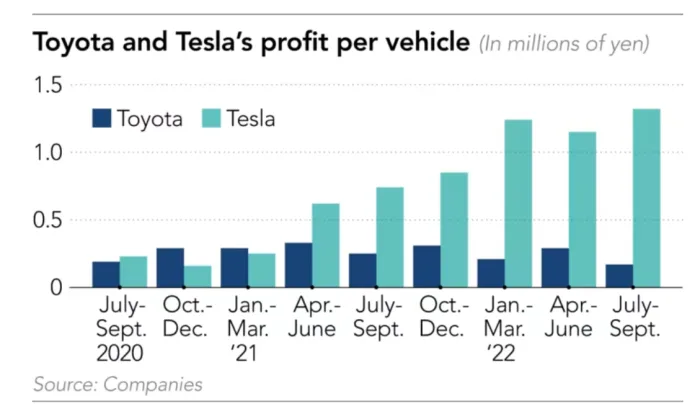

Making cars vs making profits

Nikkei Asia reports Tesla earns 8 times more profit than Toyota per car.

Market cap is not about making cars but about making profits.

One could have bought TSLA at $11.80 in mid-2019. At that point sales and margins were low. The above chart shows Toyota made a bigger profit and made more cars in the fourth quarter of 2020.

Toyota did better even in the first quarter of 2021 but shares by then already soared to $300.

Now what?

The problem for Tesla is not where it's at but where it's headed.

Four possible takeaways from market reaction

-

Tesla cannot maintain its profit margin.

-

Tesla cannot maintain its sales growth and might even lose some to other EV makers.

-

Tesla has other issues such as Twitter which might necessitate Musk dumping more shares into a plunging market.

-

The market is irrational.

For the stock to be reacting how it is, at least one of those factors is in play.

At $415 per share, the market believed Tesla could maintain profit margins and sales would expand.

Shares are now plunging fast. If you think the market is irrational and Tesla will hold margins, you have a buying opportunity.

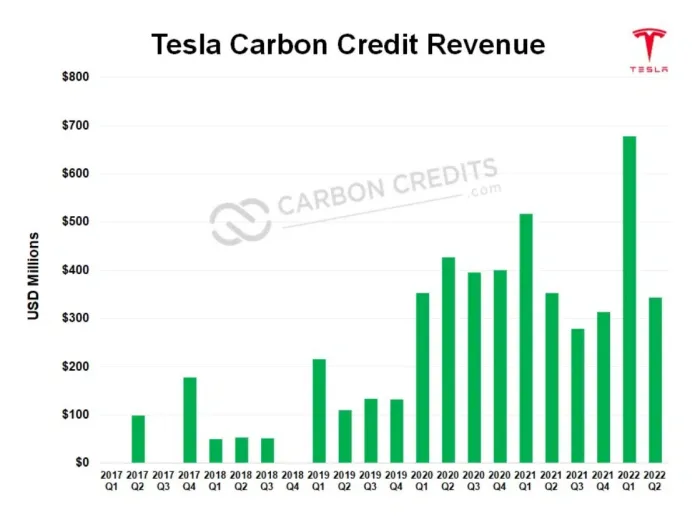

Carbon credits

Please note Tesla’s Carbon Credit Sales Down 49% in 2022 Q2

Since 2017, Tesla has made ~$5.1 billion from the sale of regulatory carbon credits as shown above. The credits sold help other automakers meet their emissions regulations and bypass billions in fines.

Though it’s common practice for other automakers to buy carbon credits from Tesla to offset their emissions, it’s not a sustainable strategy. To meet stricter regulatory mandates worldwide, an industry-wide shift to EVs is crucial.

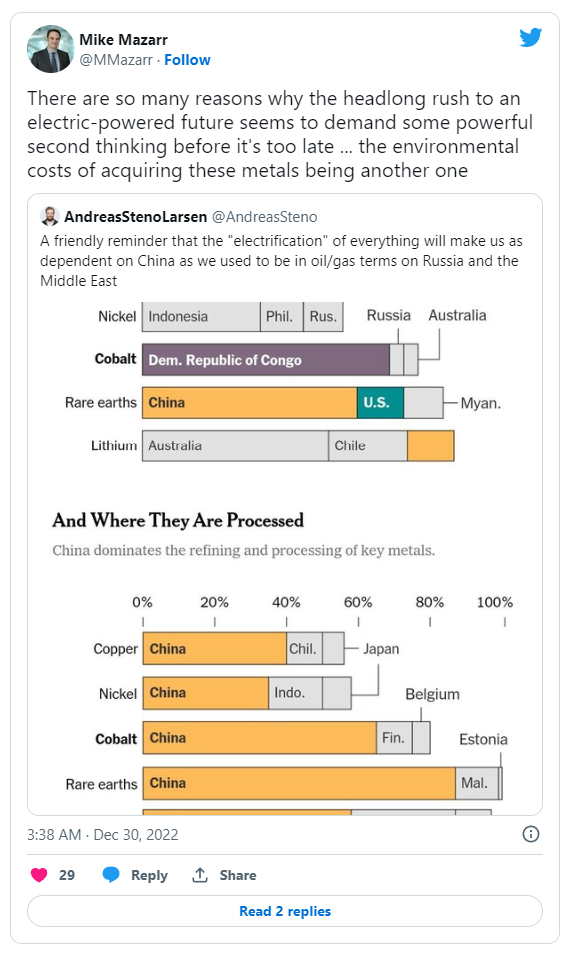

Where are the minerals?

A mad rush to build more EV factories, but where are the minerals?

Please note A Mad Rush to Build More EV Factories, But Where are the Minerals?

Questions of the day

-

Is anyone in the administration seriously considering any of these issues?

-

How much CO2 and pollution is caused in the mining, processing, and transportation of these minerals vs natural gas?

-

How much inflation can we expect from this?

If the cost of minerals surge, there is more competition, demand slumps in a recession, and carbon credit revenue sinks, what does that do to Tesla's profit margins?

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended content

Editors’ Picks

AUD/USD: Next on the downside comes 0.6500

Further gains in the US Dollar kept the price action in commodities and the risk complex depressed on Tuesday, motivating AUD/USD to come close to the rea of the November low near 0.6500.

EUR/USD: No respite to the sell-off ahead of US CPI

The rally in the Greenback remained well and sound for yet another session, weighing on the risk-linked assets and sending EUR/USD to new 2024 lows in the vicinity of 1.0590 prior to key US data releases.

Gold struggles to retain the $2,600 mark

Following the early breakdown of the key $2,600 mark, prices of Gold now manages to regain some composure and reclaim the $2,600 level and beyond amidst the persistent move higher in the US Dollar and the rebound in US yields.

SOL Price Forecast: Solana bulls maintain $250 target as Binance lists ACT and PNUT

Solana price retraced 7% from $225 to $205 on Tuesday, halting a seven-day winning streak that saw SOL become the third-largest cryptocurrency by market capitalization.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.