Tesla: An accident waiting to happen

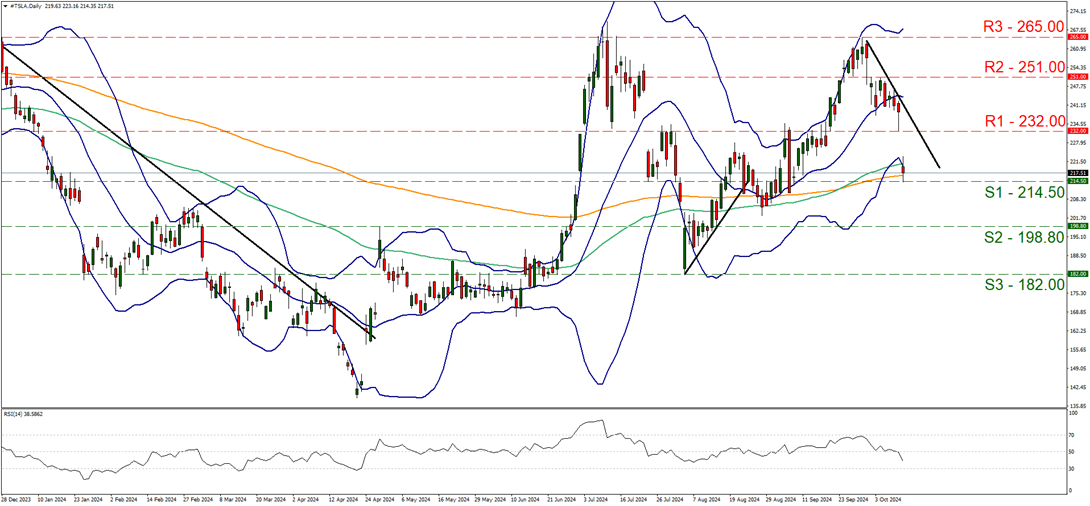

Tesla daily chart

Support: 214.50 (S1), 198.80 (S2), 182.00 (S3).

Resistance: 232.00 (R1), 251.00 (R2), 265.00 (R3).

Tesla’s share price tumbled on Friday and opened with a negative gap during today’s Asian session, with a number of analysts highlighting the possibility that the drop may be only the start for the bearish movement of Tesla’s share price. Fundamentals tended to weigh on Tesla’s share price for a while now, with a number of analysts highlighting how the share price may be overpriced. The popularity, size and instability of the company highlighted how both the stakes and uncertainty are high, making the company possibly, a prime target. It’s characteristic that analysts are quoted stating that the company value would be around $200 Billion, a far cry from the company’s current market cap of around $680B, even after the today’s drop. The accident fire in France claiming four lives and mostly Tesla’s disappointing robotaxi event on Friday caused the share price to tumble on a fundamental level. An encouraging element could be that Tesla managed to reach a production level of 3 million cars in Shanghai, yet that falls short to cover for the market worries surrounding the company.

On a technical level, we note that the beginning of last week, with the share price reaching a low point on Friday at 214.50 (R1) support line, yet during today’s Asian session the share’s price opened with a negative gap turning the level from support to resistance. The share’s price seems to have stabilised after hitting one the 214.50 (S1) support line, diverging further to the negative from the downward trendline that had started to form since the beginning of the month. The RSI indicator has dropped breaking clearly the reading of 50 signaling that the market sentiment has turned bearish yet has still some way to go before reaching the reading of 30, implying that there is still some room to play for the bears. On the flip side, the price action is testing the lower Bollinger band which may act as an early warning sign for the bears to ease their pressure. Nevertheless, we expect further bearish price action to emerge for the share and highlight as critical today’s American opening as a make or break situation. Should the bears continue to lead the share’s price action we may see it breaking the 214.50 (S1) support line and start aiming for the 198.80 (S2) support level. On the other side, for any contrarians out there, the bar for a bullish outlook is very high as the share’s price action in our opinion, would have to reverse direction, break the prementioned downward trendline, break the 232.00 (R1) resistance line clearly and start reaching if not breaking the 251.00 (R2) resistance level.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.