TELL Stock News: Tellurian drops lower as broader markets sink further into despair

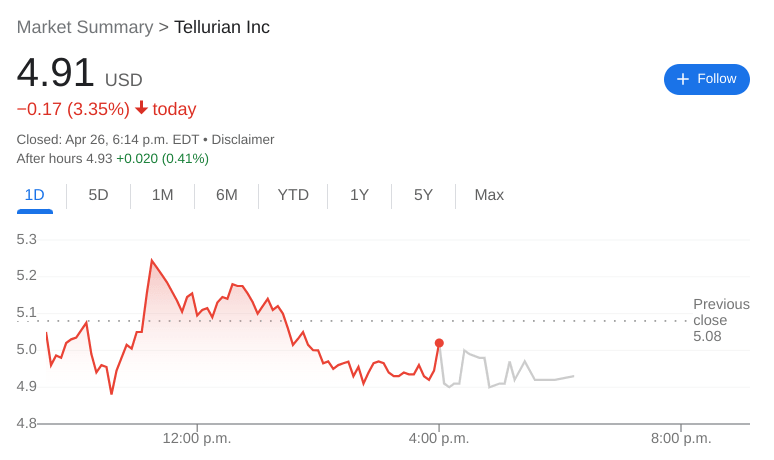

- NYSEAMERICAN:TELL fell by 3.35% during Tuesday’s trading session.

- LNG stocks were mixed on Tuesday despite the bearish sell off.

- Tellurian receives a revised upgrade from Zacks Investment Research.

NYSEAMERICAN:TELL slipped lower once again as Monday’s market reversal was short-lived. On Tuesday, shares of TELL dipped by 3.35% and closed the trading day at $4.91. For now, Tellurian remains trading above both its key 50-day and 200-day moving averages, which indicates the stock is still trending in the right direction. The same cannot be said for the broader markets as all three major indices plunged further on Tuesday ahead of the first big tech earnings from Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT). The Dow Jones sank by 809 basis points, while the S&P 500 and NASDAQ dropped by 2.81% and 3.95% respectively during the session.

Stay up to speed with hot stocks' news!

LNG stocks were mixed on Tuesday despite energy futures trading higher as crude oil prices rebounded and natural gas continued to show strength. Companies like Chesapeake Energy (NASDAQ:CHK) and Pioneer Natural Resources (NYSE:PXD) were below water alongside Tellurian. One LNG stock that was flying higher was the US leader, Cheniere Energy (NYSEAMERICAN:LNG), which announced that its board had approved a quarterly dividend for its shareholders. The dividend will be in the amount of $0.33 per common share and will be payable to shareholders on May 17th who were on record as shareholders as of May 10th.

TELL stock news

Tellurian received an upgrade from Zacks Investment Research on Tuesday. Just weeks after the firm lowered its rating from a Hold to a Sell. It seems that all it took was a few bearish sessions, as now Zacks has a rating of Hold once again for the stock. The stock currently has a consensus Buy rating from analysts and a one-year median price target of $6.24.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet