Teladoc Stock News and Forecast: Time for the doctor as TDOC earnings show it is sick

- Teladoc stock falls sharply after the earnings release.

- TDOC earnings actually beat on revenue.

- TDOC though was negative in its outlook.

Teladoc stock (TDOC) continued its trend for 2022 – that of sharp losses – as it released its earnings after the close on Wednesday. TDOC shares fell about 20% in afterhours trading as the market reacted to a revenue beat but was disappointed with forward guidance. Teladoc was one of the pandemic stocks that drew a lot of attention from retail traders and features strongly among the fabled but now infamous Cathie Wood ARK Invest funds. TDOC stock is one of a multitude of ARK fund's biggest holdings.

TDOC stock earnings

Revenue came in slightly ahead of Wall Street estimates at $592 million versus the $584 million estimate, but earnings per share (EPS) arrived at a whopping $-19.22 on an impairment charge due to goodwill being written down. The adjusted EPS outside of this was a more sedate $-0.44. The goodwill impairment charge was in the region of $ 3 billion or amounting to $18.78 per TDOC share.

"Teladoc Health delivered solid second quarter results with significant progress against our whole person care strategy, including growing momentum in Primary360," said the CEO. Excuse me for nearly choking on my breakfast, but these are far from solid results, and the market reaction seems to agree. As we have droned on here repeatedly, company executives are salesmen designed to sell you their shares. So always take what they say with a large grain of salt, just not perhaps with your cereal.

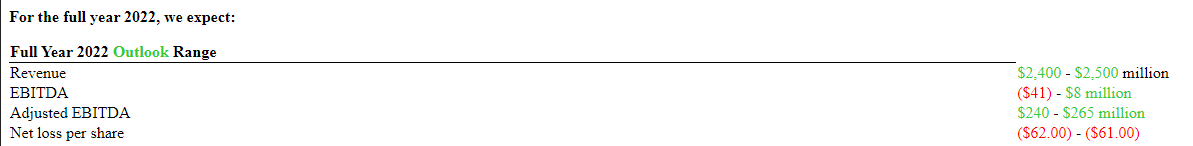

Source: Company filings

Again a full-year loss of $-62 to $-61 is not exactly solid in my language, but maybe I learned a different version of English from the CEO!

Source: Company filings

At least stock-based compensation is falling! It was the statement that guidance would be at the lower end of the previously given range that set things in motion to the downside however.

TDOC stock forecast

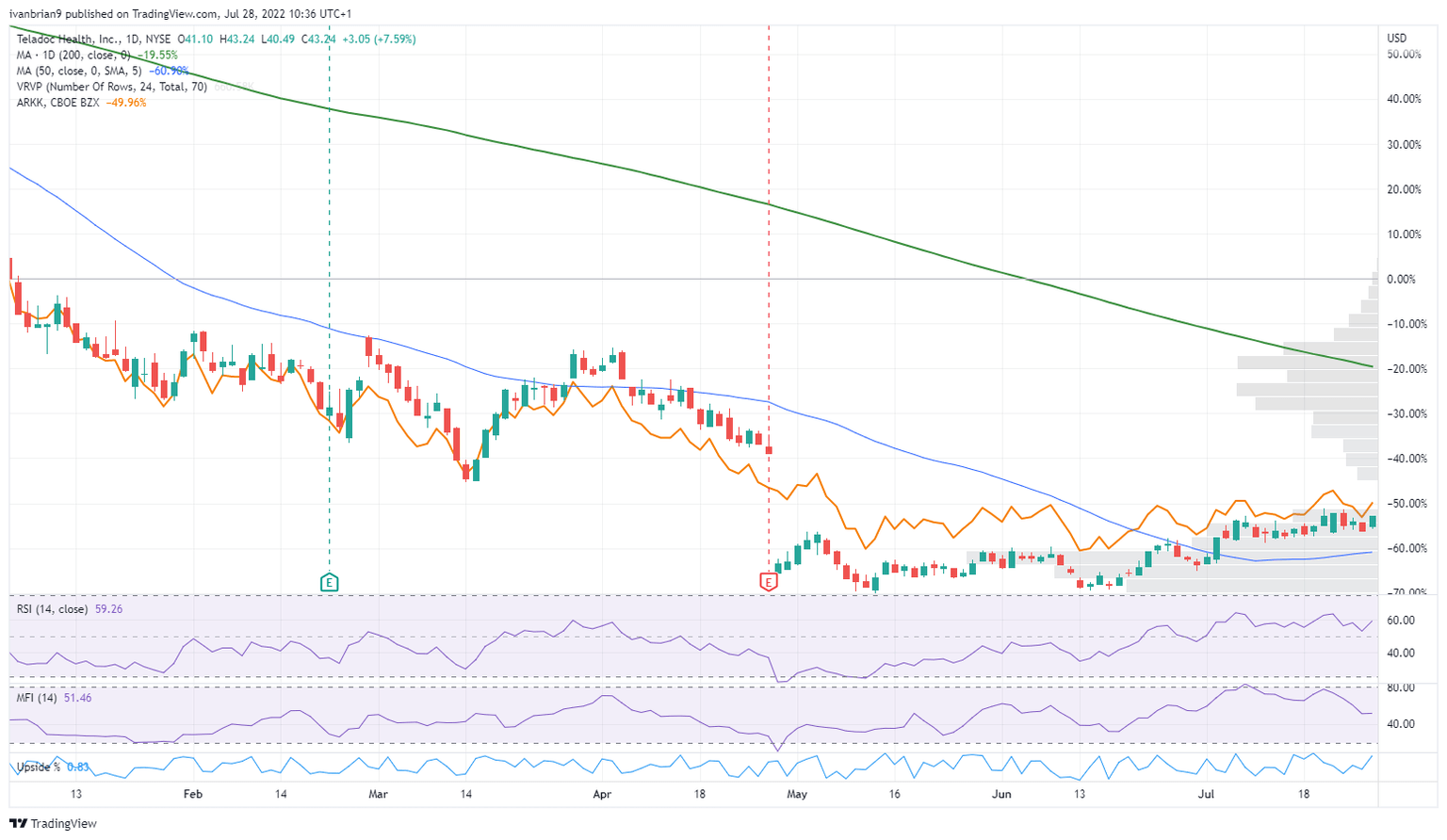

Based on the correlation we show below, we should be looking at more declines for ARKK based on TDOC collapsing in the afterhours market. So far the move in ARKK ETFs is more sedate as it lost only 2% in the premarket despite the 20% fall for TDOC.

TDOC versus ARKK, daily year-to-date % change

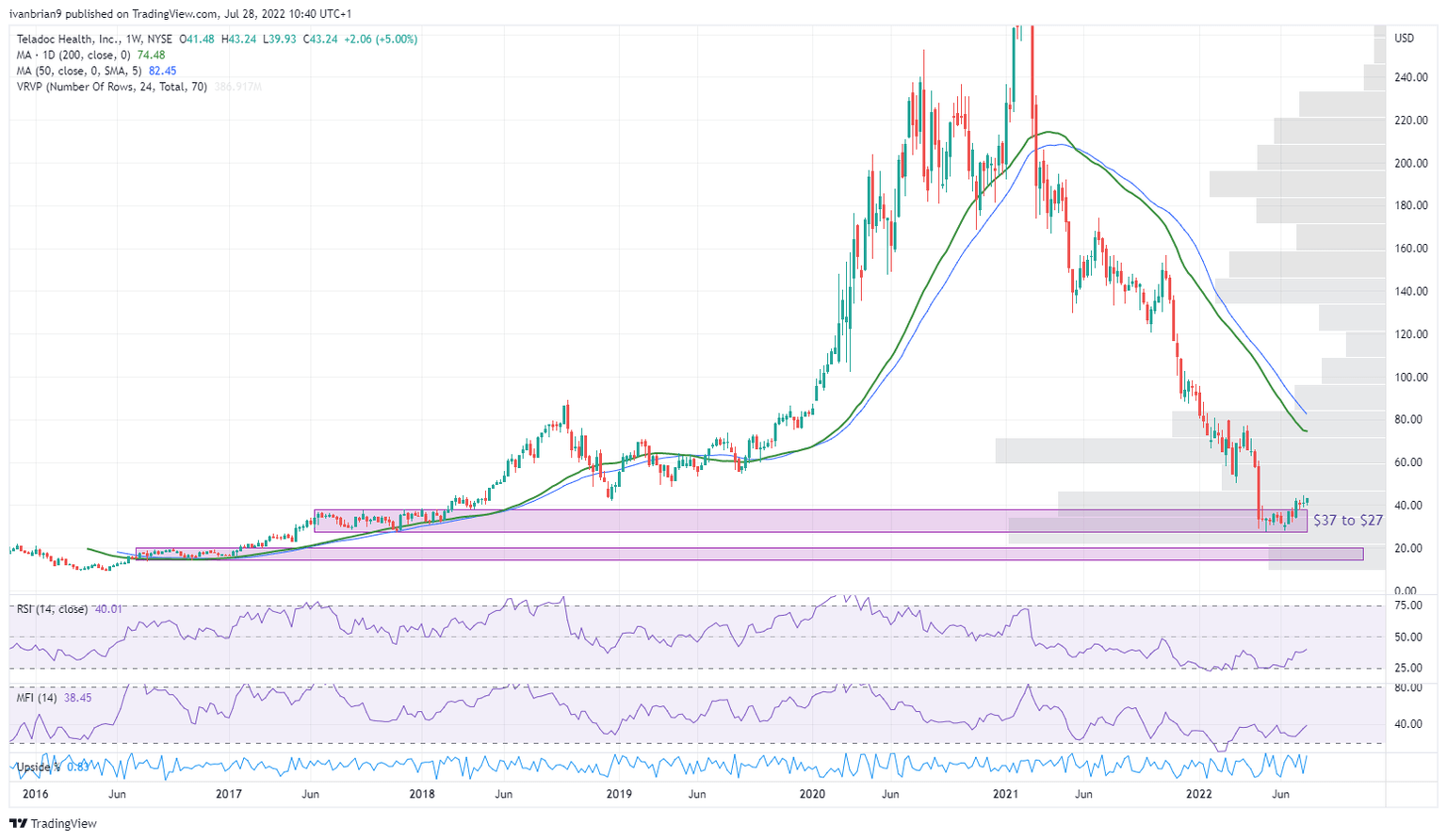

Expect TDOC stock to break out of its current range of $37 to $27, which is the consolidation phase from back in June 2017 to February 2018. Breaking below will see TDOC head for the next support consolidation zone from $20 to $15. This is a consolidation zone from summer 2016.

TDOC stock chart, weekly

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.