Tata Motors Elliott Wave technical analysis [Video]

![Tata Motors Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Materials/pic-extracting-mine-materials_XtraLarge.jpg)

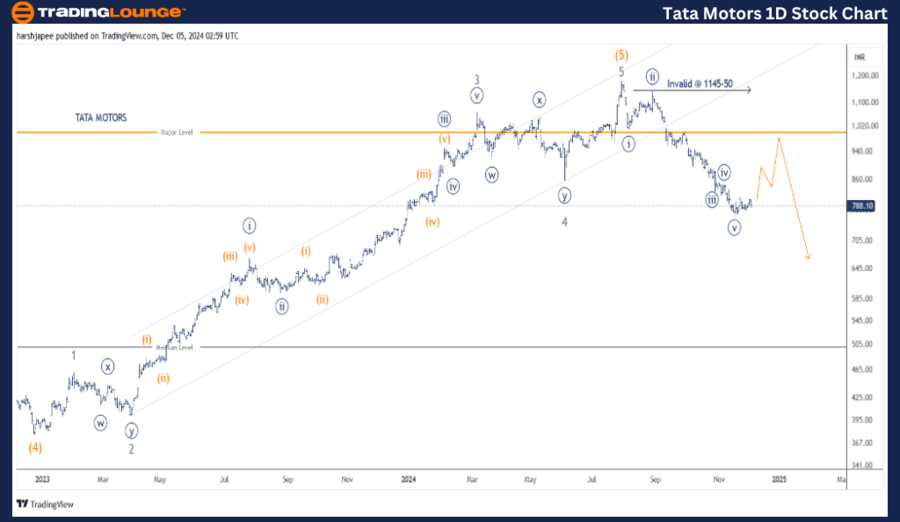

TATAMOTORS Elliott Wave technical analysis

Function: Counter Trend (Minute degree, Navy).

Mode: Corrective.

Structure: Potential Impulse within larger degree corrective wave.

Position: Minute Wave ((v)) Navy.

Details: Minute Wave ((v)) Navy might be complete around 770 mark as bulls prepare for a counter trend rally soon.

Invalidation point: 1145-50.

Tata Motors daily chart technical analysis and potential Elliott Wave counts

TATA MOTORS daily chart is indicating a potential trend reversal from 1145-50 high carved in July 2024. The first impulse drop could be complete around 770 or near to completion with one more low. Alternatively, Minor Wave 4 is complete around 770 and the stock is ready to turn higher from here.

TATA MOTORS had earlier dropped through 380 lows in December 2022, marked as Intermediate Wave (5) Orange. The subsequent rally thereafter can be sub divided into five waves labelled as Minor Wave 1 through 5 respectively.

If the above holds, prices would stay below 1145-50 range and continue to carve lower lows and lower highs as bears remain in control going forward.

TATAMOTORS Elliott Wave technical analysis

Function: Counter Trend (Minute degree, Navy).

Mode: Corrective.

Structure: Potential Impulse within larger degree corrective wave.

Position: Minute Wave ((v)) Navy.

Details: Minute Wave ((v)) Navy might be complete around 770 mark as bulls prepare for a counter trend rally soon. Alternatively, the stock could print another low below 770 to complete the impulse before turning higher again.

Invalidation point: 1145-50.

Tata Motors four-hour chart technical analysis and potential Elliott Wave counts

TATA MOTORS 4H chart is highlighting the sub-waves after Minor Wave 3 Grey terminated around 1070 in March 2024. Please note that Wave 4 was a combination followed by a potential impulse Wave 5 through 1145-50 range.

Furthermore, the price action is revealing an impulse drop from 1145-50 high, indicating a potential trend reversal. Alternatively, the entire structure from Minor Wave 3 high could be an expanded flat, which is now complete around 770 or near to completion.

If the latter is true, the stock might turn higher soon and push through 1145-50 zone.

Conclusion

TATA MOTORS has carved a potential impulse from 1145-50 high to 770 levels. Expect a turn to unfold from current levels soon.

Tata Motors Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.