Tata Consumer Product Elliott Wave technical analysis [Video]

![Tata Consumer Product Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/close-up-of-candlestick-stock-chart-with-pen-40815814_XtraLarge.jpg)

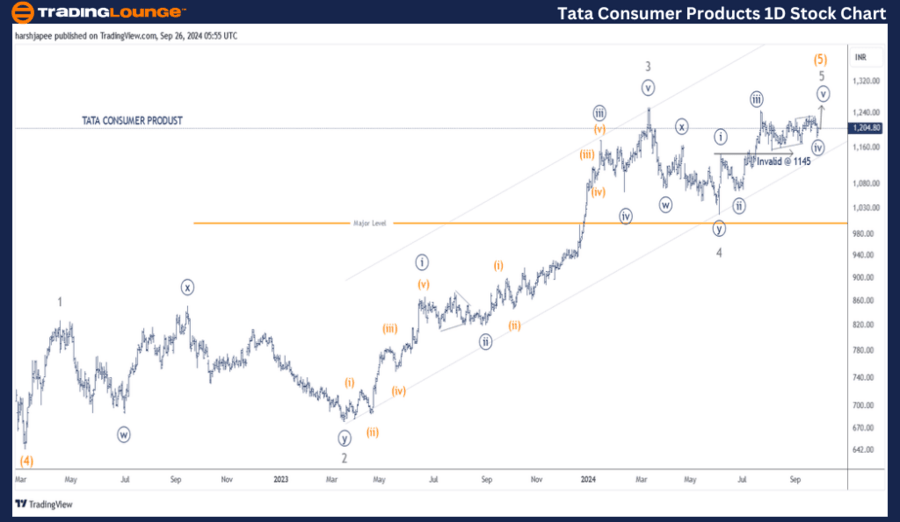

TTATACONSUM Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave (iv) Navy.

Details: Minute Wave (v) Navy progressing higher within Minor Wave 5 Grey of Intermediate Wave (5) Orange against 1145.

Invalidation point: 1145, Risk tightened.

TATA Consumer Product daily chart technical analysis and potential Elliott Wave counts:

TATA Consumer Product daily chart is suggesting a larger degree uptrend within its last leg to terminate its fifth wave at multiple degrees around 1300 levels. The stock could be now progressing within Minute Wave ((v)) Navy of Minor Wave 5 Grey against 1145.

TATA Consumer Product stock prices earlier terminated Intermediate Wave (4) Orange around 645 mark in March 2022. Since then prices have rallied through 1260 levels terminating Minor Wave 3 Grey. Minor Wave 4 terminated around 1020 on June 04, 2024.

Minor Wave 5 has been progressing since then, and has potentially terminated Minute Waves ((i)) through ((iv)) as marked on the chart here. If correct, the stock is now unfolding Minute Wave ((v)) potentially targeting above 1300 mark.

TATACONSUM Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave (iv) Navy.

Details: Minute Wave (v) Navy progressing higher within Minor Wave 5 Grey of Intermediate Wave (5) Orange against 1145. Potential upside could be seen around 1325 mark.

Invalidation point: 1145, Risk tightened.

TATA Consumer Product Four-hour Chart technical Analysis and potential Elliott Wave counts:

TATA Consumer Product 4H chart highlights the sub waves after Minor Wave 3 Grey completed around 1260 level. Please note Minor Wave 4 unfolded as a combination ((w))-((x))-((y)), terminating around 1020 mark. Minor Wave 5 could be now unfolding as a potential impulse towards 1325 levels. Ideally, prices should stay above 1145 mark.

Conclusion

TATA Consumer Product is progressing within Minute Wave ((v)) within Minor Wave 5 of Intermediate Wave (5) against 1145 mark.

Tata Consumer Product Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.