TASI Index Elliott Wave technical analysis [Video]

![TASI Index Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Utilities/phone-company-637435359713720498_XtraLarge.jpg)

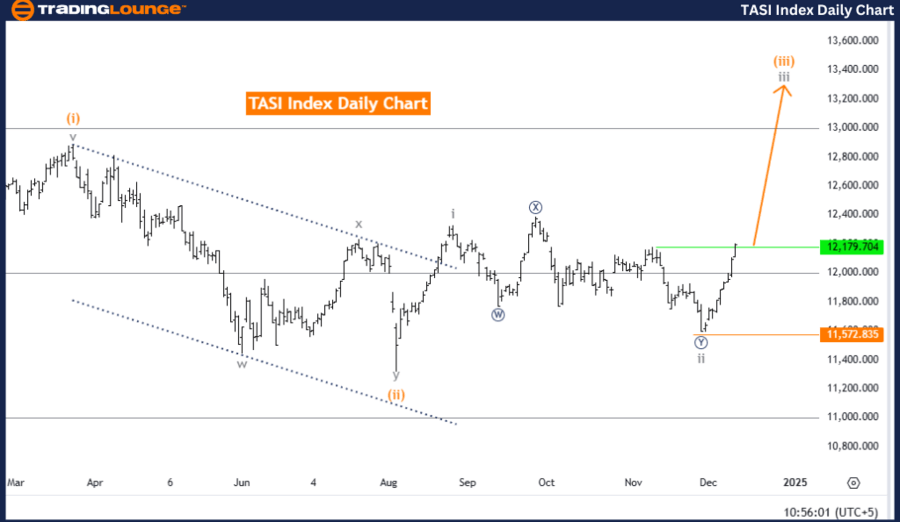

TASI Index Elliott Wave Analysis - Trading Lounge Day Chart.

TASI Index Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Gray Wave 3.

-

Position: Orange Wave 3.

-

Direction (next higher degrees): Gray Wave 3 (initiated).

-

Details: Gray Wave 2 appears complete, and Gray Wave 3 is currently progressing.

-

Wave invalid level: 11,572.835.

The TASI Index daily chart presents an Elliott Wave analysis that confirms a bullish trend. The wave structure is classified as Gray Wave 3 within an impulsive mode, with Orange Wave 3 actively developing. This suggests continued upward momentum, consistent with the broader bullish outlook.

Key insights

-

Completion of Gray Wave 2: The analysis indicates that Gray Wave 2 has been completed, signaling the start of Gray Wave 3.

-

Impulsive Waves Drive Momentum: According to Elliott Wave Theory, impulsive waves indicate strong directional trends. The progression of Gray Wave 3 highlights a sustained bullish phase with potential for additional gains.

-

Invalidation Level at 11,572.835: If the market drops below this level, the current wave structure will be invalidated, requiring a reassessment of the bullish scenario.

This analysis provides a detailed understanding of the ongoing bullish trend in the TASI Index. The shift from Gray Wave 2 to the active development of Gray Wave 3 emphasizes robust upward momentum. Traders and investors can use this information to anticipate further gains and adjust their strategies accordingly.

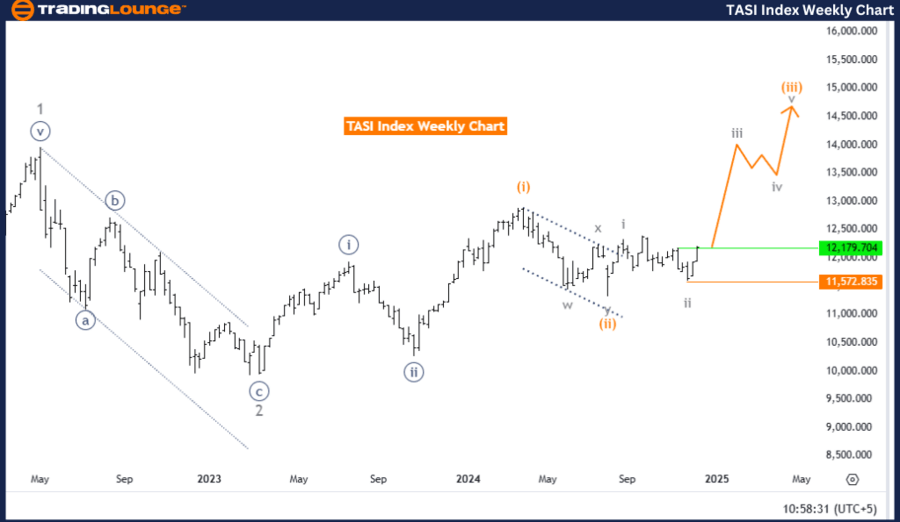

TASI Index Elliott Wave Analysis - Trading Lounge weekly chart

TASI Index Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Gray Wave 3.

-

Position: Orange Wave 3.

-

Direction (next higher degrees): Gray Wave 3 (initiated).

-

Details: Gray Wave 2 has been completed, and Gray Wave 3 is actively progressing.

-

Wave Invalid Level: 11,572.835.

The TASI Index weekly chart highlights a bullish trend as interpreted through the Elliott Wave framework. The wave structure is categorized as Gray Wave 3 within an impulsive mode, with Orange Wave 3 actively unfolding. This reflects a strong upward movement consistent with the broader bullish momentum.

Key insights

-

Completion of Gray Wave 2: The analysis confirms that Gray Wave 2 has concluded, allowing the market to advance into Gray Wave 3.

-

Impulsive Wave Strength: In Elliott Wave Theory, impulsive waves represent dominant market trends. The ongoing development of Gray Wave 3 underscores sustained growth and potential for further gains.

-

Invalidation Level at 11,572.835: A decline below this level would negate the current wave structure, requiring a reassessment of the bullish scenario.

This analysis underscores the strong upward trend in the TASI Index. The shift from the corrective phase of Gray Wave 2 to the impulsive phase of Gray Wave 3 demonstrates robust bullish momentum. Market participants can leverage this structured analysis to anticipate continued growth and make informed decisions aligned with the prevailing trend.

TASI Index Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.