TASI Index Elliott Wave technical analysis [Video]

![TASI Index Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/CommercialServices/office-meeting_XtraLarge.jpg)

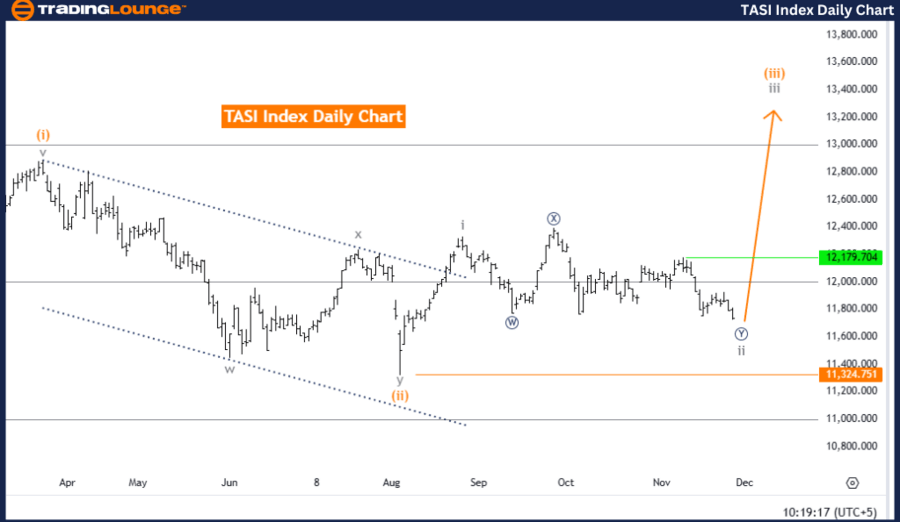

TASI Index Elliott Wave Analysis Trading Lounge Day Chart.

TASI Index – Day Chart.

TASI Index Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Gray Wave 2.

-

Position: Orange Wave 3.

-

Direction (next higher degree): Gray Wave 3.

Details:

-

Gray wave 1 is completed, and gray wave 2 remains active, appearing to near its conclusion.

-

Wave Cancel Invalidation Level: 11324.751

Analysis Summary:

This analysis evaluates the TASI Index using Elliott Wave theory on a daily chart. The index is currently in a counter-trend phase, characterized by a corrective mode representing a temporary reversal within the broader trend.

Key Observations:

-

Primary Structure:

-

The analysis focuses on gray wave 2, which began after the completion of gray wave 1.

-

This ongoing corrective phase is expected to approach its end soon.

-

-

Current Position:

-

The index is within orange wave 3, a smaller wave within the broader gray wave 2 corrective structure.

-

This phase reflects the continuation of the counter-trend movement as gray wave 2 progresses toward completion.

-

-

Next Phase:

-

The conclusion of gray wave 2 will transition the index into gray wave 3, resuming the impulsive trend at a higher degree.

-

-

Invalidation Level:

-

An invalidation level is set at 11324.751. If the index declines to this point, the current wave count and corrective outlook will no longer hold.

-

This benchmark is critical for risk management and trend confirmation.

-

Conclusion:

The Elliott Wave analysis indicates that the TASI Index is in a counter-trend corrective phase, with gray wave 2 nearing completion. The completion of gray wave 1 confirmed the initiation of this correction, and orange wave 3 currently drives its progression.

The counter-trend scenario remains valid as long as the index remains above the invalidation level of 11324.751. The analysis anticipates that the corrective phase will conclude shortly, leading to the impulsive phase represented by gray wave 3.

TASI Index Elliott Wave Analysis Trading Lounge Weekly Chart.

TASI Index – Weekly Chart.

TASI Index Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Orange Wave 3.

-

Position: Navy Blue Wave 3.

-

Direction (next higher degree): Continuation of Orange Wave 3.

Details:

-

Orange wave 2 has been completed, and orange wave 3 is now active.

-

Wave Cancel Invalidation Level: 11324.751

Analysis Summary:

This analysis evaluates the TASI Index using Elliott Wave theory on a weekly chart. The market exhibits a bullish trend in an impulsive mode, characterized by strong upward momentum.

Key Observations:

-

Primary Structure:

-

The analysis focuses on orange wave 3, which began following the completion of orange wave 2.

-

This phase signals the continuation of the bullish trend within the Elliott Wave structure.

-

-

Current Position:

-

The index is currently in navy blue wave 3, a smaller wave within the broader orange wave 3 structure.

-

This wave reflects the active progression of the impulsive upward movement.

-

-

Next Phase:

-

The ongoing orange wave 3 is expected to continue driving the bullish trend to higher levels, maintaining strong upward momentum.

-

-

Invalidation Level:

-

A critical invalidation level is set at 11324.751. If the index falls to this level, the current wave count and bullish outlook will no longer be valid.

-

This benchmark ensures effective risk management and confirms the integrity of the bullish trend.

-

Conclusion:

The Elliott Wave analysis identifies the TASI Index as being in a bullish trend, with orange wave 3 actively driving the impulsive phase. Following the completion of orange wave 2, navy blue wave 3 represents the ongoing upward progression within the structure.

The bullish outlook remains intact as long as the index stays above the invalidation level of 11324.751. The analysis anticipates continued upward momentum as orange wave 3 advances further in the impulsive phase.

Technical analyst: Malik Awais.

TASI Index Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.