TASI Index Elliott Wave technical analysis [Video]

![TASI Index Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Ibex/madrid-stock-exchange-spain-eu-16703960_XtraLarge.jpg)

TASI Index Elliott Wave Analysis Trading Lounge Day Chart,

TASI Index Elliott Wave technical analysis

Function: Trend.

Mode: Corrective.

Structure: Red wave 2.

Position: Blue Wave 3.

Direction next higher degrees: Red wave 3.

Details: Red wave 1 looking completed at 12893.725. Now red wave 2 of 3 is in play.

Wave Cancel invalid level: 10223.275.

The TASI Index (Tadawul All Share Index) Elliott Wave analysis on the daily chart provides an insightful overview of the market's current trends and potential future movements based on Elliott Wave theory. Here's a detailed summary:

Function

The analysis identifies the primary function as "Trend," indicating that the current market movement aligns with a broader, sustained trend direction, suggesting a potential continuation of this trend.

Mode

The mode is described as "corrective," which means that the market is currently undergoing a corrective phase within the broader trend. Corrective waves typically counter the primary trend direction and are usually composed of three sub-waves (A-B-C).

Structure

The structure in focus is "red wave 2," indicating that the market is in the second wave of the corrective phase. This wave is part of a larger impulsive wave sequence and typically retraces some of the gains made during the preceding wave 1.

Position

The current position is identified as "blue wave 3," suggesting that within the larger corrective structure, the market is in the third wave of the blue wave sequence. This implies that the market has likely completed the first two waves (1 and 2) and is now progressing through the third wave.

Direction for next higher degrees

The direction for the next higher degrees is "red wave 3," which indicates that after completing the current corrective wave 2, the market is expected to move into a new impulsive phase (red wave 3). This wave is anticipated to follow the completion of the corrective phase and resume the primary trend direction.

Details

The detailed analysis notes that "red wave 1" has been completed at the level of 12,893.725. Currently, "red wave 2 of 3" is in play, suggesting that the market is experiencing a retracement or correction from the previous wave's gains. The wave cancellation or invalidation level is set at 10,223.275. If the market falls below this level, the current wave count would be invalidated, indicating a possible shift in market dynamics.

In summary, the TASI Index Elliott Wave analysis on the daily chart suggests that the market is currently undergoing a corrective phase (red wave 2) within a larger trend. The completion of "red wave 1" sets the stage for "red wave 2 of 3" to play out, with careful monitoring required around the invalidation level of 10,223.275. This analysis provides valuable insights for traders and investors tracking the TASI Index's price movements and potential future trends.

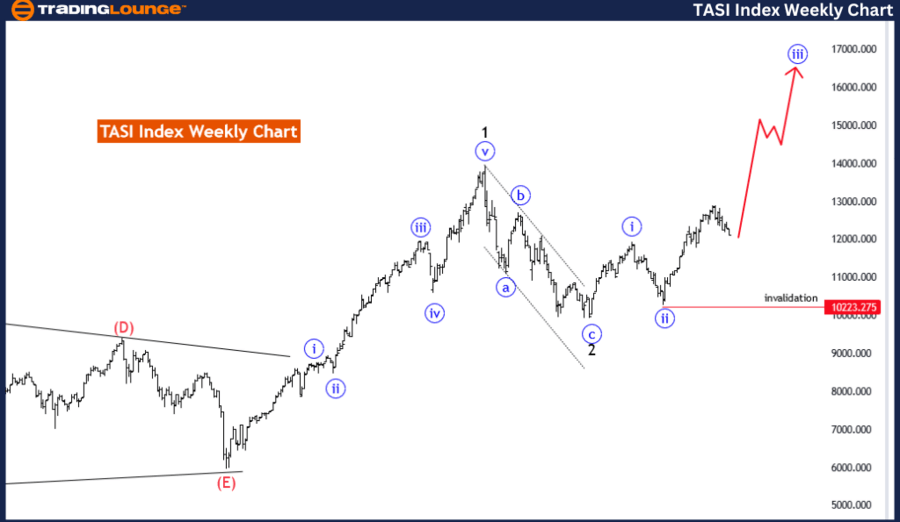

TASI Index Elliott Wave Analysis Trading Lounge Weekly Chart,

TASI Index Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Blue wave 3.

Position: Black wave 3.

Direction next lower degrees: Red wave 4.

Details: Blue Wave 2 looking completed at 10223.275. Now blue wave 3 of 3 is in play . Wave Cancel invalid level: 10223.275

The TASI Index (Tadawul All Share Index) Elliott Wave analysis on the weekly chart offers a comprehensive look at the market's current trends and projected movements based on Elliott Wave principles. Here is a detailed summary:

Function

The primary function identified in the analysis is "Trend," indicating that the TASI Index is currently moving in alignment with a sustained and ongoing trend, likely suggesting continued movement in the same direction.

Mode

The mode of the current market movement is described as "impulsive." Impulsive waves are a strong movement in the direction of the main trend and are characterized by five sub-waves. This mode suggests robust market activity driving the index in the trend direction.

Structure

The structure in focus is "blue wave 3," signifying that the market is in the third wave of an impulsive sequence. Wave 3 is typically the strongest and longest in a five-wave sequence, often showing significant price movement.

Position

The current position is identified as "black wave 3," indicating that within the larger structure, the market is specifically in the third wave of the black wave sequence. This means that the market is experiencing a strong, upward movement within the context of the broader trend.

Direction for next lower degrees

The direction for the next lower degrees is "red wave 4," suggesting that after completing the current impulsive wave (blue wave 3), the market will enter a corrective phase (red wave 4). This phase will involve a retracement or pullback before potentially resuming the main trend.

Details

The analysis notes that "blue wave 2" appears to have completed at the level of 10,223.275. The market is now in the midst of "blue wave 3 of 3," indicating continued strong upward movement. The wave cancellation or invalidation level is set at 10,223.275. If the market falls below this level, the current wave count would be invalidated, indicating a potential change in market dynamics.

In summary, the TASI Index Elliott Wave analysis on the weekly chart suggests that the index is currently in an impulsive phase (blue wave 3), with strong upward momentum. The completion of "blue wave 2" sets the stage for "blue wave 3 of 3" to continue playing out. Market participants should monitor the invalidation level of 10,223.275, as falling below this level would negate the current wave count and indicate a possible shift in the market trend. This analysis is crucial for traders and investors focusing on long-term trends in the TASI Index.

TASI Index Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.