Support.com Inc (SPRT) (GREE) Stock News and Forecast: Losing all support as ticker changes to GREE

- Support.com dropped sharply in Tuesday's session.

- Short interest was reportedly high for SPRT stock.

- New ticker GREE trading from today.

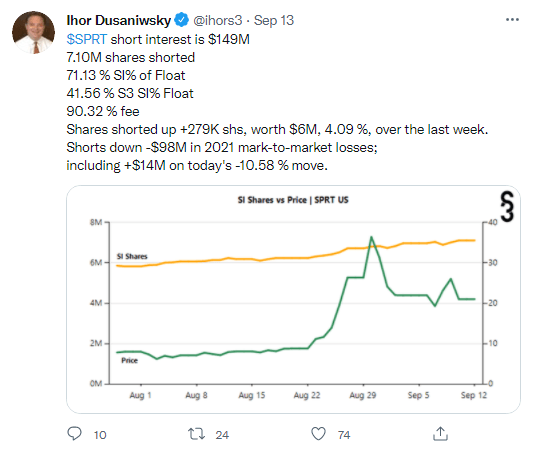

Shares in popular meme name Support.com tumbled on Tuesday as the stock continued its wild ride. The shares have been a favourite of the retail crowd lately as SPRT has a very large short interest with Ihor Dusaniwasky tweeting that SPRT had reached as high as 70% short interest with the fee rising to 90%.

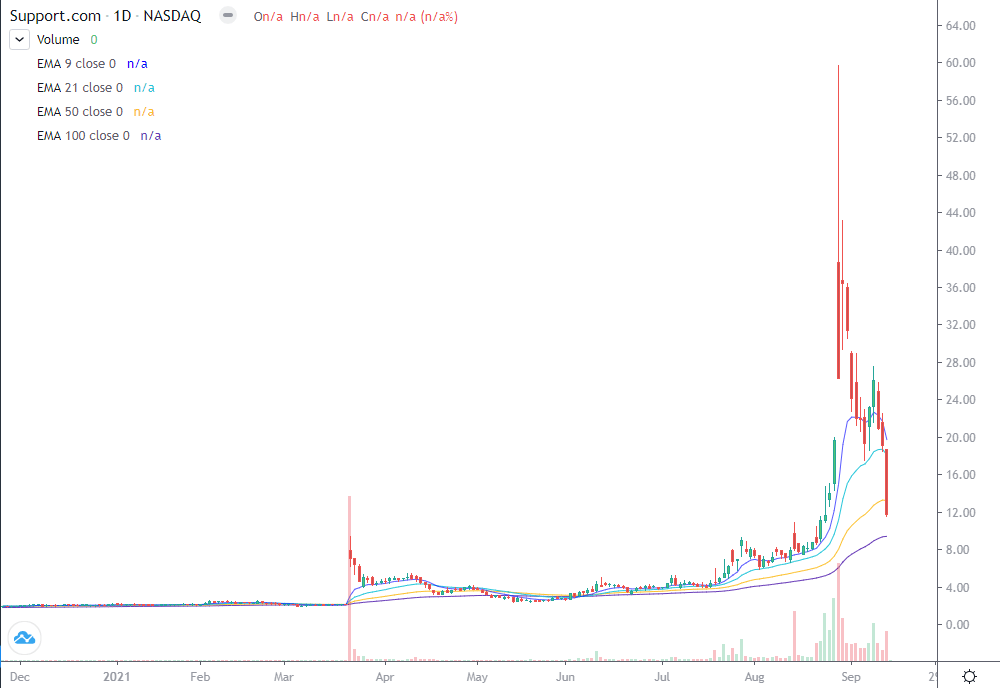

SPRT shares dropped sharply by over 38% on Tuesday as the impending merger with Greenidge Generation (GREE) was completed and the combined entity will start trading under the ticker GREE today. Support.com is now effectively a subsidiary of GREE. Every share of SPRT entitles holders to 0.115 shares in GREE. The merger between GREE and SPRT was only approved on Friday. Since then SPRT stock has dropped sharply despite the large short interest. SPRT stock though has had some strong surges leading into the merger, but many retail traders had been hoping for further short covering once the deal went through.

Greenidge Generation Holdings Inc (GREE) is a Bitcoin mining and power generation company, but it is committed to 100% carbon neutral Bitcoin mining. Support.com (SPRT) is a poster child for the pandemic working from home situation as the company provides customer and technical solutions for this type of remote working. Understandably then we can see why SPRT had captured the attention of retail traders. SPRT is a typical huge volatility stock so trade carefully with this one. Support.com peaked at nearly $60 in August and had dropped to $11.80 by Tuesday's close. SPRT was still up sharply for 2021 as the stock opened the year at just over $2.

SPRT stock news

Now that the merger is completed and the stock begins trading today under the ticker GREE, will that reduce the volatility in the name? That is unknown, but volume is sure to remain high for a number of days as the stock remains much discussed among retail traders on social media. This morning GREE announced that it will expand its Bitcoin mining operation with an order of miners from Bitmain, according to a report from Reuters. Crypto stocks are already a retail favourite, so this one is sure to be added to the list.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.