- SBFM stock soared over 148% on Tuesday, closing at $5.61.

- The stock soared due to positive news about mRNA cancer treatment.

- Sunshine BioPharma is a small-cap pharma stock, listed in February.

Sunshine BioPharma is a recent addition to the publicly listed space – it is a small-cap company having a market capitalization of just $40 million. Sunshine BioPharma is a Canadian company focused on developing and commercializing oncology and antiviral treatments. The company applied to the list on the Nasdaq in September of last year and was listed in February 2022. Sunshine BioPharma has a collaboration agreement with the University of Arizona for anti-coronavirus drug development.

Sunshine BioPharma (SBFM) stock news

SBFM stock soared on Tuesday as the company announced that two of its mRNA molecules were effective in treating cancer cells. The cancer cells were grown in culture and included breast cancer and ovarian cells. Sunshine BioPharma said in a statement that "Toxicity studies using non-transformed (normal) human cells showed that these mRNA molecules had little or no cytotoxic effects. These new mRNA molecules are readily adaptable for delivery to patients using the mRNA vaccine technology. The company anticipates filing a patent application in connection with these results soon".

Dr Steve Slilaty, CEO of Sunshine Biopharma added that they "are delighted by these findings in connection with our ongoing mRNA-as-therapeutic-agents research." Slilaty continued to say that "the potential use of mRNA to treat cancer opens the door to many possibilities for patients including convenience, reduced toxicity, and enhanced efficacy," he added, source Globe Newswire.

Sunshine BioPharma (SBFM) stock forecast

Sunshine BioPharma is an early-stage company, and these kinds of pharma investments are highly risky. Some can deliver huge returns – the most obvious example in recent times is Moderna (mRNA), so we would naturally advise caution when investing in this sector and SBFM stock.

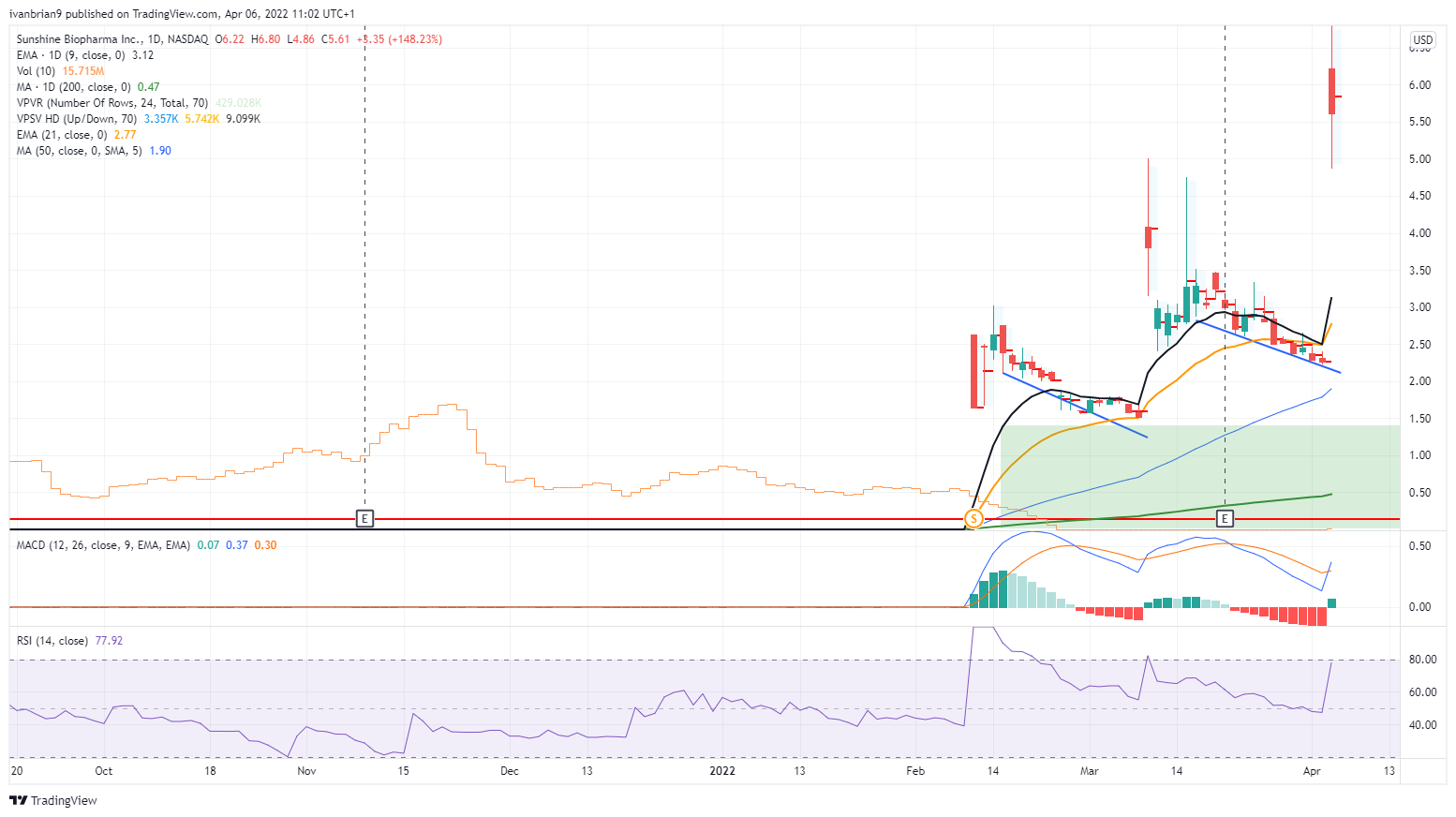

From a technical perspective, something so early stage and only recently listed does not lend itself to technical analysis, but we can point out the recent spikes in SBFM stock have followed a similar pattern. A massive breakout was followed by a period of retraction and consolidation before another breakout. So we expect this recent move to fall back as the news flow slows. These types of stocks react to news flow, not technical developments.

SBFM stock chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains offered near the 1.0800 zone

On Monday, EUR/USD remains rangebound around 1.0800, as risk-averse sentiment keeps the US Dollar buoyant amid ongoing tariff concerns, while investors remain wary ahead of "liberation day".

Gold sits at record highs above $3,100 amid tariff woes

Gold price holds its record-setting rally toward $3,150 in the second half of the day on Monday. The bullion continues to capitalize on safe-haven flows amid intensifying global tariff war fears. US economic concerns weigh on US Treasury bond yields, allowing XAU/USD to push higher.

GBP/USD stays in range near 1.2950 as mood sours

GBP/USD fluctuates in a narrow channel at around 1.2950 at the beginning of the new week. Growing concerns over US President Donald Trump's tariffs igniting inflation and dampen economic growth weigh on risk mood and don't allow the pair to gain traction.

Seven Fundamentals for the Week: “Liberation Day” tariffs and Nonfarm Payrolls to rock markets Premium

United States President Donald Trump is set to announce tariffs in the middle of the week; but reports, rumors, and counter-measures will likely dominate the headline. It is also a busy week on the economic data front, with a full buildup to the Nonfarm Payrolls (NFP) data for March.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.