Sun Pharmaceuticals Elliott Wave technical analysis [Video]

![Sun Pharmaceuticals Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/hand-drawing-stock-chart-63151915_XtraLarge.jpg)

SUNPHARMA Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate Degree orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((v)) Navy.

Details: Minute Wave ((v)) of Minor Wave 3 Grey might be still progressing towards 2000 mark. We have adjusted the risk to 1470 to allow room for correction. Further, Minuette Wave (iv) Orange could be complete around 1750 and bulls would be back soon to push higher. Alternatively Minor Waves 3, 4 and 5 could be complete as marked, and a larger degree corrective wave is underway.

Invalidation point: 1470.

Sun Pharmaceutical daily chart technical analysis and potential Elliott Wave counts:

SUN PHARMACEUTICAL daily chart is indicating a progressive rally, which is potentially targeting 2000 and higher. The stock is extending its Minor Wave 3 and is within its final leg higher as Minuette Wave (v) Orange begins to unfold against 1470 low.

The stock had completed Intermediate Wave (4) low around 785 mark in June 2022. Since then, the rally has carved Minor Waves 1 and 2; while Wave 3 is still unfolding as an extension. Alternatively, Minor Waves 3, 4, and 5 terminated around 1630, 1380 and 1960 levels respectively.

SUNPHARMA Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate Degree orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((v)) Navy.

Details: Minute Wave ((v)) of Minor Wave 3 Grey might be still progressing towards 2000 mark. We have adjusted the risk to 1470 to allow room for correction. Further, Minuette Wave (iv) Orange could be complete around 1750 and bulls would be back soon to push higher. Alternatively Minor Waves 3, 4 and 5 could be complete as marked, and a larger degree corrective wave is underway.

Invalidation point: 1470.

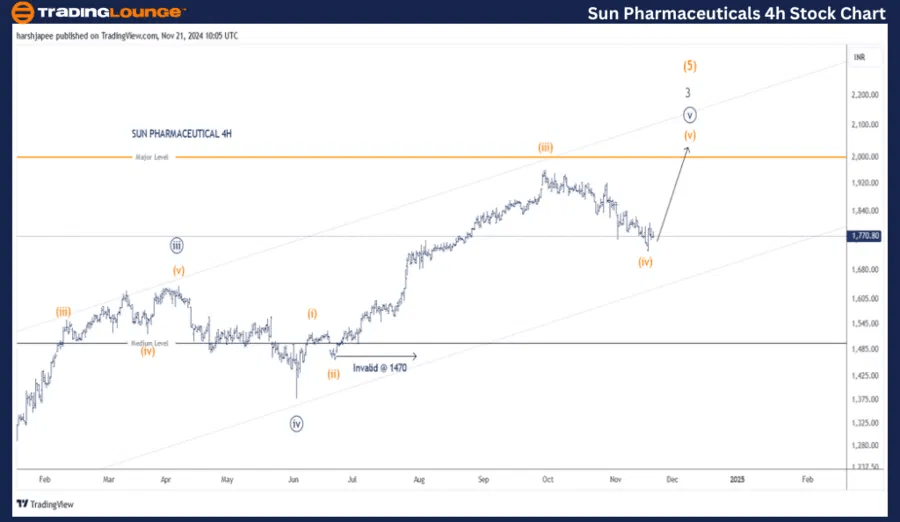

Sun Pharmaceutical four-hour chart technical analysis and potential Elliott Wave counts

SUN PHARMACEUTICAL 4H chart is highlighting the Minuette degree sub waves post Minute Wave ((iv)) of Minor Wave 3 terminated around 1380 mark on June 04, 2024. As marked here, Minuette Wave (iv) Orange might be complete around 1740-50 zone.

If correct, the stock should resume its rally towards 2000 mark to terminate Minuette Wave (v) of Minute Wave ((v)) within Minor Wave 3 Grey.

Conclusion

Sun Pharmaceuticals could be progressing higher towards 2000 mark as Minute Wave ((v)) of Minor Wave 3 of Intermediate Wave (5) begins to unfold.

Sun Pharmaceuticals Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.