The S&P 500 bounced on Monday, and today it’s going to open much higher after the CPI data. Will the uptrend resume?

The broad stock market index gained 1.43% yesterday, as it went the highest since last Tuesday. Last week on Monday it reversed lower after a better-than-expected ISM Services PMI release, and on Tuesday it was as low as 3,918.39 (going down from its last week’s local high of 4,100.51).

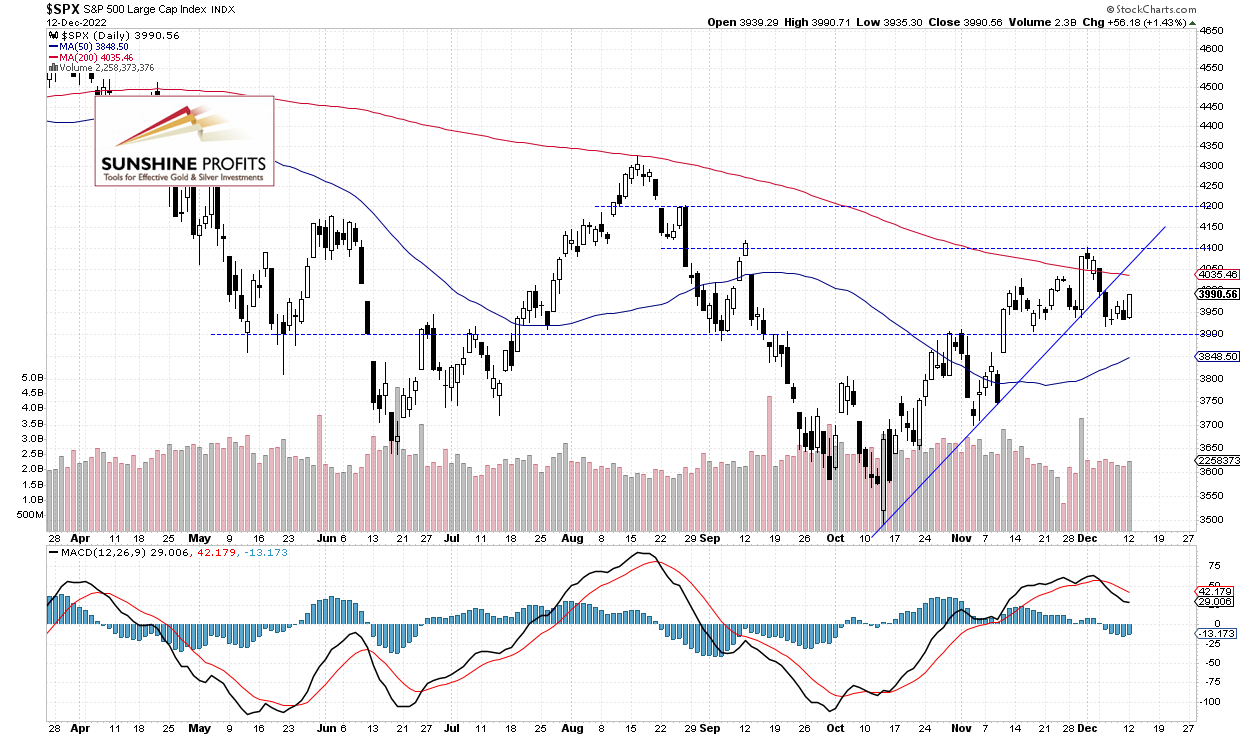

This morning the S&P 500 will likely open 2.7% higher following lower-than-expected Consumer Price Index release. The market will be now waiting for tomorrow’s FOMC release. It still looks like a weeks-long consolidation within an uptrend. However, last week on Tuesday the index broke below its two-month-long upward trend line, as we can see on the daily chart:

Futures contract rallies to new high

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke above the previous local highs on the inflation release. The support level is now at 4,050-4,100, marked by the recent resistance level.

Conclusion

Stocks are about to open much higher this morning on lower than expected consumer inflation release. So the S&P 500 index will likely get back above the 4,000 level. Tomorrow we will have the important FOMC release, and there will likely be even more volatility.

Here’s the breakdown:

-

S&P 500 index got close to the 4,000 level yesterday, and today it will break above it.

-

Stock prices may resume their two-month-long uptrend.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

U.S. Pres. Trump expected to announce reciprocal tariffs –LIVE

U.S. President Donald Trump is set to unveil the details of his reciprocal tariffs on what he dubs "Liberation Day." Markets are on high alert, bracing for increased volatility amid growing concerns that these tariffs could negatively impact both economic growth and inflation prospects.

EUR/USD looks to retest 1.0900

EUR/USD surged to multi-day highs in response to further selling pressure on the Greenback and news that the EU could be planning measures to alleviate Trump’s tariffs.

Gold looks consolidative near $3,120 ahead of Trump's “Liberation Day”

Gold is regaining momentum, climbing above $3,120 after a slight pullback from Tuesday’s near-record high of $3,150. Retreating US yields are bolstering XAU/USD, ahead of President Trump's official announcement of the reciprocal tariff measures later this Wednesday.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

Grayscale launches Bitcoin options ETF with a focus on income generation

In a press release on Wednesday, Grayscale announced the launch of Bitcoin options-based ETFs, the Grayscale Bitcoin Covered Call ETF (BTCC) and Grayscale Bitcoin Premium Income ETF (BPI).

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.