Market surging on electronics sector reprieve, but is this a new uptrend or just a correction?

The S&P 500 closed 1.81% higher on Friday, partially recovering from Thursday's sharp sell-off but still not reaching Wednesday's high. This morning, futures point to a 1.3% higher open following news that the Trump administration will temporarily exempt smartphones, computers, and other electronics from its tariffs on Chinese imports.

Goldman Sachs released its earnings this morning, with the stock gaining over 1% in pre-market trading, though backing off from earlier highs. This starts a significant week for corporate earnings, with several major financial institutions set to report in the coming days.

Investor sentiment remained bearish, as shown in the last Wednesday’s AAII Investor Sentiment Survey, which reported that 28.5% of individual investors are bullish, while 58.9% of them are bearish.

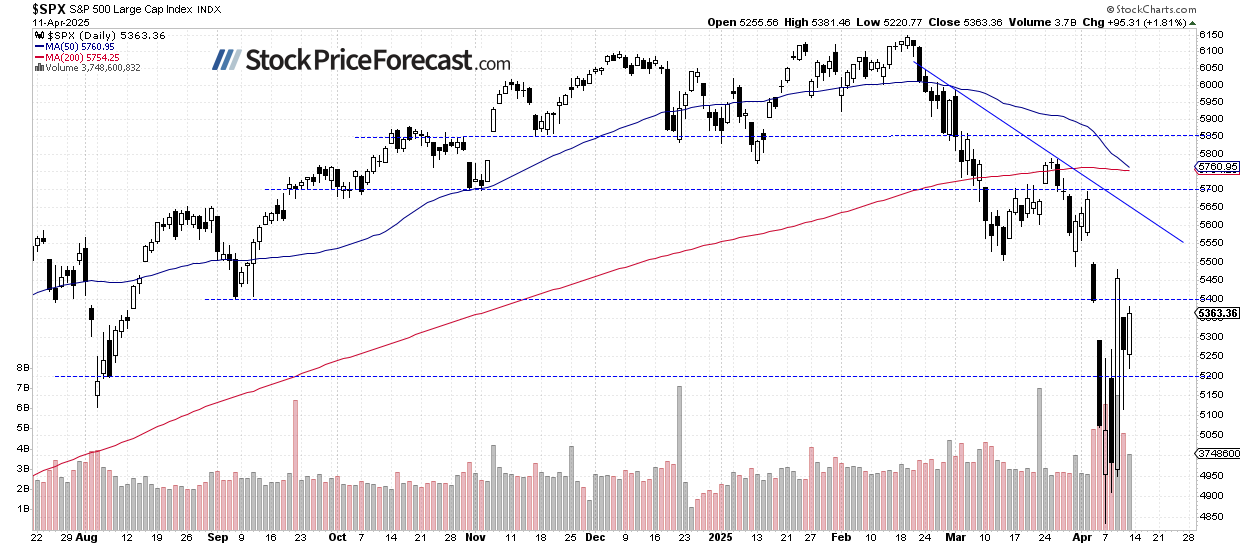

The S&P 500 continues to experience significant volatility, as we can see on the daily chart.

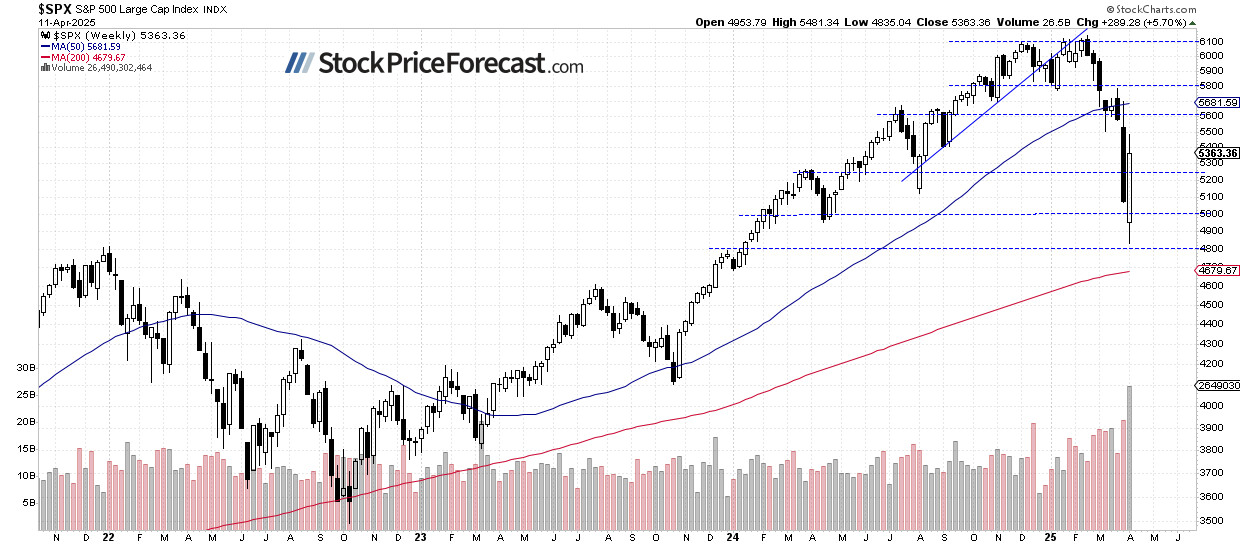

S&P 500: Strong weekly rebound

The S&P 500 gained an impressive 5.70% last week, rebounding from a local low of 4,835.04. The market recovered following the recent tariff-induced volatility. On Monday, April 7, it was at the lowest point since January of 2024.

Last week's performance suggests potential bottom forming, though the market remains vulnerable to trade policy headlines. The sharp recovery indicates strong buying interest at lower levels. However, the sustainability of this advance remains in question.

Key support now sits around 5,000-5,100, while resistance is near last Wednesday's high of around 5,480.

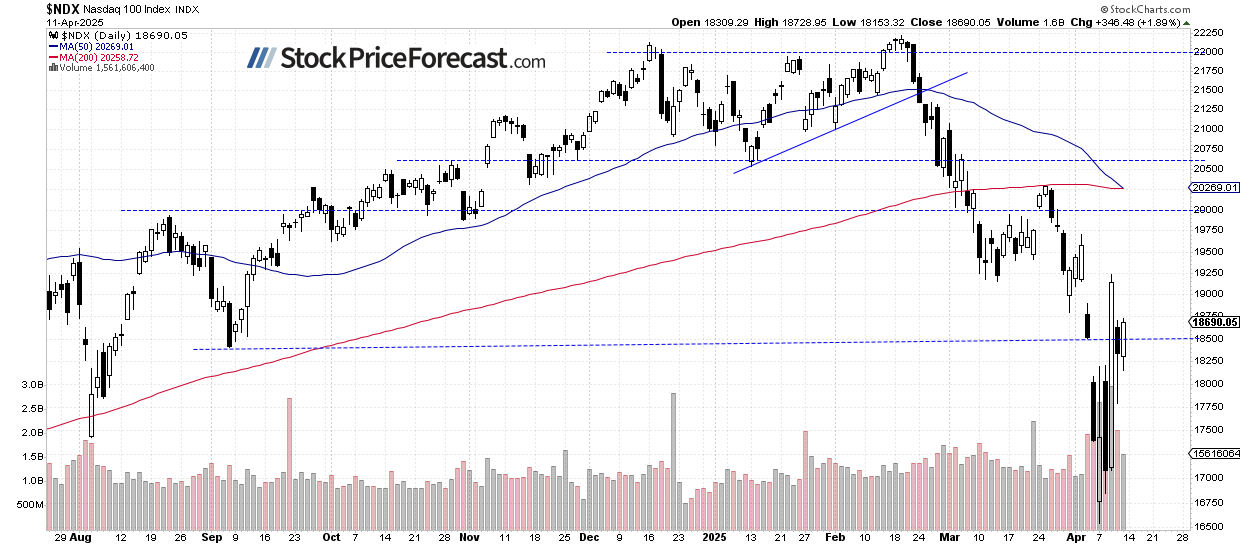

Nasdaq 100 – Set to open higher

The Nasdaq 100 gained almost 2% on Friday, and this morning, tech majors with heavy exposure to China, specifically Apple, are likely to see relief. The tech-heavy Nasdaq is particularly well-positioned to benefit from the administration's decision to exempt electronics from the steep 145% tariffs on Chinese imports.

However, investors should note the White House indicated these exemptions are temporary and designed to give companies more time to shift production to the United States.

Futures suggest a 1.7% higher open for the Nasdaq 100, but uncertainty remains high. Resistance is now around 19,000-19,200, and support remains around 18,200.

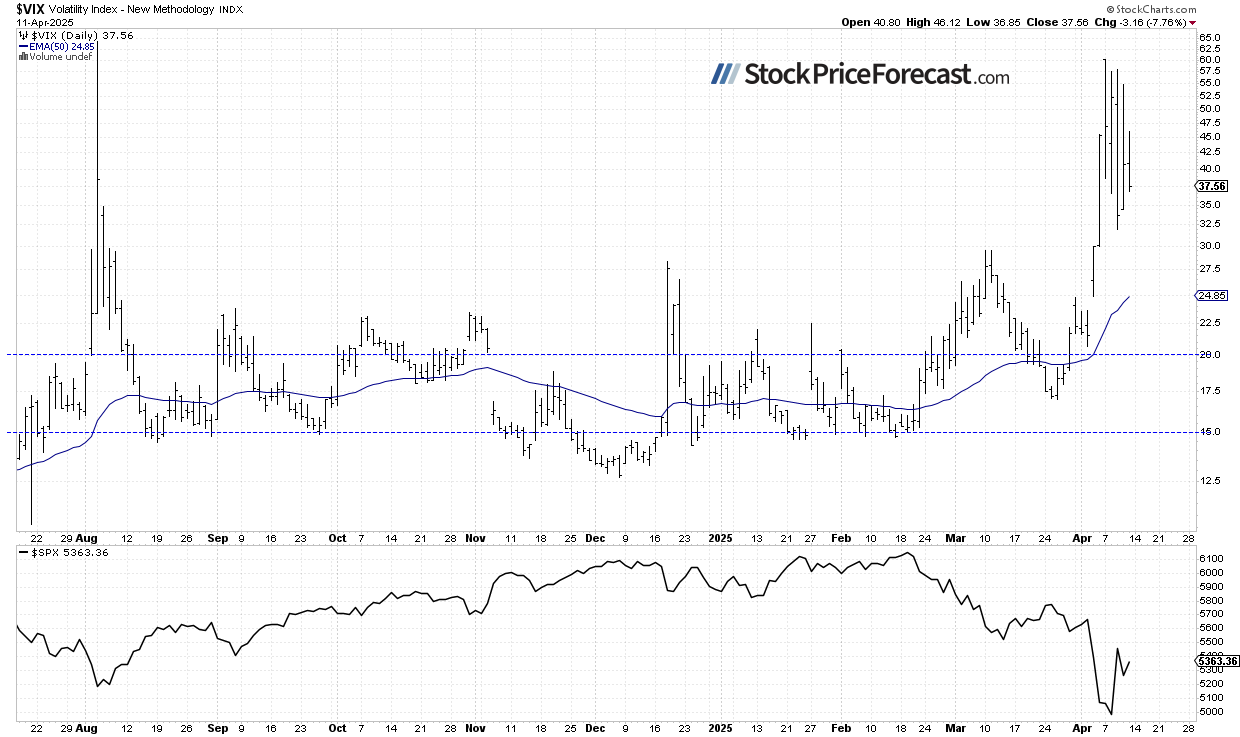

VIX – Volatility still elevated

The VIX, while retreating from recent highs, remains elevated compared to historical norms, indicating ongoing uncertainty.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures contract: Surging higher

This morning, the S&P 500 futures contract is trading 1.3% higher, building on Friday's gains and suggesting upward momentum at the open.

Key support remains around 5,350-5,400, marked by Friday’s fluctuations. Resistance remains around 5,500.

Last Wednesday, I noted that “The contract may be forming a double-bottom pattern, though it's too early to confirm.” This proved correct.

Conclusion

The stock market is showing strong short-term bullish momentum as hopes and news about tariff delays and exemptions fuel optimism. The S&P 500's 5.70% gain last week marks a significant recovery from recent lows.

However, it remains uncertain whether we're witnessing the beginning of a new uptrend or simply an upward correction following the recent declines. The market continues to be highly sensitive to trade policy developments, and volatility is likely to persist.

Here’s the breakdown:

-

S&P 500 futures point to a 1.3% higher open following Trump electronics tariff exemption.

-

Goldman Sachs earnings came in strong, with the stock gaining over 1% pre-market.

-

Tech sector poised to benefit from tariff exemptions for electronics.

-

It is still a news-driven market, with tariff developments in focus.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.