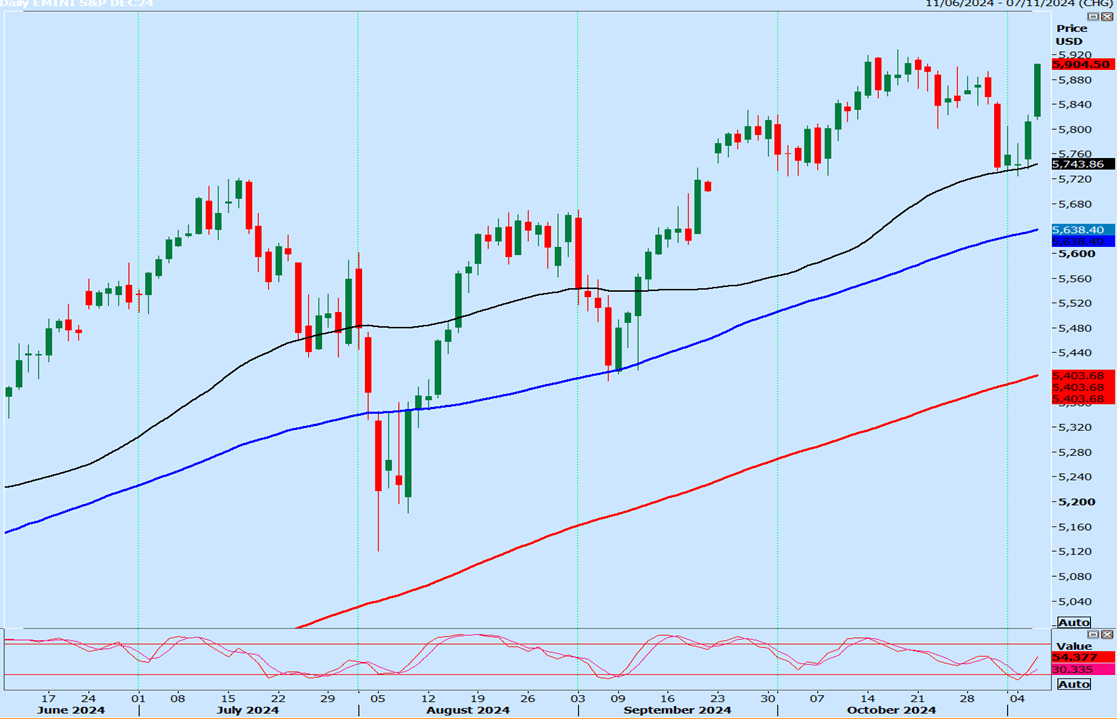

Stocks soar from strong support levels

-

Emini S&P December soars to 5894 as Trump leads.

The low & high for the last session were 5735 - 5823. -

Emini Nasdaq December made a low for the day week exactly at the buying opportunity at 20100/20000.

Last session high & low for the last session were: 20041 - 20385. -

Emini Dow Jones December recovers as far as 43019.

Last session high & low for the last session were: 41917 - 42460.

Emini S&P December futures

-

Emini S&P made a low for the week exactly at very strong support at the October low at 5730/5724.

-

Longs worked perfectly as we shot higher to resistance at 5790/5800 but we continue higher to beat resistance at 5830/34 & reach5894 as I write.

-

A break above 5900 can retest the all time high at 5927.

-

A break higher is a buy signal targeting 5970/75 & 6000/6005.

On further gains look for 6026/29 & 6050/54. -

Support at 5855/50 but below 5845 look for 5830/25.

Nasdaq December futures

-

We hit the next downside target & support at 20100/20000 with a low for the week here.

-

Targets of 20300/320 then 20390/410 & strong resistance at 20470/510 were hit for up to 300 ticks profit but shorts here stopped above 20550.

-

We reached 20640 & if we continue higher look for 20700/710 then a retest of the October high at 20760/788

-

Above 2800 can retest the all time high at 20940/983.

-

First support at 20500/460 but we could find better support at 20400/20350 & longs need stops below 20250.

Emini Dow Jones December futures

-

We held resistance at 42500/600 yesterday but over night we shot higher to 43019.

-

First support at 42750/710 but longs need stops below 42650.

-

A break lower can target 42450/400 & longs need stops below 42350.

-

If we continue higher through 43050 look for 43260/290 then 43400/430.

Author

Jason Sen

DayTradeIdeas.co.uk