The S&P 500 index closed 0.42% higher, reaching a new local high of 5,632.68, edging closer to the July 16 record high of 5,669.67. This rally has retraced nearly all the declines that led to the panic selling and the August 5 local low of 5,119.26. The market has slightly extended its advance following a much larger-than-expected revision of annual jobs numbers yesterday. This morning, the S&P 500 is likely to open 0.2% higher, potentially leading to a consolidation phase.

Yesterday, I wrote “Recently, the market has continued to climb following the brief Yen crisis at the start of August, surprising many traders. The question is whether the market will continue to new highs or reverse course and retrace the recent rally. I think there is a chance the market will reverse its course and correct some of the advances, retracing a large part of the rally.”

Although there have been no confirmed negative signals, I decided to open a speculative short position on Tuesday.

Last Thursday, I wrote “It still appears to be a correction following a decline that started in mid-July; however, the market may also advance towards a double-top or new highs.” This remains accurate as we could see a medium-term consolidation following early August volatility.

Investor sentiment much improved yesterday, as indicated by the AAII Investor Sentiment Survey, which showed that 51.6% of individual investors are bullish, while only 23.7% of them are bearish – down from 28.9% last week.

The S&P 500 index remained above the 5,600 level yesterday, as we can see on the daily chart.

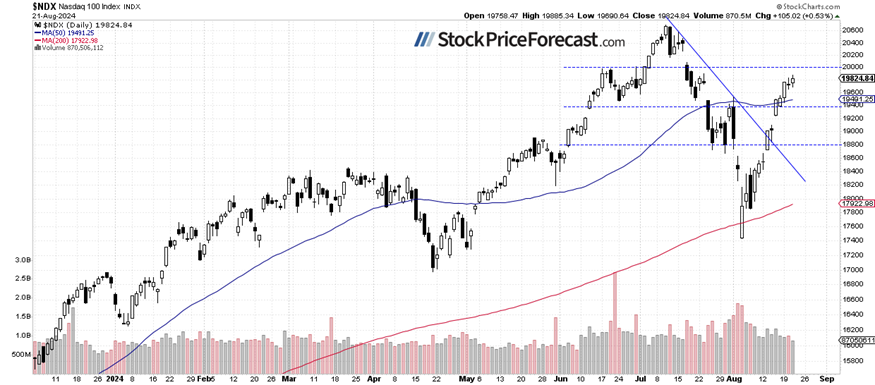

Nasdaq 100 getting closer to 20,000

The technology-focused Nasdaq 100 gained 0.52% yesterday after declining by 0.2% on Tuesday. However, it remains relatively weaker than the broader stock market following the early August sell-off. The index is being driven higher by a few key stocks, including NVDA, which rallied by over 40% from its low point. This is significant given its multi-trillion-dollar market cap.

The resistance level remains around 20,000, marked by the July 17 daily gap down of 20,080.27 to 20,266.51, among others. Today, the Nasdaq 100 is likely to open 0.3% higher.

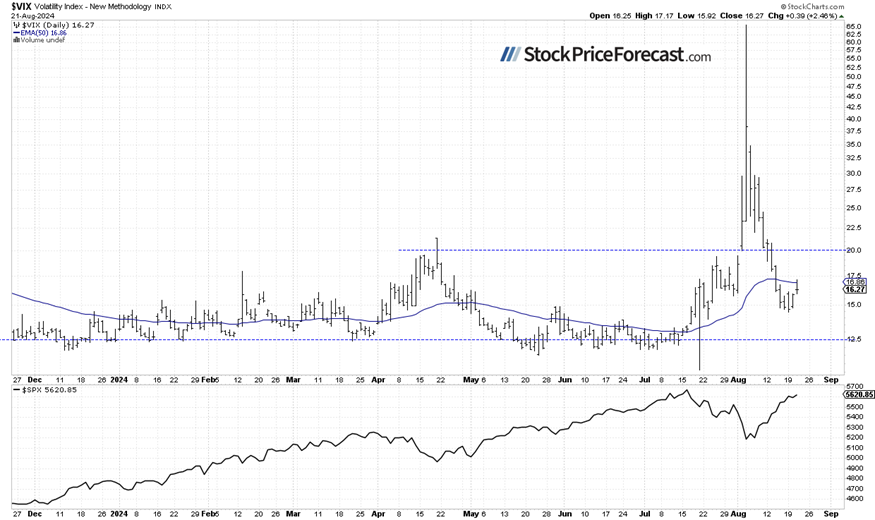

VIX: Higher despite gaining stocks

Last Monday, the VIX index, a measure of market fear, reached a new long-term high of 65.73 - the highest level since the 2008 financial crisis and the COVID sell-off in 2020. This reflected significant fear in the market. However, it has since been retracing, dropping as low as 14.46 on Monday, indicating much less fear. The VIX has returned to 'normal' levels, considering the past few months. Yesterday, though, it traded higher, breaking above the 16 mark.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures contract trading near highs

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Monday, it broke above the 5,600 level, accelerating its uptrend. This morning, it’s breaking the 5,650 level, slightly extending its advance. The resistance level is at 5,700-5,720, marked by previous highs.

As I wrote on Wednesday, “The market seems to be heading toward new record highs but is becoming increasingly overbought and susceptible to a short-term correction. The recent volatility suggests a potential shift in the long-term outlook, and the market may be entering a medium-term consolidation.”

Conclusion

In my Stock Price Forecast for August, I noted “a sharp reversal occurred, and by the end of the month, the S&P 500 experienced significant volatility following the sell-off. August is beginning on a very bearish note, but the market may find a local bottom at some point.”

The rebound from the previous Monday’s low has been significant, and bulls have regained control of the market.

On Friday, I questioned “Will this lead to new record highs? For now, it still seems like a correction within the downtrend. However, if the market breaks above its early August local high, the road to re-test the all-time high will be open.”

Stock prices are likely to open slightly higher this morning. Recently, the S&P 500 broke its August high, which may be a bullish sign, but in the short term, there is an increasing likelihood that the market will reach a top soon. All the attention seems to be focused on the Fed Chair Powell’s speech at the Jackson Hole Symposium tomorrow at 10:00 a.m.

I decided to open a speculative short position in the S&P 500 futures contract on Tuesday.

On the previous Friday, I wrote “(…) rebound brought some hope for bulls, but it seems they are not out of the woods yet. The recent sell-off was significant, and it will likely take more time to recover.

There is also a chance that the current advances are merely an upward correction, and the market could revisit its lows at some point.”

For now, my short-term outlook remains bearish.

Here’s the breakdown:

-

The S&P 500 index continues to extend its gains, though at a slower pace than recently.

-

Today, the market is likely to open slightly higher, but a correction may be looming; Jackson Hole Symposium in focus.In my opinion, the short-term outlook is bearish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

EUR/USD extends correction toward 1.1100 after US data

EUR/USD stays under modest bearish pressure and declines toward 1.1100 in the second half of the day on Thursday. The US Dollar preserves its recovery momentum following the mixed PMI data, making it difficult for the pair to regain its traction.

GBP/USD retreats to 1.3100 on USD rebound

GBP/USD pulls away from the 13-month high it set at 1.3130 earlier in the day and trades near 1.3100. The US Dollar gathers strength against its rivals after the PMI figures showed that the private sector continued to grow at a healthy pace in August.

Gold slumps below $2,480 as US T-bond yields stretch higher

Gold extends its correction and trades below $2,480 in the American session Thursday. The benchmark 10-year US Treasury bond yield clings to daily gains after August PMI data from the US, forcing XAU/USD to stay on the back foot.

MATIC price poised for rally as on-chain data shows a positive bias

Polygon's (MATIC) price has risen 27% since the start of this week and, as of Thursday, is continuing to trade higher by 0.5% at $0.52. On-chain data shows that MATIC's TVL is rising.

US S&P Global PMIs seen broadly unchanged in August, signaling moderate economic expansion

S&P Global will publish the preliminary estimates of the US PMIs for August on Thursday. The indexes are the result of surveys of the senior executives in the private sector and are meant to indicate the overall health of an economy.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.