Stocks creeping higher: Signs of exhaustion?

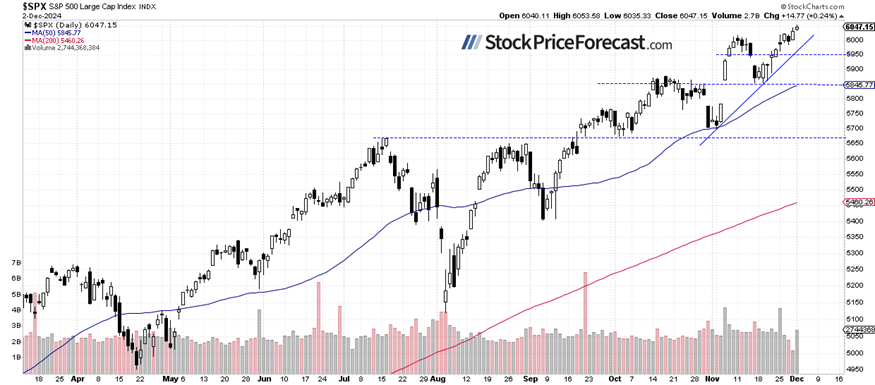

Stocks extended their uptrend on Monday, with the S&P 500 index reaching a new record high of 6,052.58 and closing 0.24% higher. The market continues to edge higher despite recent weakness in the technology sector. However, tech stocks rebounded yesterday, with the Nasdaq 100 slightly surpassing its early November record. This morning, S&P 500 futures suggest a likely unchanged opening.

Investor sentiment weakened last week, as shown by Wednesday’s AAII Investor Sentiment Survey, which reported that 37.1% of individual investors are bullish, while 38.6% of them are bearish - an increase from 33.2% the previous week.

The S&P 500 maintained its uptrend yesterday, as we can see on the daily chart.

Nasdaq 100: New record

The Nasdaq 100 index closed 1.12% higher yesterday after reaching a new all-time high of 21,201.03. This morning, it is expected to open 0.1% lower. Key support is now at 21,000, marked by the recent resistance level.

VIX: Even lower

The VIX index, a measure of market volatility, reached a new local low of 13.30 yesterday - the lowest level since mid-July, prior to the August stock market correction. This could signal an impending downward reversal and a potential correction in stock prices.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures consolidating higher

The S&P 500 futures contract hit a new record high yesterday morning and has since traded within a relatively narrow range. While there are no immediate bearish signals, a potential correction cannot be ruled out. The support is at 6,030-6,040, marked by the recent fluctuations.

Conclusion

Stock prices are expected to move sideways at the opening of today’s trading session. Could this be a short-term topping pattern? Overbought conditions could lead to a downward correction in the near term. Investors are closely watching today’s JOLTS Job Openings release at 10:00 a.m.

Yesterday, in my Stock Price Forecast for December 2024, I wrote “the stock market experienced a strong rally in November, driven by the presidential election outcome. While December is historically a bullish month, increased volatility and a short-term correction remain likely. The technology sector continues to underperform relative to the broader market.”

For now, my short-term outlook is neutral.

Here’s the breakdown:

-

The S&P 500 continues to hit record highs, after breaking the 6,000 level.

-

The market is still seeing increased volatility following the post-election rally.

-

In my opinion, the short-term outlook is neutral.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.