Yesterday, the S&P 500 index reached a new record high of 5,670.81, briefly surpassing the previous high from July 16 before reversing and closing just 0.03% higher. Today's focus is on the FOMC rate decision, with the announcement scheduled for 2:00 p.m., followed by a press conference at 2:30 p.m. The index is expected to open virtually flat and will likely consolidate ahead of the Fed release, which is expected to increase market volatility.

I am maintaining a speculative short position, opened on Monday.

Last week, the investor sentiment deteriorated, as shown by AAII Investor Sentiment Survey on Wednesday, which reported that 39.8% of individual investors are bullish, while 31.0% of them are bearish, up from 24.9% last week.

The S&P 500 index rebounded from its July high yesterday, as we can see on the daily chart.

Nasdaq 100 continues to fluctuate

The tech-focused Nasdaq 100 gained 0.05% yesterday, following a 0.5% decline on Monday. It continued fluctuating near the 19,500 level.

The index remains relatively weaker than the broader market, trading below the local high from August 22 and significantly below the July 10 record high of 20,690.97. This morning, the Nasdaq 100 is expected to open 0.1% higher.

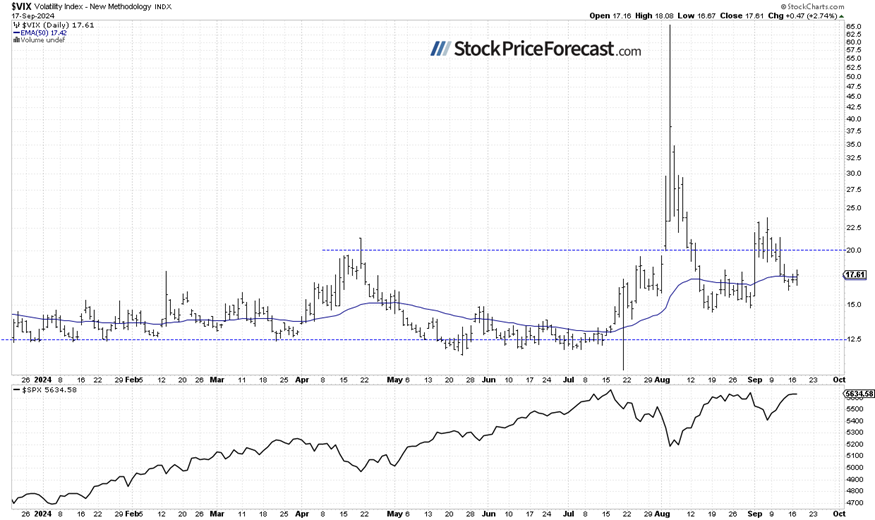

VIX: Moving along 17

On the previous Friday, the VIX index, a measure of market fear, reached a local high of 23.76. It was indicating elevated fear among investors. However, a stock rebound on last week pushed the VIX lower; yesterday, it remained below 18.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures contract: Sideways ahead of the Fed

Let’s take a look at the hourly chart of the S&P 500 futures contract (December series). The market continues to trade along the 5,700 level this morning. The support level remains at 5,680-5,700. Volatility is expected to increase after the Fed release, and the market appears to be forming a short-term top.

Conclusion

This morning, stock prices are expected to open flat, with all eyes on the Fed's rate decision later today. The market has been rallying ahead of the event, but the key question remains: what will happen afterward? A "buy the rumor, sell the news" scenario seems likely, but a bullish breakout to new highs can't be ruled out either.

I opened a speculative short position in the S&P 500 futures contract on Monday.

In my Stock Price Forecast for September 2024, I noted that, “the market experienced significant volatility in August, with a roller-coaster ride that included a sell-off to the August 5 local low and a subsequent advance, leading to a consolidation near the record high. (…) sharp reversal suggests more volatility in September. Last month, I wrote that ‘August is beginning on a very bearish note, but the market may find a local bottom at some point.’ The same could be said today, and September will likely not be entirely bearish for stocks.”

For now, my short-term outlook is bearish.

Here’s the breakdown:

-

The S&P 500 reached a new record high, briefly surpassing its July peak.

-

Investors await today's FOMC rate decision.

-

In my opinion, the short-term outlook is bearish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.