Stock markets wipe out Monday's gains

-

Emini S&P December made it as far as 5918 but has hit profit taking in overbought conditions as we wipe out Monday's strong gains. The low & high for the last session were 5850 - 5915 (To compare the spread to the contract you trade)

-

Emini Nasdaq December finally beat the September high but then collapsed yesterday & wiped out Monday's gains. Last session high & low for the last session were: 20254 - 20659.

-

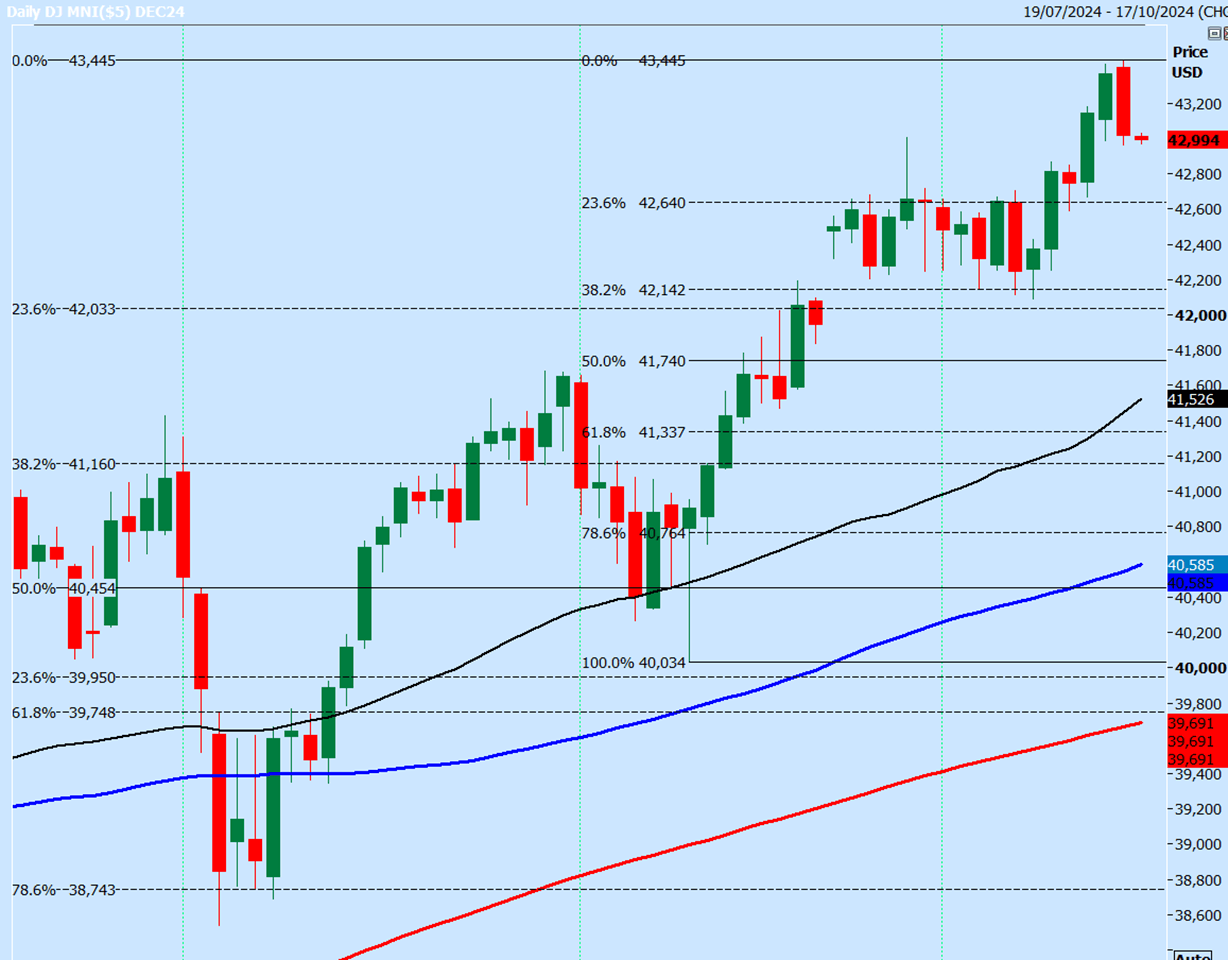

Emini Dow Jones December collapsed from a new all time high at 43445 leaving a bearish engulfing candle on the daily chart. Last session high & low for the last session were: 42964 - 43445.

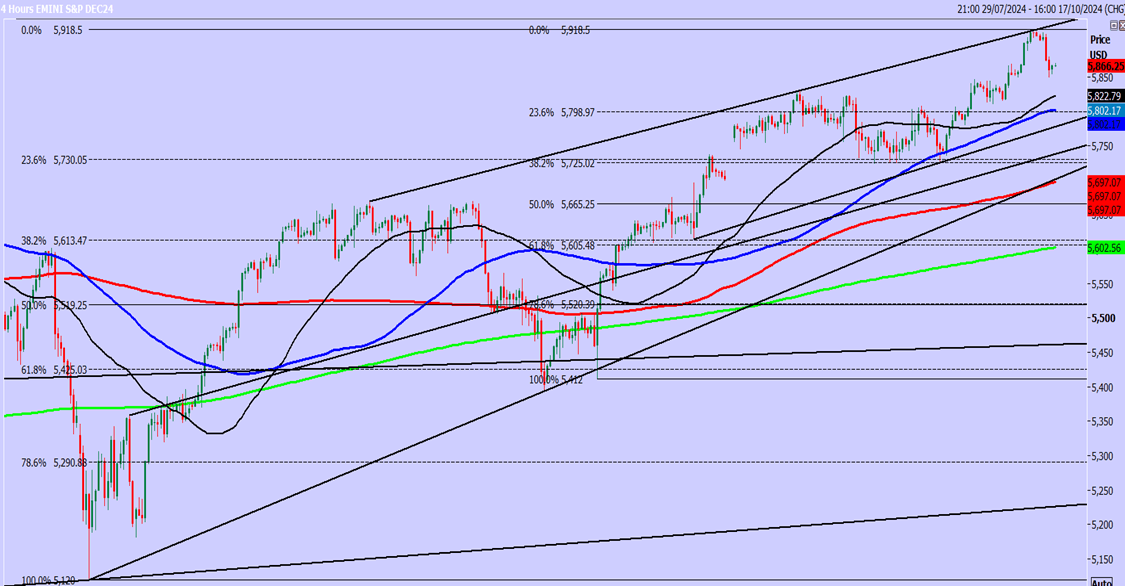

Emini S&P December futures

-

Emini S&P broke support at 5898/88 but made a low for the day at support at 5850/40.

-

However I think we could see further losses today & we could fall as far as a buying opportunity at 5810/5790. Longs need stops below 5780. Targets: 5830, 5850, perhaps as far as 5870.

-

I cannot think about short positions in the strong longer term bull trend on any recovery, despite overbought conditions. But it is possible that we trade in a sideways range for a while to consolidate gains, so I will be watching for a pattern to form.

Nasdaq December futures

-

Nasdaq unexpectedly collapsed & broke strong support at 20540/500.

-

Key support at 20350/250 today from short term moving averages & a 5 week trend line. Longs need stops below 20200.

-

A break lower risks a slide to a buying opportunity at 19950/850 & longs need stops below 19700.

Emini Dow Jones December futures

-

We have unexpectedly collapsed leaving a bearish engulfing candle on the daily chart as we test support at 43000/42900 & longs need stops below 42800.

-

A break lower should target a better buying opportunity at 42660/620.

-

A good chance of a low for the day but longs need stops below 42500.

Author

Jason Sen

DayTradeIdeas.co.uk