Stock markets test resistance levels

-

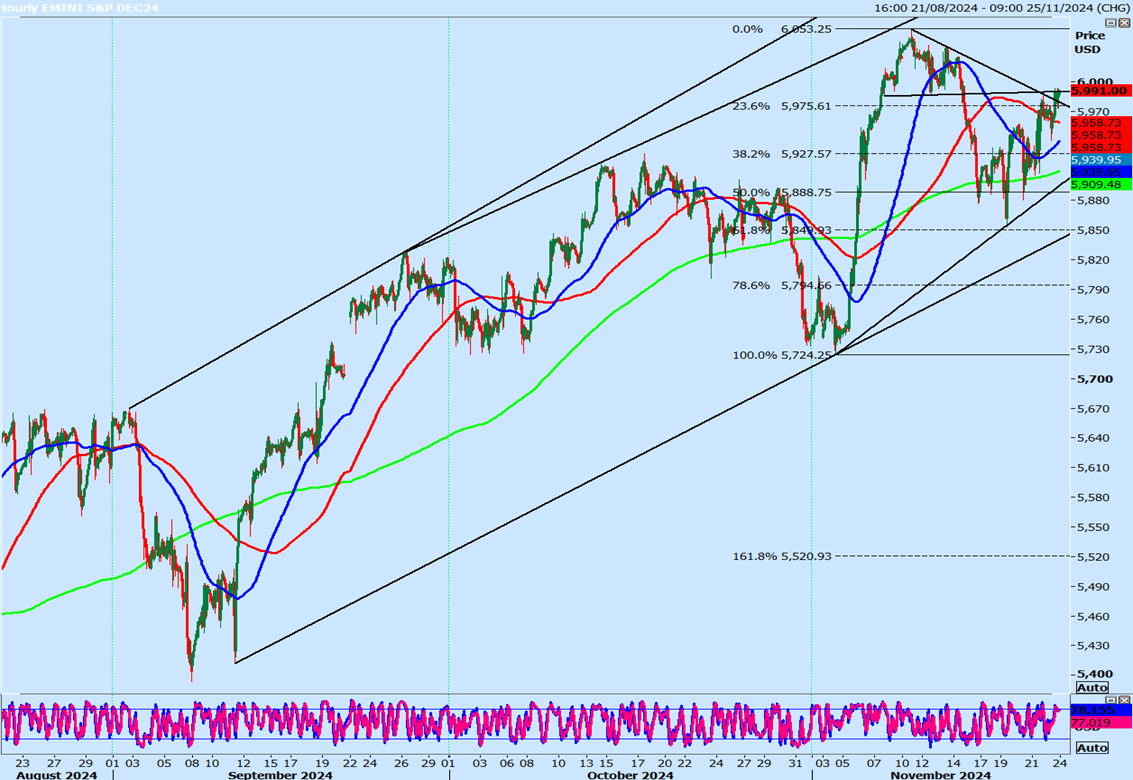

Emini S&P December choppy again as we bounce from 5940.

The low & high for the last session were 5940 - 5993. -

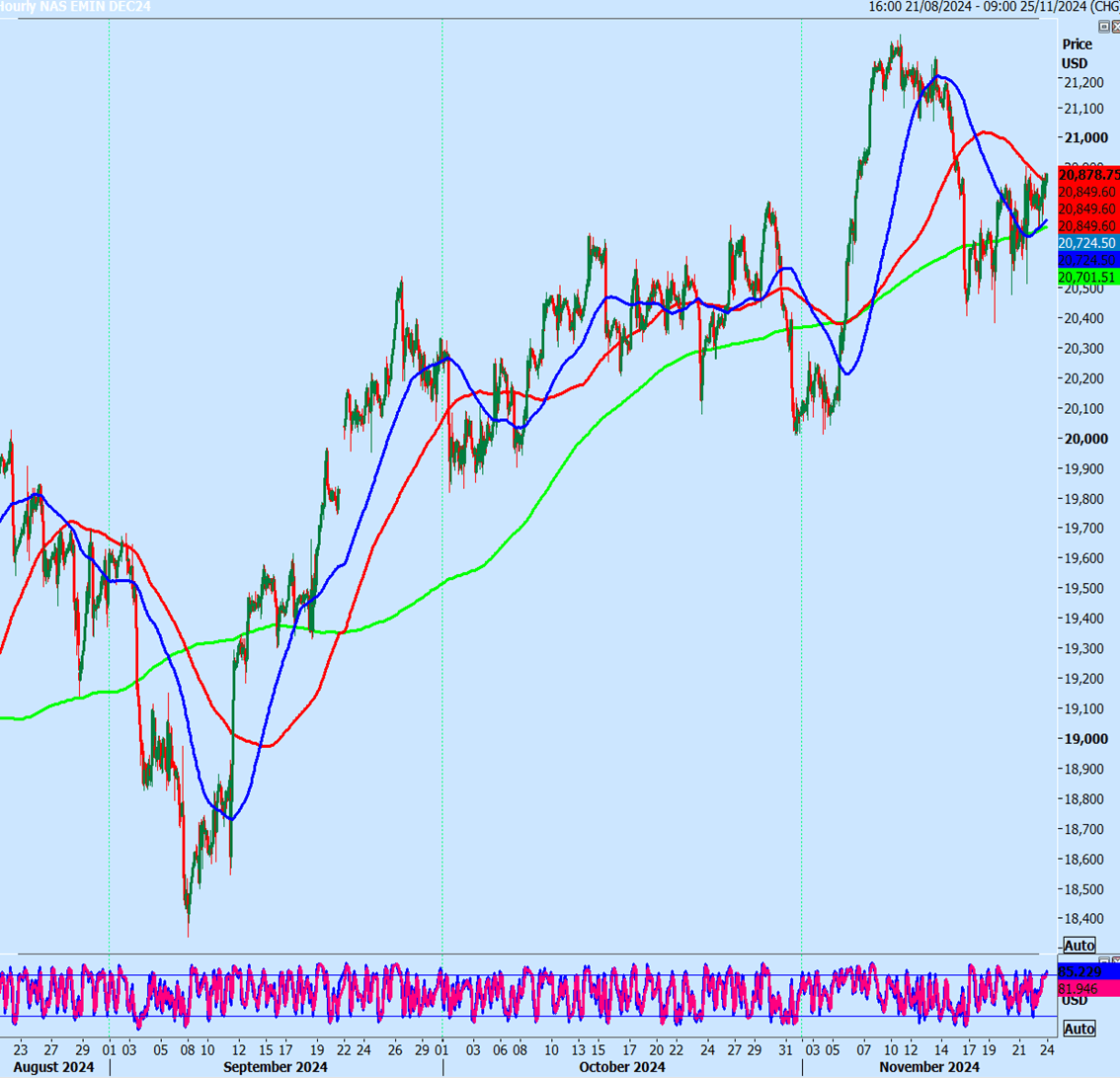

Emini Nasdaq December held inside Thursday's candle so same levels apply for today.

Last session high & low for the last session were: 20693- 20880. -

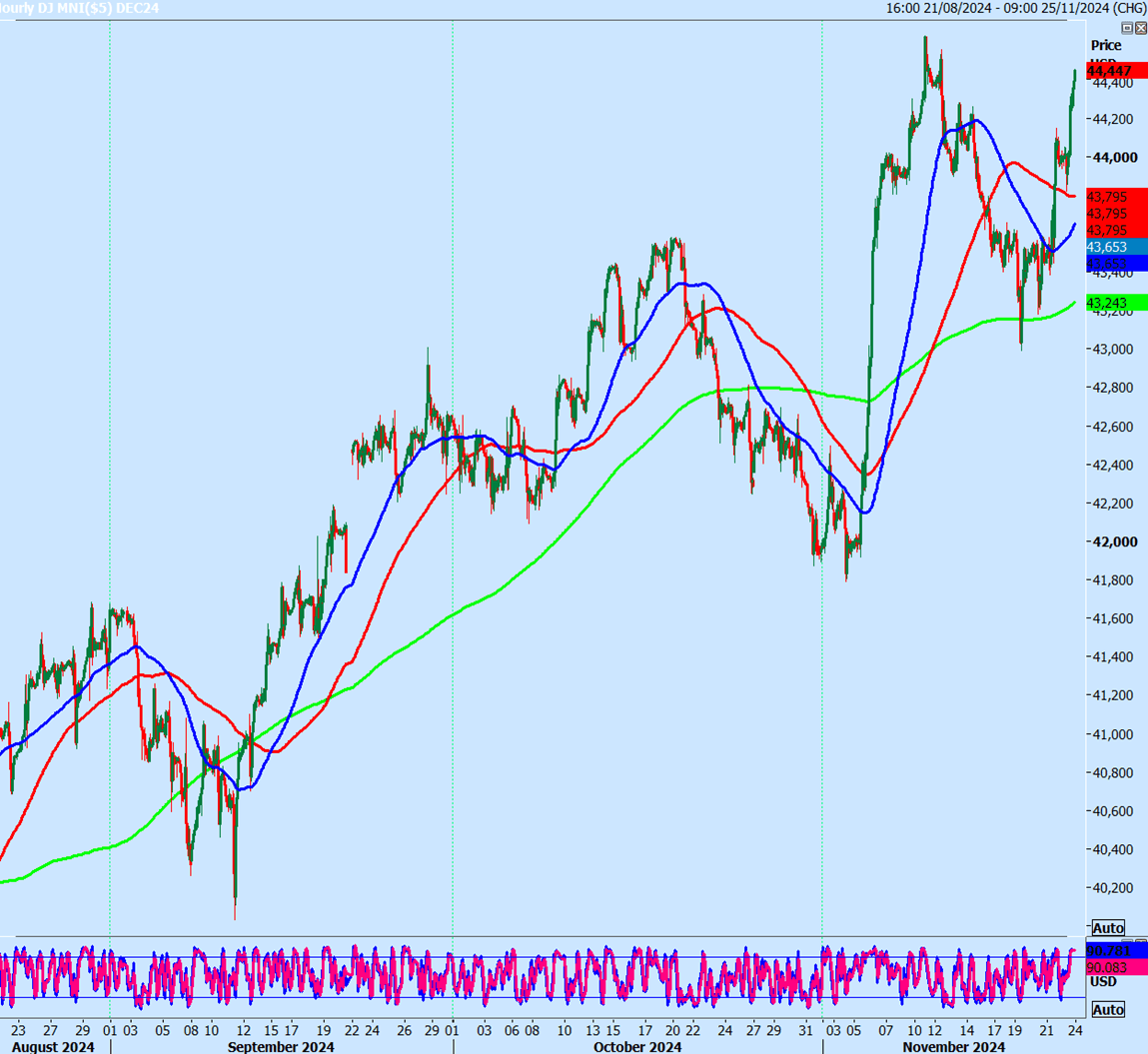

Emini Dow Jones December shot higher to resistance at 44450/490.

Last session high & low for the last session were: 43818 - 44452.

Emini S&P December futures

-

Emini S&P still holding strong resistance at 5980/90 & shorts need stops above 6000 this week.

-

A break higher is a buy signal targeting 6006/6009 & we should struggle here but a break higher can target 6025.

-

Minor support at 5960/55 did not work on Friday,

-

I think we should have support at 5950/45 & longs need stops below 5940.

Nasdaq December futures

-

Resistance at 20960/990. Shorts need stops above 21090.

-

A break higher targets 21140 & 21190.

-

The best support for this week again at 20420/380 & longs need stops below 20300.

-

Just note that the last 4 daily candles have long lower wicks so it's obviously buyers are ready to jump in aggressively on weakness.

Emini Dow Jones December futures

-

A low for the day only 18 ticks above support at 43800/700 before we shot higher to my target of 44300/310 & 4 month trend line resistance at 44450/490,

-

A high for the day exactly here,

-

A break higher retests the all time high at 44625.

-

Support again at 43800/700 but longs need stops below 43600.

Author

Jason Sen

DayTradeIdeas.co.uk