-

Emini S&P December longs at support at 6050/45 worked perfectly as we shot higher to 6102 The low & high for the last session were 6040 - 6102. (To compare the spread to the contract you trade)

-

Emini Nasdaq December longs at strong support at 21390/330 worked perfectly with a high for the day here before we shot higher to 21820. Last session high & low for the last session were: 213405- 21820.

-

Emini Dow Jones December continues lower to 44123 with losses 5 days in a row. Last session high & low for the last session were: 44181 - 44442.

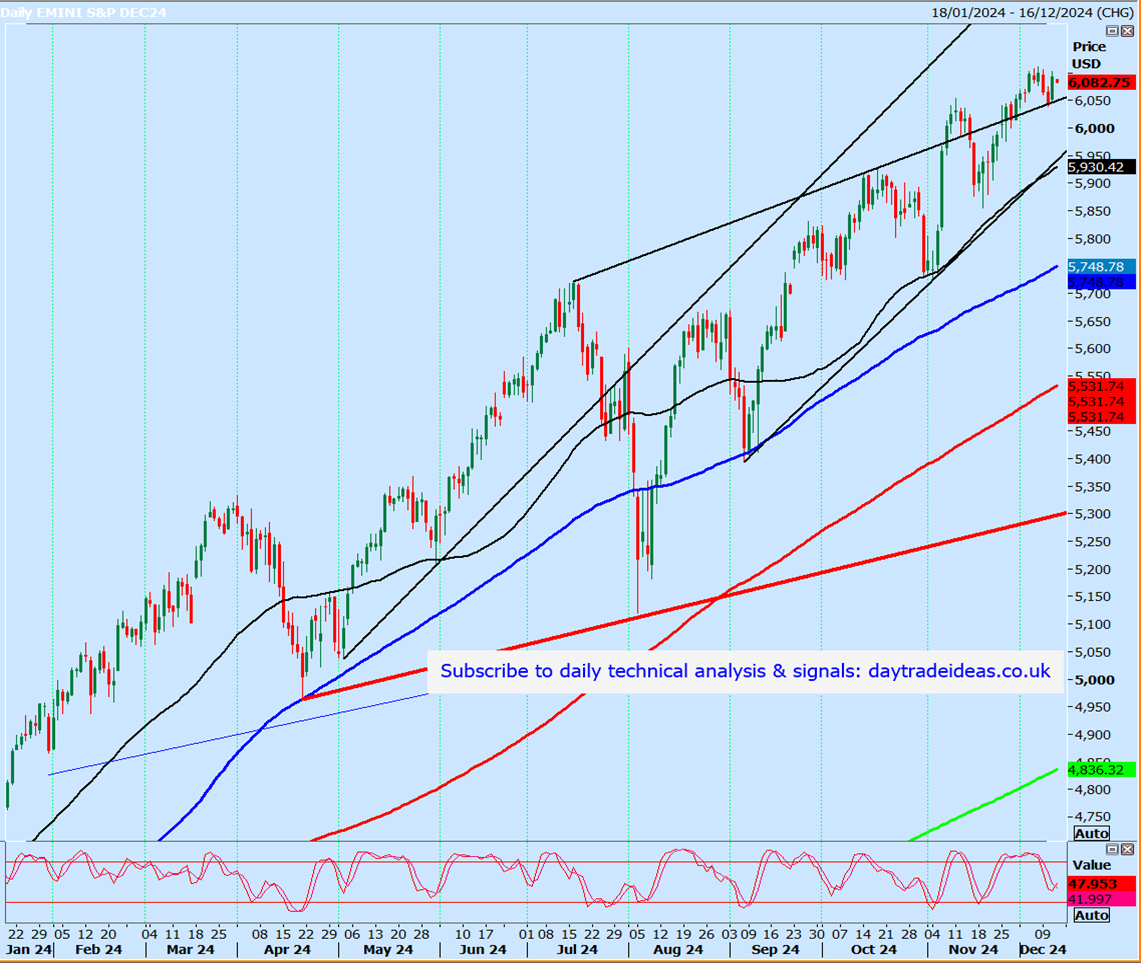

Emini S&P December futures

-

Emini S&P longs at the buying opportunity at 6050/45 worked perfectly with a low for the day at 6040 before we shot higher to all targets of 6057, 6066, 6070, 6081/83.

-

A buying opportunity again at 6050/45 today & longs need stops below 6040.

-

Targets again: 6057, 6066, 6070, perhaps as far as 6081/83

-

Just be aware that a break below 6040 can target a buying opportunity at 6020/10 & longs need stops below 6000.

-

On a break above 6112 we can target 6126/31 & eventually 6170/75 is possible.

Nasdaq December futures

-

A low for the day exactly at strong support at 21390/330 & longs worked perfectly as we beat all time high at 21706 hitting targets of 21730, 21750, almost as far as 21840.

-

Failure to hold above 21690 today risks a slide to 21600/550. If we continue lower look for a retest of strong support at 21390/330 Longs need stops below 21250.

-

A break lower targets 21200, perhaps as far as 21070/21000.

-

A break above 21840 targets 21920, perhaps as far as 22200/250.

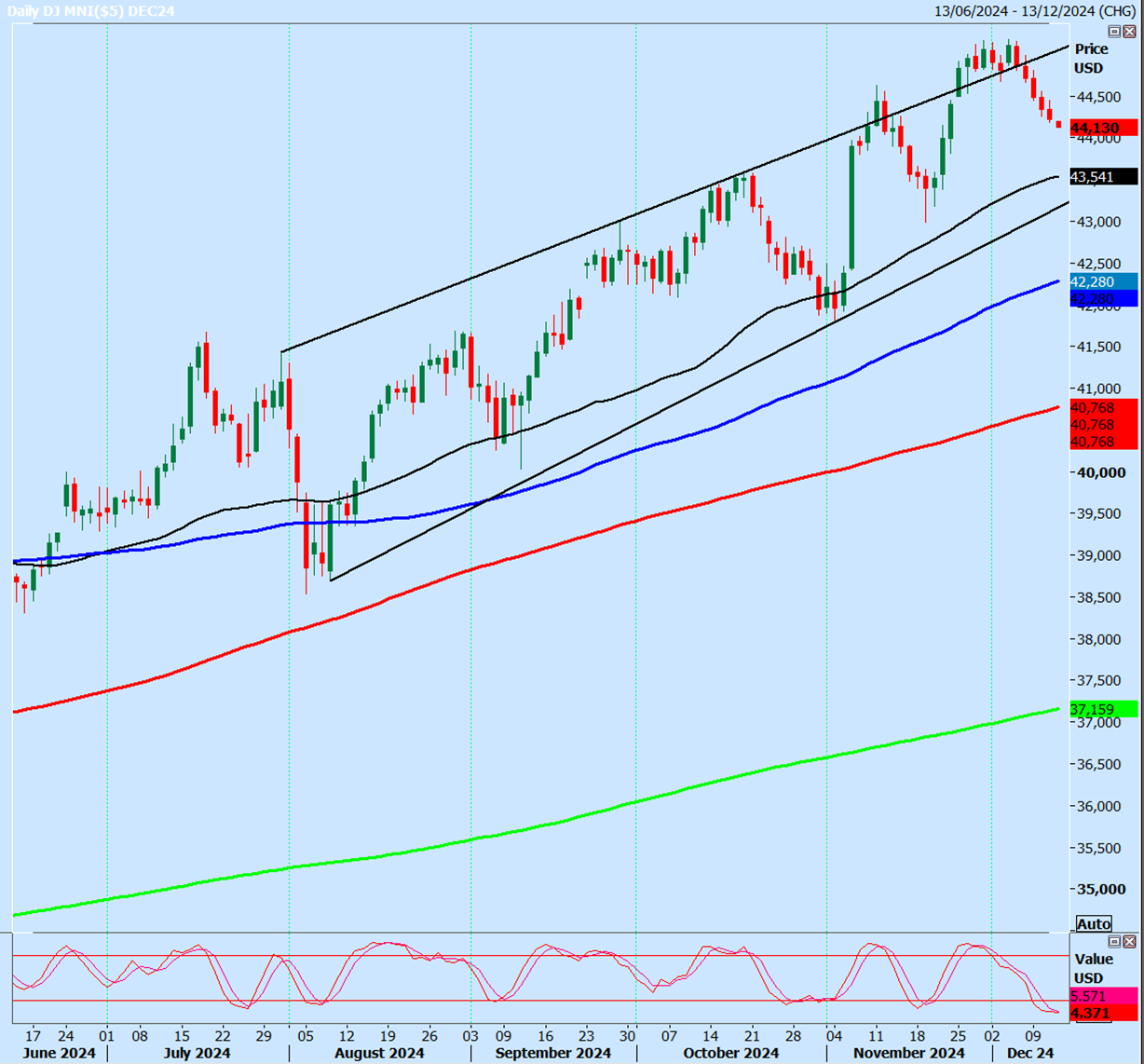

Emini Dow Jones December futures

-

We broke support at 44580/520 to target 44150, perhaps as far as support at 43930/850 (we are certainly on the way) & longs here need stops below 43750.

-

Resistance at 44350/450 could see a high for the day but shorts need stops above 44550.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

EUR/USD drops below 1.0450 as USD gathers strength

EUR/USD stays on the back foot and trades below 1.0450 on Wednesday. The cautious market stance helps the US Dollar (USD) stay resilient against its rivals and weighs on the pair as markets wait for the Federal Reserve to publish the minutes of the January policy meeting.

Gold climbs to new all-time high near $2,950

Gold retreats slightly from the all-time high it touched at $2,947 but manages to stay above $2,930 on Wednesday. The benchmark 10-year US Treasury bond yield clings to modest gains above 4.55%, limiting XAU/USD's upside.

GBP/USD retreats below 1.2600 despite strong UK inflation data

GBP/USD struggles to hold its ground and trades in the red below 1.2600 on Wednesday. Earlier in the day, the data from the UK showed that the annual CPI inflation climbed to 3% in January from 2.5% in December. Market focus shifts to FOMC Minutes.

Maker Price Forecast: MKR generates highest daily revenue of $10 million

Maker (MKR) price extends its gains by 6%, trading around $1,189 on Wednesday after rallying more than 20% so far this week. Artemis data shows that MKR generated $10 million in revenue on February 10, the new yearly high in daily revenue.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.