Stock market expected to continue lower this week

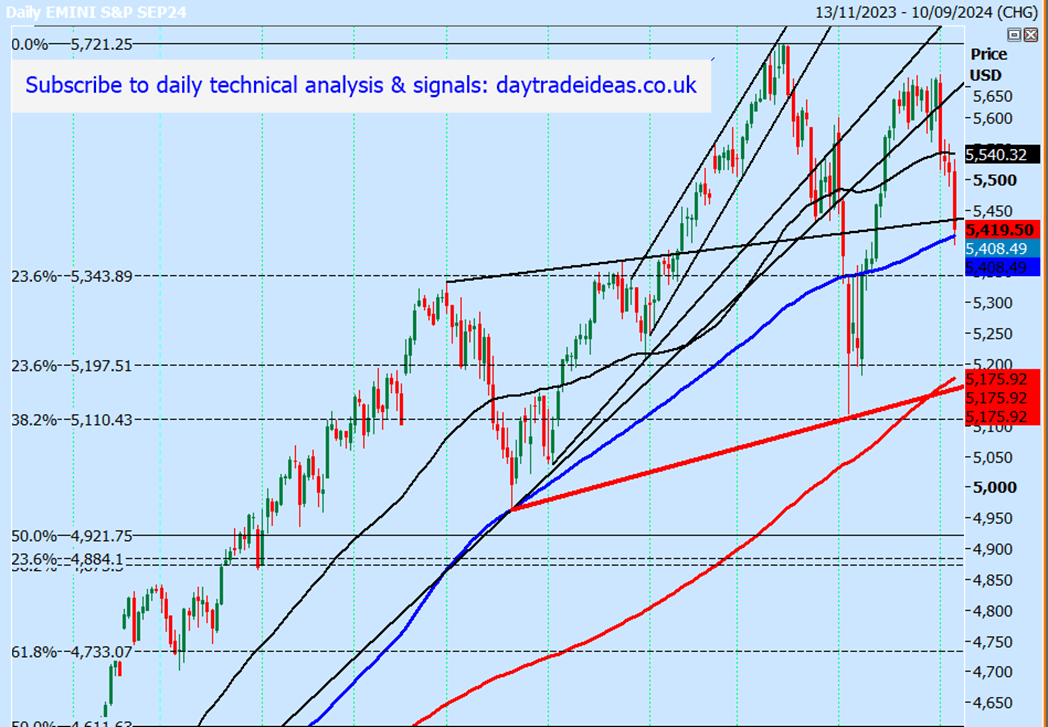

Emini S&P September futures lower on the important data.

Note we closed below the 100 day moving average at 5408

The low & high for the last session were 5394 - 5532.

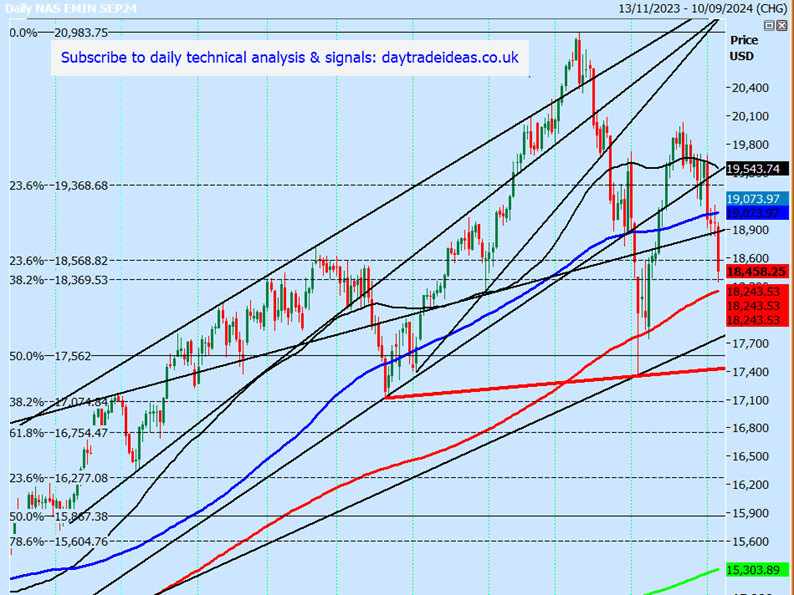

Emini Nasdaq September collapsed to 18340

Last session high & low for the SEPTEMBER futures contract: 18340 - 18972.

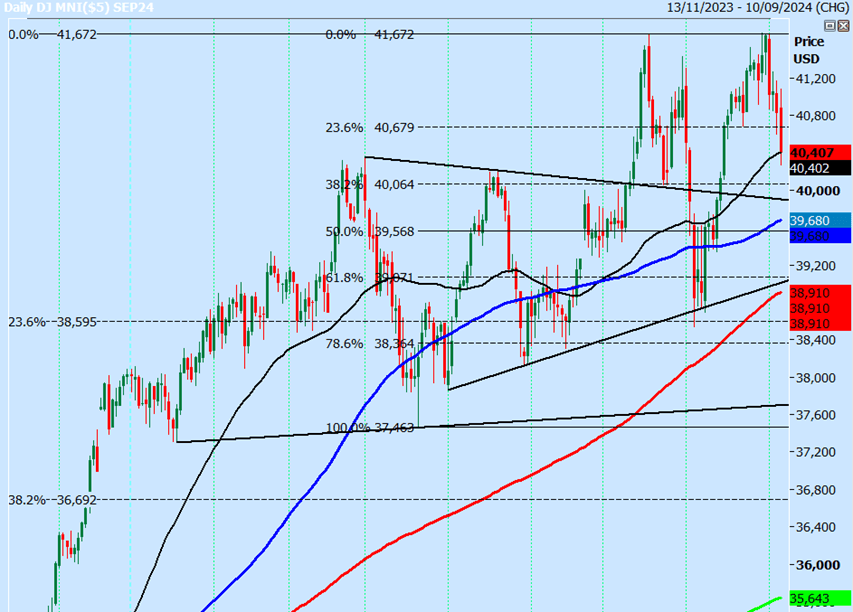

Emini Dow Jones September has a potential double top sell signal after the collapse from the new all time high at 41682 & on Friday we fell as far as 40264.

Last session high & low for the SEPTEMBER futures contract: 40264 - 41080.

Emini S&P September futures

Emini S&P broke the best support at 5470/60 as we look likely to form that right shoulder.

It appears that the path of least resistance is to the downside, with a weak employment number triggering losses on Friday.

2 months ago that would have trigger strong gains with speculation of deep interest rate cuts, but now it looks like the market is increasingly worried about the economy. Therefore further losses look likely this week unless we start to see stronger economic data.

Core inflation & CPI out on Wednesday so a higher than expected number would likely be catastrophic for stock markets.

I think shorts are the safest bet, with resistance at 5455/65 & shorts need stops above 5575.

Resistance again at 5495/5505 & shorts need stops above 5515.

A break below 5390 (Friday's low was 5494) targets 5370 & support at 5350/45.

Bear in mind that even if we are building a bear trend (& I think we are) there will be very strong bounces at support levels.

Bulls never give up & buying the dip has worked for too long for them to stop now!!

Nasdaq September futures

I have been warning & watching for the formation of a right shoulder in a 6 month head & shoulders pattern & this is playing out nicely.

We broke the support at 18880/18830 this time for another sell signal targeting strong Fibonacci support at 18600/500, but we over ran as far as 18340

Holding below 18550/600 keeps the pressure on for further losses with a break below the 200 day moving average at 18250/200 expected to trigger losses as far as 17980/950 & 17850/800.

Gains are likely to be limited with minor resistance at 18700/750 & strong resistance at 18850/950. Shorts need stops above 19000.

Emini Dow Jones September futures

Broke short term support at 40700/650 for a sell signal targeting 40400/350 & perhaps as far as 40100 on Monday.

We meet minor support at 40000/39900 but I think longs are too risky.

A break below 39900 is another sell signal targeting 39700/660 & 39370/340.

Again, gains are likely to be limited with resistance at 40580/660 & shorts need stops above 40750.

Author

Jason Sen

DayTradeIdeas.co.uk