SBIN Elliott Wave technical analysis

Function: Counter Trend (Minor degree, Grey).

Mode: Motive.

Structure: Impulse within larger degree zigzag.

Position: Minor Wave 2.

Details: Minor Wave 2 Grey might have extended through 860 zone, If correct, expect Wave 3 to be underway soon.

Invalidation point: 910.

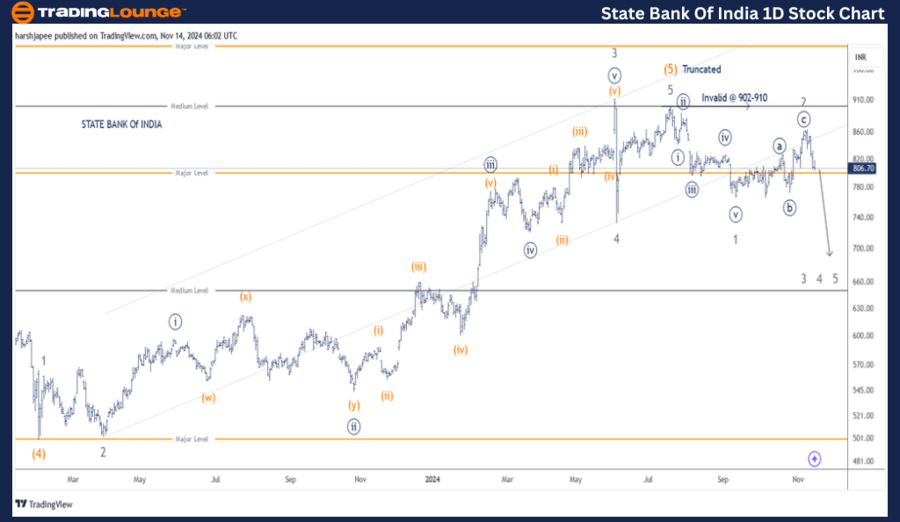

State Bank of India daily chart technical analysis and potential Elliott Wave counts

State Bank of India daily chart is indicating a potential trend reversal after hitting the 920 high; Intermediate Wave (5) Orange. The truncation has been followed by an impulse lower to 765 levels, Minor Wave 1 and a subsequent counter trend rally towards 860 high as Wave 2 termination.

If the above structure holds, bears are now back in control as Wave 3 begins to unfold. The bottom line for bearish structure is at 920 mark. Also note that a break below 730 will accelerate further. Alternatively, a push through 920 will confirm bulls are back in control.

SBIN Elliott Wave technical analysis

Function: Counter Trend (Minor degree, Grey).

Mode: Motive.

Structure: Impulse within larger degree zigzag.

Position: Minor Wave 2.

Details: Minor Wave 2 Grey might have extended through 860 zone, If correct, expect Wave 3 to be underway soon. The stock trades around 803 at the time of writing as bears remain inclined to drag further.

Invalidation point: 910.

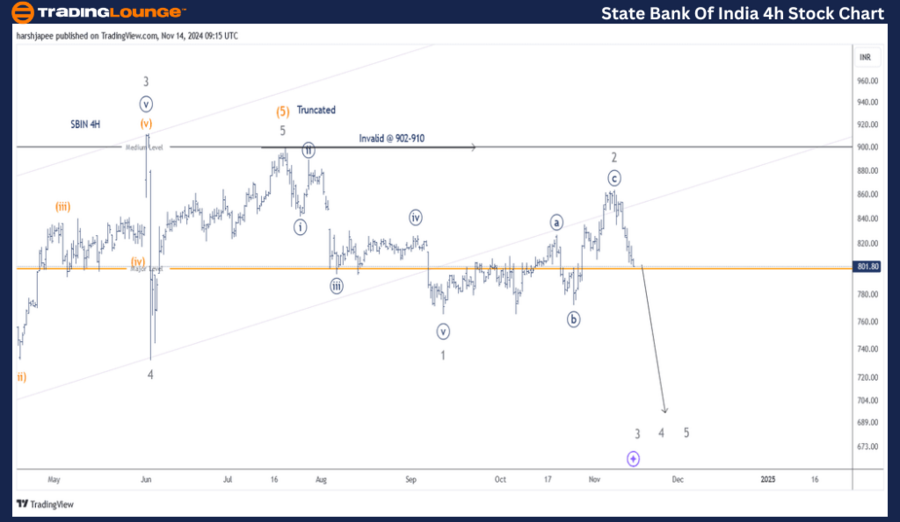

State Bank of India four-hour chart technical analysis and potential Elliott Wave counts

State Bank of India 4H chart highlights the wave structure post Minor Wave 4 termination around 730 mark on June 04, 2024. Kindly note that Minor Wave 5 has been proposed as a truncation, which terminated around 910 level.

Since then, there has been an impulse drop Minor Wave 1 Grey, followed by a corrective rally Minor Wave 2 Grey, terminating around 860 mark. If the above is correct, price action is now unfolding Minor Wave 3, which is projected way below the 700 mark.

Conclusion

State Bank of India is progressing lower within Wave 3 towards 700 mark, against 920 high.

State Bank of India Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD stabilizes around 1.2550 after hitting two-year lows

EUR/USD plunged to 1.0223, its lowest in over two years, as risk aversion fueled demand for the US Dollar. Thin post-holiday trading exacerbated the movements, with financial markets slowly returning to normal.

USD/JPY flirts with multi-month highs in the 158.00 region

The USD/JPY pair traded as high as 157.84 on Thursday, nearing the December multi-month high of 158.07. Additional gains are on the docket amid prevalent risk aversion.

Gold retains the $2,650 level as Asian traders reach their desks

Gold gathered recovery momentum and hit a two-week-high at $2,660 in the American session on Thursday. The precious metal benefits from the sour market mood and looks poised to extend its advance ahead of the weekly close.

These 5 altcoins are rallying ahead of $16 billion FTX creditor payout

FTX begins creditor payouts on January 3, in agreement with BitGo and Kraken, per an official announcement. Bonk, Fantom, Jupiter, Raydium and Solana are rallying on Thursday, before FTX repayment begins.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.