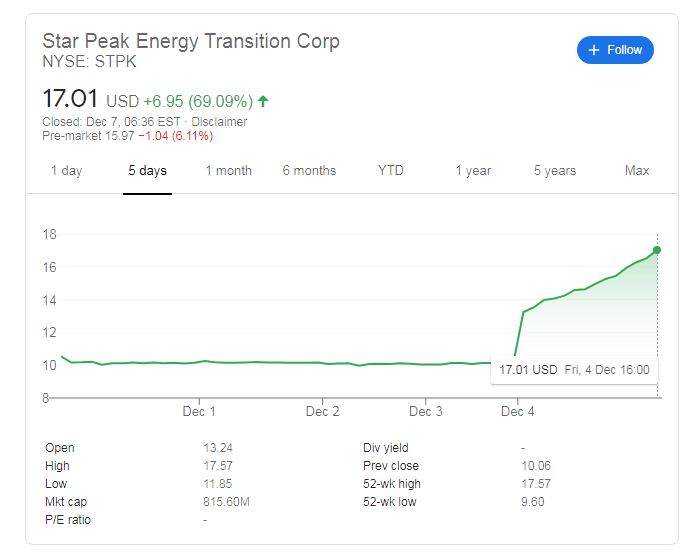

- NYSE: STPK has surged by 69.09% on Friday after long days of steady trading.

- Star Peak Energy Transition Corp announced it is merging with Stem to make the latter firm public.

- Stem´s battery technologies draw high interest which could further boost share prices.

First storage, then delivery – Star Peak Energy Transition Corp (NYSE: STPK) first raised funds as a blank check company, and some four months later, it is delivering on its promise. The Illinois-based shell company announced a Special Purpose Acquisition Company (SPAC) merger with Stem, which is an energy company.

Stem, founded back in 2009, focuses on battery storage and optimization – the latter using Athena, an artificial intelligence platform that is used to forecast energy demand. By correctly optimizing battery utilization, it lowers costs for those using its batteries.

STPK originally raised $350 million in its IPO and the deal includes investments from Van Eck and Blackrock to reach a total of $608 million. The valuation of the merged firm will be around $1.35 billion – above the stock's current market capitalization of around $815 million.

STPK stock forecast

NASDAQ: STPK leaped by 69.09% on Friday to close at $17.01 after changing hands around $10 for a long period. Monday's premarket trading is pointing to a drop of around 7% or $1.21 – a much-needed profit-taking move. However, the intended higher valuation for the energy company provides hopes for additional gains.

Star Peak Energy Transition's sector is experiencing high interest and growth which has further grown after Joe Biden was elected President. The former Vice-President has vowed to push environmentally-friendly policies and nominated former Secretary of State John Kerry as a climate czar. If Democrats win control of the Senate, they will likely push for a $2 trillion investment toward the climate crisis, with some funds potentially trickling toward STPK.

More NIO Stock Price and Forecast: Gets crushed again amidst investor concerns and rival downgrades

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats below 1.0800 ahead of US data

EUR/USD loses traction and trades below 1.0800 on Tuesday. The risk-averse market atmosphere ahead of Wednesday's tariff announcements makes it difficult for the pair to hold its ground as the market attention turns to US data releases.

GBP/USD struggles to stabilize above 1.2900

Following a short-lasting uptick in the European session, GBP/USD edges lower and trades slightly below 1.2900 on Tuesday. The US Dollar (USD) holds its ground as investors adopt a cautious stance in anticipation of data releases and Wednesday's tariff decisions.

Gold pulls away from record highs, holds comfortably above $3,100

Gold corrects lower but manages to hold comfortably above $3,100 after touching a new record-high near $3,150 earlier in the day. Falling US Treasury bond yields help XAU/USD limit its losses as investors refrain from taking large positions ahead of US tariff announcements.

JOLTS job openings set to decline modestly in February

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Tuesday by the United States Bureau of Labor Statistics. Markets expect job openings to decline to 7.63 million on the last business day of February.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.