Stagflationary data ahead

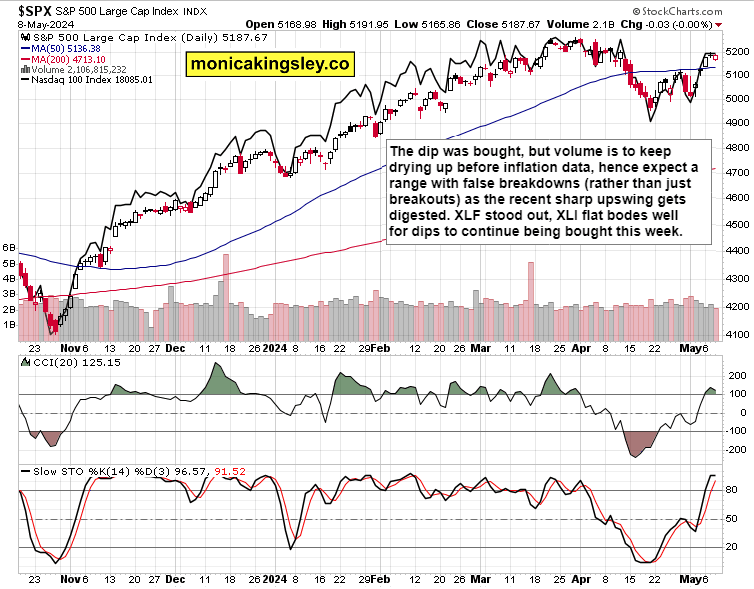

S&P 500 withstood the rising yields (I warned yesterday these were to turn up, and they still do), and reacted with relief to the 10y Treasury auction results. This week is to be full of intraday traps as the recent sharp upswing will be digested (supply being eaten up as I called it earlier), and I still favor (relatively shallow) dips to be bought – this is best to be approached from the intraday perspective such as yesterdayor the day before.

Dollar won‘t get far this week, yields are to listen to statements a la Kashkari, and get positioned for higher for longer. For now, the odds of Sep rate cut are slowly retreating from 50% lately to 48% now – but that is going to change in the aftermath of 231K initial claims just in, which is to affect risk-taking and assets from equities (hello Russell 2000, time to wake up) and both precious metals (not just silver but the underperforming gold as well – question being the spike longevity).

The market is willing to run on retreating yields, and that‘s what‘s following the job market data, with both 2y and 10y Treasury offering exactly that.

Why this title though? I‘m thinking of CPI and positioning for it...

S&P 500 and Nasdaq

S&P 500 will spend most of the time these days between 5,188 and 5,115, and these levels are unlikely to be decisively broken one way or the other with success. Sectoral rotations would keep the market relatively up, and it‘s still time for XLF and XLI to lead the market among cyclicals. Buyers have the initiative today.

As written yesterday, I expect the sellers to have limited success – limited as in lasting a day or two, and relatively shallow as the deterioration in breadth isn‘t nearly enough deep, and following today‘s data, the prospects of a dip got way, way lower than they were when I was writing yesterday‘s analysis.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.