- NASDAQ: SRNE is on course for a 10% above $20, on top of the 30% rally on Monday.

- Sorrento Therapeutics is benefiting after announcing buying a COVID-19 therapy developer.

- Demand for coronavirus immunization is on the rise despite Russia's vaccine breakthrough.

Serenity for Sorrento Therapeutics investors – NASDAQ: SRNE is set to extend its gains, proving it is more than a one-day wonder in equity markets. The California-based pharma firm's shares are on the rise following its move into the coronavirus space.

Sorrento announced it is planning to acquire SmartPharm Therapeutics, a company providing therapy for COVID-19. Managers also said it licensed the rights to a rapid test – identifying the virus in saliva within 30 minutes.

While some skeptics doubt Sorrento's fast and furious announcements, investors are piling up, pushing SRNE's valuation to around $4.5 billion at the time of writing.

Demand for any cure or vaccine for the novel coronavirus is at elevated levels. Companies that announce progress – whether in a clinical or earlier trial – see their shares rise quickly, especially from the Robinhood crowd.

Russian President Vladimir V. Putin declared that his country registered the world's first coronavirus vaccine – and that his daughter already received it. If immunization is already available, why would other efforts still make sense?

First, Putin's claims are met with doubts –scientists want to see the underlying data before hailing Moscow's Gamaleya Institute's achievement. This is not another Sputnik moment. Moreover, it is unclear how long any vaccine is effective – antibodies tend to disappear from recovered coronavirus patients.

And while those that have a large number of defenses against the SARS-Cov-2 virus may avoid illness, they could remain infectious and those who are unprotected could suffer. There is still a need for a coronavirus cure, not only a vaccine.

SRNE Stock Price

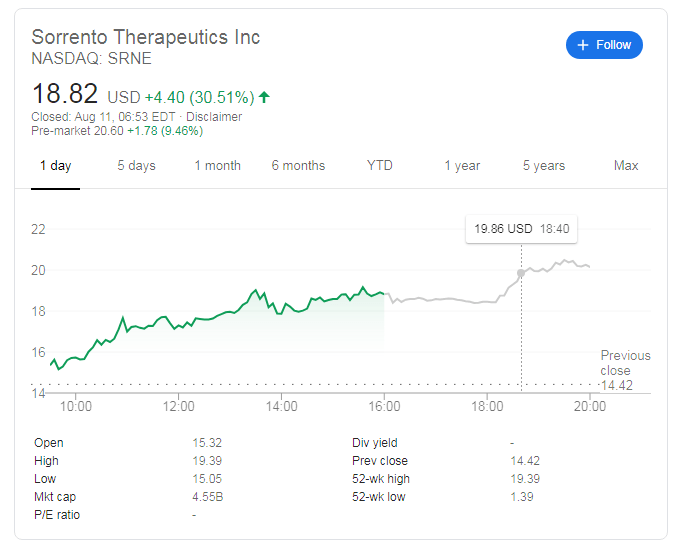

NASDAQ: SRNE soared by over 30% to close at $18.82 on Monday. Tuesday's pre-market trading is pointing to another leap of around 10% to above the $20 mark, putting Sorrento's share price above the 52-week high of $19.39.

It is essential to stress that SRNE changed hands as low as $1.39 in the past 52 weeks.

More: Novavax receives bullish $290 share target amid coronavirus vaccine progress

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD consolidates strong Aussie Retail Sales-led gains above 0.6900

AUD/USD consolidates gains above 0.6900 in Asian trading on Tuesday. Stronger-than-expected Australian Retail Sales data continue to underpin the pair amid a broad US Dollar resurgence, as risk sentiment sours. US data and Fedspeak eyed.

USD/JPY trades with sizeable gains above 144.00 on renewed US Dollar demand

USD/JPY holds firm above 144.00 in the Asian session on Tuesday, reversing a brief led by the mixed Japanese data and BoJ's hawkish rhetoric on further interest rate hikes. The pair tracks the renewed US Dollar uptick, as traders turn cautious ahead of key US data, Fedspeak.

Gold price bounces off $2,625-2,624 pivotal support

Gold price ticks higher on Tuesday and stalls its recent corrective slide from the all-time top. Bets for further rate cuts by the Fed and geopolitical risks continue to benefit the XAU/USD. Traders now look forward to the release of key US macro data for some meaningful impetus.

Three reasons why SUI could continue its ongoing rally

Sui is extending its gains, trading at $1.9 at the start of the new month after a sharp rise last month. This bullish momentum could continue, driven by a new all-time high in Total Value Locked, rising open interest, and an uptick in daily active addresses.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.