SPY ETF selling the rallies at the blue box area

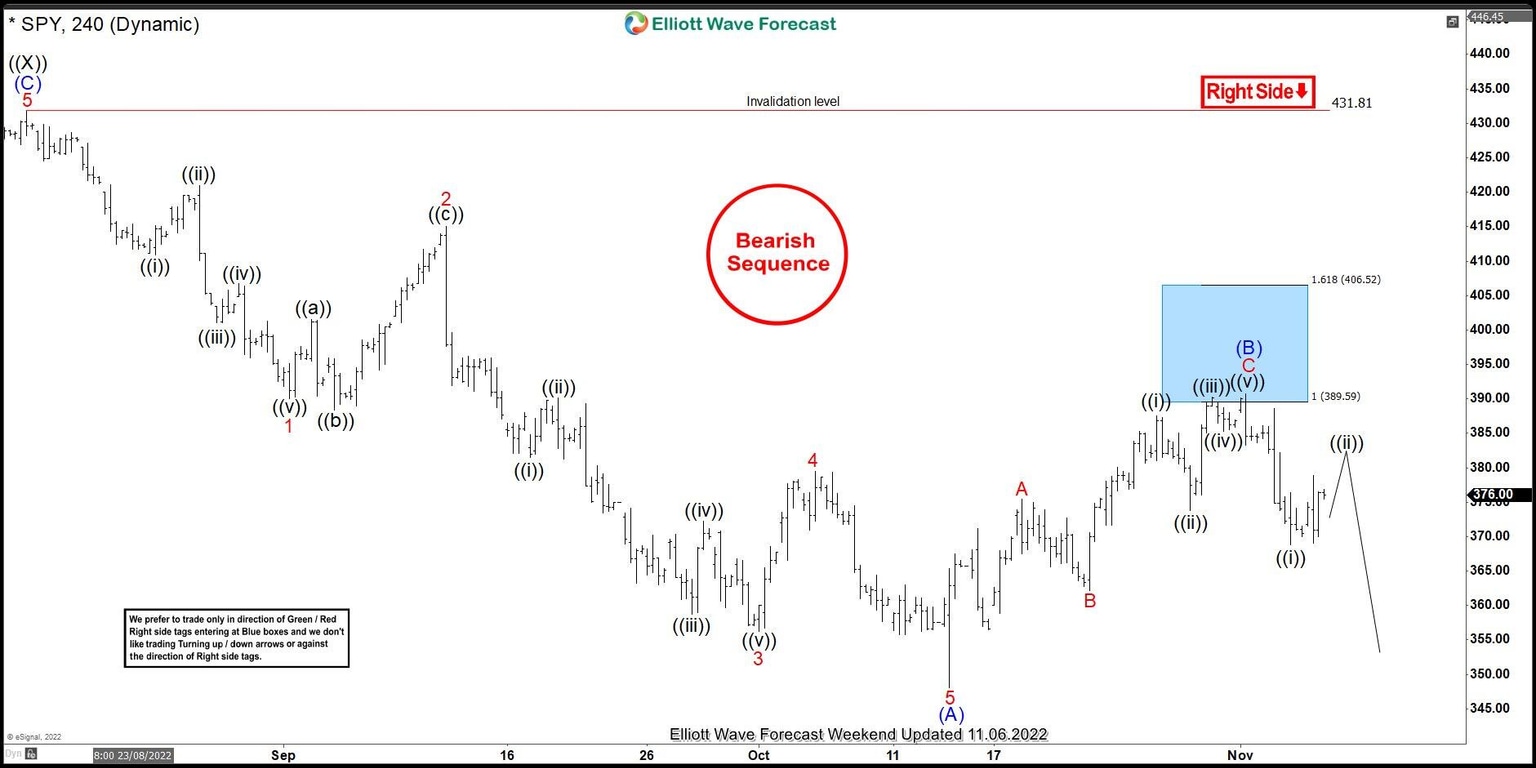

Another trading setup we have had recently was selling the rallies in SPY ETF. In this technical blog we’re going to take a quick look at the Elliott Wave charts of SPY published in membership area of the website. As our members know, SPY is showing incomplete bearish sequences in the cycle from the 480.05 peak. That makes the ETF bearish against the 431.81 pivot against which we have been selling the rallies. Recently SPY has given us good trading opportunity. We got 3 waves recovery which found sellers right at equal legs area as we expected. In the further text we are going to explain the Elliott Wave Forecast and trading setup.

SPY 1h Elliott Wave analysis 10.26.2022

SPY made 5 waves down in the cycle from the 431.81 peak and now it’s correcting it. Recovery looks incomplete at the moment. Wave (B) blue recovery can see more upside toward 389.3-406.2 area ( blue box). As the ETF is currently in bearish cycle, we expect sellers to appear at the marked blue box area for further decline toward new lows ideally or for a 3 waves pull back at least . Once pull back reaches 50 Fibs against the X red low, we will make short position risk free ( put SL at BE) and take partial profits. However if price breaks above 1.618 fib ext : 406.2 before pull back happens that would invalidate the trade. As our members know Blue Boxes are no enemy areas , giving us 85% chance to get a reaction.

SPY 1h Elliott Wave analysis 11.06.2022

SPY made rally toward blue box area and found sellers as expected. Recovery (B) blue ended at 390.76 high. We got nice decline from the Blue Box (selling zone) that has reached and exceeded 50 dibs against the connector. As a result, members who took short trades mad positions risk free. ( Put SL at BE) and took partial profits.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com